SanDisk 2026 Q2 Earnings Preview: Explosive Demand for AI Storage Drives Accelerat

TradingKey - Against the backdrop of a structural recovery in the global storage industry, the data storage leader SanDisk Corp (SNDK) will release its financial results for the second quarter of fiscal year 2026 (approximately Q4 2025 of the calendar year) after the U.S. market close on January 29, 2026.

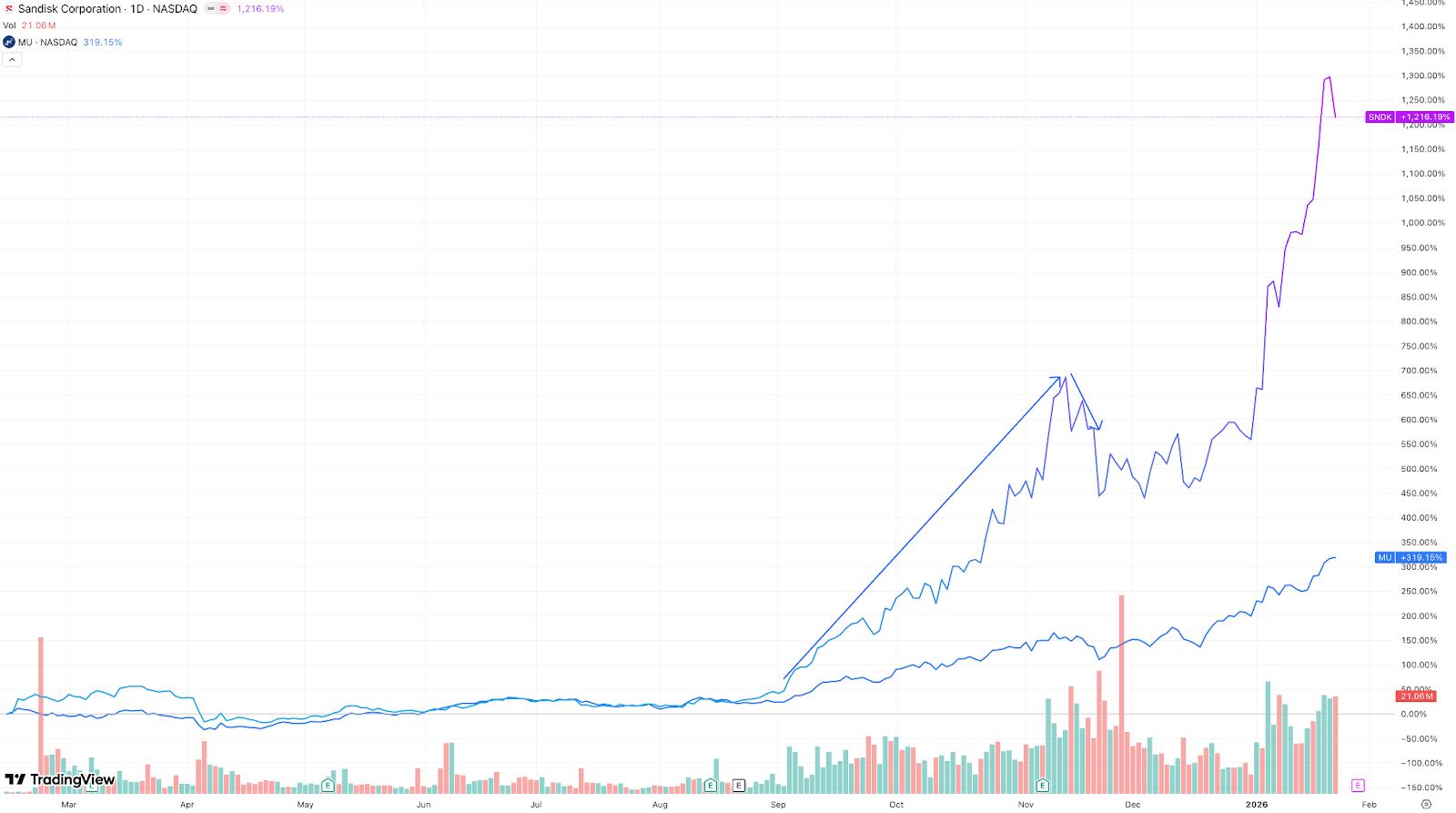

As a highly watched storage up-and-comer following its independent listing, SanDisk's upcoming earnings report will test its ability to deliver on its business promises. Benefiting from the rebound in the storage cycle driven by the AI investment wave, SanDisk's stock price has surged over 1,000% this year, with the market focusing intently on the quality of its earnings and the sustainability of its growth.

