Rigetti Computing Stock: A Buy for 2026?

Key Points

Rigetti has launched 18 quantum systems over the past several years.

The company generates revenue by offering customers access to these platforms.

- 10 stocks we like better than Rigetti Computing ›

Technology investors have won big in the past by spotting new technologies and getting in early on companies developing or benefiting from them. Think internet companies several years ago, or in more recent times, social media players and artificial intelligence (AI) stocks. And that's why the area of quantum computing has caught the attention of investors over the past couple of years.

Quantum computing offers the possibility of solving problems that are impossible for even today's most advanced supercomputers. So these computers could be one of the world's next game-changing technologies. With this in mind, is quantum computing pure play Rigetti Computing (NASDAQ: RGTI) stock a buy for 2026? Let's find out.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Image source: Getty Images.

Classical vs quantum computing

First, a quick bit about quantum computing. The technology, relying on the ideas of quantum mechanics, involves the interaction of subatomic particles to solve problems. While classical computers use bits to process data as 0s and 1s, quantum computers use qubits, which can process data as a 0, a 1, or both at the same time. This allows these machines to scale exponentially and achieve speed and scope that's not possible with today's classical computers.

Many companies are involved in the field, from tech giants such as Microsoft to pure play companies focused uniquely on this technology. Rigetti is a pure play company and far from a new kid on the block in this area. This quantum specialist was founded back in 2013 and has since launched 18 quantum systems.

Rigetti is vertically integrated, meaning it handles the entire process, from chip design and manufacturing to deployment in the cloud. This is a strength, and sets Rigetti apart from rivals, as it offers the company more control over its progress and favors speed-to-market. And speaking of speed, the company's technology, using superconducting qubits, also is known for its fast processing of information -- though error rates, a challenge in quantum computing, tend to be higher than in the slower trapped ion method.

The quantum computing goal

Rigetti generates revenue as it offers access to its quantum hardware to customers, but, like peers, the company hasn't yet reached the quantum finish line. The goal is to develop a generally useful quantum computer, and experts predict that's a few years away.

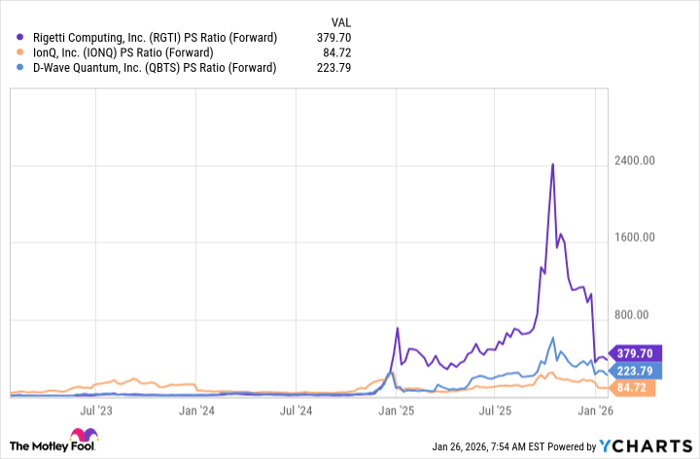

Now, let's return to our question: Is Rigetti a buy? Rigetti stock, like that of other pure play companies, trades at enormous price-to-sales ratios.

RGTI PS Ratio (Forward) data by YCharts

So it's difficult to use traditional valuation methods to assess their worth. Instead, it's best to consider the strength of their technology, their competitive position, and your own comfort with risk. Pure play companies come with more risk than a tech giant like Microsoft, for example.

In the case of Rigetti, if you're a cautious investor, this stock may not be the best choice for you. But aggressive investors, considering Rigetti's full-stack advantage and solid progress over the years, might choose to pick up a few shares of this exciting pure play quantum company.

Should you buy stock in Rigetti Computing right now?

Before you buy stock in Rigetti Computing, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Rigetti Computing wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $464,439!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,150,455!*

Now, it’s worth noting Stock Advisor’s total average return is 949% — a market-crushing outperformance compared to 195% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of January 27, 2026.

Adria Cimino has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends IonQ and Microsoft. The Motley Fool has a disclosure policy.