The Ultimate Growth Stock to Buy With $1,000 Right Now

Key Points

MercadoLibre continues to demonstrate outstanding performance across various metrics.

The e-commerce platform has tremendous long-term opportunities in multiple segments.

Yet, the shares of this Uruguay-based company still trade at an attractive valuation.

- 10 stocks we like better than MercadoLibre ›

Growth investors have a specific goal: seeing their funds appreciate. Since there's never a way to know the future, that often comes with risk, and growth investors typically accept that risk as part of the equation. There are many factors that come into the formula, with higher-risk choices often coming with the highest potential for gains.

Many investors can benefit from high-potential stocks without moving toward the speculative end of the spectrum. Take MercadoLibre (NASDAQ: MELI) stock, for example. It has already delivered for investors, but it still has outsized opportunities. While I wouldn't call it a low-risk stock, it's stable and established, making it a high-growth stock that can suit nearly any investor's risk level. That's why it's the ultimate growth stock.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Performance

While some growth investors are willing to overlook current performance for the long-term opportunity, with MercadoLibre, there's no need to do that. It consistently reports robust growth on the top-line metrics, the softer metrics demonstrate strong engagement, and the company is highly profitable.

Take the third-quarter results as a snapshot in a much larger story. Total revenue increased 49% year over year (currency neutral). Consider that this is on top of similar growth rates for years, and it's truly outstanding performance.

Image source: Getty images.

MercadoLibre started out as an e-commerce company, and it's still growing rapidly in this space. Gross merchandise volume increased 35% year over year in the third quarter, with a 26% increase in active buyers, the highest increase in nearly five years. Management recently lowered its free shipping threshold in Brazil, one of its top three markets, and it has resulted in a cascade of positive results, starting with more active customers, leading to more sellers wanting to be on the platform, and a cycle of high engagement and sales in the region.

The full MercadoLibre ecosystem includes a fintech app called MercadoPago. It's a digital wallet that has grown to include a vast array of services, including bank accounts and credit cards, and MercadoLibre is aiming to become the top digital bank in Latin America. Monthly active users increased 29% year over year in the third quarter, and total payment volume increased 54%.

As for profitability, operating income increased 30% over last year in the quarter, but operating margin fell from 10.5% last year to 9.8%. As management put it, "a reasonable trade-off for investments that expand our addressable markets, seed future growth, strengthen our competitive position, and drive long-term scale."

Opportunity

Clearly, management is investing for the future. And the opportunity is massive, since the company's addressable market is a population of more than 500 million people in Latin America, and this region is behind the curve in e-commerce and fintech. Brazil is its largest market, and it's making investments to capture e-commerce market share, such as the lower free shipping threshold. Shipments increased 28% over last year in the country in the third quarter without any negative impact on speed or service, and unit costs actually fell 8% as the level of scale rises.

The opportunity in fintech is at least equally compelling. In Brazil, 59% of credit is still in the hands of the five large, established banks that control most of the country's financial management. And $200 billion is sitting in low-yield accounts, a situation ripe for disruption.

Management sees the biggest opportunities here in what it calls principality, or becoming the main banking partner for its users. That results in higher retention rates, more cross-selling activity, and lower delinquencies.

Valuation

It would be hard to call any stock the ultimate growth stock if it were too expensive. There are some excellent growth stocks out there today with tremendous long-term opportunity and incredible performance, but so much of that is already carried in the price that it's a setup for a correction.

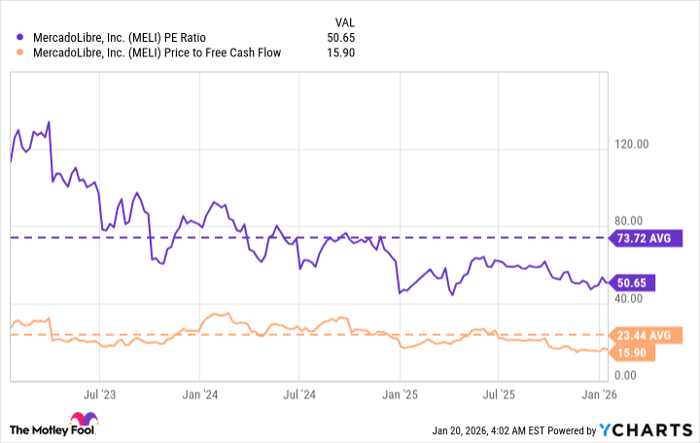

MELI PE Ratio data by YCharts

However, MercadoLibre stock trades at a reasonable P/E ratio and price-to-free cash flow ratio, both of which are below their three-year averages. If you have $1,000 available to invest today, it will only get you a piece of one share, but fractional shares can be an excellent gateway to participate in this exceptional stock's story.

Should you buy stock in MercadoLibre right now?

Before you buy stock in MercadoLibre, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and MercadoLibre wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $460,340!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,123,789!*

Now, it’s worth noting Stock Advisor’s total average return is 937% — a market-crushing outperformance compared to 194% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of January 22, 2026.

Jennifer Saibil has positions in MercadoLibre. The Motley Fool has positions in and recommends MercadoLibre. The Motley Fool has a disclosure policy.