[SanDisk Stock Price Trend Since Listing (Compared to Micron MU), Source: TradingView]

According to FactSet data, analysts expect SanDisk's revenue for this quarter to reach $2.68 billion, with adjusted earnings per share (EPS) of $3.58, significantly higher than last quarter's $1.22.

This strong quarter-on-quarter growth is mainly driven by rising volume and prices in the edge business, improved visibility of data center orders, and consumer-side channel inventory returning to healthy levels. If the performance meets expectations, SanDisk is poised to confirm a turning point in its transition from "cyclical recovery" to "structural growth."

Edge Business Takes the Lead, Volume and Price Synergy Supports Revenue Resilience

SanDisk's core revenue source—the Edge Solutions business—contributed $1.387 billion last quarter, accounting for 60.1% of total revenue, and is the company's most stable cash cow. This business covers high-barrier scenarios such as smartphone UFS, automotive embedded storage, and industrial-grade eMMC, with clients including leading manufacturers like Apple, Tesla, and Samsung.

Recent supply chain data shows that prices for mainstream capacity segments (such as 256GB/512GB UFS) have been continuously adjusted upward over the past six months, with some models seeing increases of up to 10%. Jefferies analysts noted that SanDisk has implemented a "gentle but firm" price-hike strategy for major customers and has reduced unit costs through high-density BiCS 6 technology, achieving a virtuous cycle of "stable volume, rising prices, and improved gross margins."

Although this quarter is typically a post-holiday off-season, demand for high-end model replacements is supporting a shift in shipping structure toward high capacity. If average selling prices (ASP) remain high and manufacturing yields stay stable, the gross margin of the edge business is expected to maintain its previous level of 29.77% or even improve slightly.

Data Center Business Becomes the Greatest Source of Elasticity as AI Storage Orders Gradually Materialize

Despite its relatively small scale (last quarter's revenue was $269 million, or 11.66%), the data center business is becoming SanDisk's most promising growth engine. With the ramp-up of NVIDIA Blackwell GPUs and a surge in capital expenditure by cloud service providers, the demand for high-performance NVMe SSDs in AI training clusters is growing exponentially.

Industry reports indicate that SanDisk has delivered the first batch of PCIe 5.0-based AI-Optimized SSDs to Microsoft Azure and Amazon AWS, with a capacity of up to 32TB per server. A Benchmark analyst emphasized: "SanDisk's enterprise-grade SSDs are close to Samsung's in terms of latency and durability metrics, and their more competitive pricing provides a key lever for gaining market share in cloud provider supply chains."

If AI-related orders are successfully recognized as revenue this quarter, it will not only drive the growth rate of the data center segment but also likely raise overall gross margins through high-value-added products. The market is closely monitoring whether management will disclose leading indicators such as "AI storage revenue share" or "cloud customer order backlog" during the conference call.

Smooth Transition for the Consumer Segment as Channel Inventory Pressures Ease

The consumer business (including SD cards, USB drives, and portable SSDs) recorded revenue of $652 million last quarter, accounting for 28.25%. Although not a core growth engine, this segment provides steady cash flow and showed good sales momentum toward the end of the holiday season.

Tiger Research pointed out that channel inventory has fallen from its late-2024 highs to a healthy level of 6–8 weeks, with promotional intensity weakening and average prices stabilizing. By cutting low-end SKUs and focusing on high-end series like Extreme Pro, SanDisk has successfully maintained brand premium and avoided getting bogged down in price wars.

Last quarter, SanDisk achieved a net profit of $112 million with a net margin of 4.85%, representing a staggering 586.96% quarter-on-quarter surge, marking the establishment of a profitability turning point.

Multiple institutions have noted that SanDisk has implemented structural price increases of over 10% across both its consumer and enterprise product lines without significantly affecting order volumes, reflecting its brand premium and technological barriers.

Over the past six months, major institutions covering SanDisk have generally maintained "Buy" ratings. Jefferies Financial Group noted that the earnings call will be a critical window for verifying the "sustainability of the pricing strategy."

SanDisk's performance this time is not just about short-term stock price; it determines whether the capital market can reposition it as a "core storage provider for the AI era" rather than a traditional consumer brand. Supported by the storage cycle upturn, the explosion of AI demand, and strengthened price discipline, SanDisk is expected to deliver results that break the curse of "cyclical rebound" and move toward "structural growth."