President Donald Trump Wanted to Make a Historic Change to Social Security in 2025. He Failed -- but This Didn't Stop Most Seniors From Winning.

Key Points

President Trump oversaw several Social Security changes last year, including the end of paper benefit checks and a quintupling in the overpayment garnishment rate.

Donald Trump's promise to do away with the least-liked aspect of Social Security ultimately fell short.

However, Trump's flagship tax and spending law, the "big, beautiful bill," should provide a needed boost for most seniors over the next three years.

- The $23,760 Social Security bonus most retirees completely overlook ›

Last year was full of history-making moments for America's leading retirement program. In the year that Social Security officially celebrated its 90th anniversary, the average monthly retired-worker benefit surpassed $2,000 for the first time in the program's storied history.

Social Security's 2.8% cost-of-living adjustment (COLA) for 2026 also marked the fifth consecutive year that beneficiaries have seen their payout climb by at least 2.5%. That hasn't happened in almost three decades (1988-1997).

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

But perhaps the biggest spotlight has been on the numerous Social Security changes that President Donald Trump or his administration oversaw since he took office in January 2025.

President Trump delivering remarks. Image source: Official White House Photo by Shealah Craighead, courtesy of the National Archives.

While these changes have had broad-reaching implications for tens of millions of beneficiaries, Trump's attempt to completely reform Social Security in 2025 ultimately failed. However, this failure may be the best thing that could have happened to retired-worker beneficiaries.

Donald Trump oversaw a multitude of direct and indirect Social Security changes in 2025

Some of the changes President Trump oversaw were enacted by putting pen to paper in the Oval Office. For example, on March 25, Trump signed an executive order ("Modernizing Payments To and From America's Bank Account") that established Sept. 30 as the compliance date when the federal government would no longer issue paper benefit checks.

Although more than 99% of Social Security's traditional beneficiaries were receiving their monthly payout through electronic fund transfers, as of the midpoint of 2025, this executive order still required more than 500,000 individuals to set up direct deposit or obtain a Direct Express card to continue receiving their benefit.

The Social Security Administration (SSA) also improved the program's personal identification safety measures. For instance, with very few exceptions, updating direct deposit information can no longer be done over the phone. Instead, beneficiaries can adjust their direct deposit info in person at an SSA office or online when using two-factor authentication.

The SSA completely revamped the overpayment and recovery rate, as well. As of the end of fiscal 2023 for the federal government (Sept. 30, 2023), close to 2 million Social Security beneficiaries had been overpaid, with these overpayments totaling an estimated $23 billion. Under former President Joe Biden, the garnishment rate to recover overpayments was reduced to 10% from 100%. This reduction coincided with the COVID-19 pandemic.

In April 2025, the SSA announced plans to end the overpayment and recovery rate established during the Biden era and initiate a 50% garnishment rate on overpayments.

But the biggest proposed Social Security change from Donald Trump is the one that didn't come to fruition.

Trump's attempt to end the tax on benefits failed -- and with good reason

The proposed historic change that President Trump wanted to make was to eliminate the tax on Social Security benefits.

In 1983, the asset reserves of Social Security's combined trust funds -- the Old-Age and Survivors Insurance trust fund (OASI) and Disability Insurance trust fund (DI) -- were running on fumes. The passage of the Social Security Amendments of 1983 introduced, among other changes, the taxation of benefits.

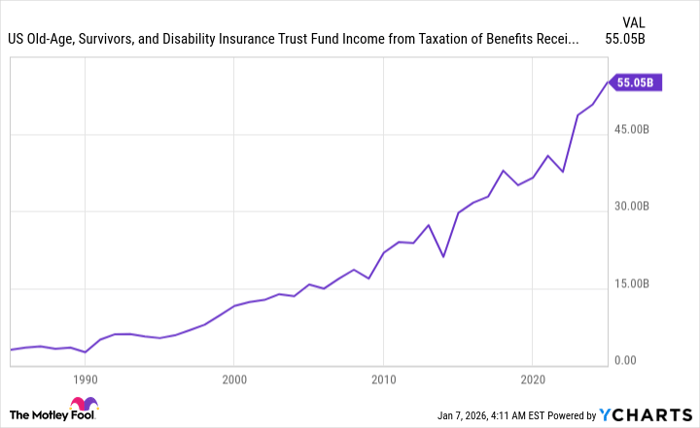

Taxing benefits has become an increasingly important source of income for Social Security. US Old-Age, Survivors, and Disability Insurance Trust Fund Income from Taxation of Benefits Receipts data by YCharts.

Beginning in 1984, individuals and couples filing jointly with respective provisional income -- adjusted gross income (AGI) + tax-free interest income + half of Social Security benefits -- above $25,000 and $32,000 could have up to 50% of their Social Security income subject to federal taxation. A decade later, a second tax tier was added, subjecting up to 85% of Social Security income to federal taxation for individuals and couples filing jointly with provisional income exceeding $34,000 and $44,000, respectively.

What's made the tax on benefits so despised is that these income thresholds have never been adjusted for inflation. What was once a tax applicable to approximately 1 in 10 senior households is now subjecting around half of all senior households to some level of taxation on their Social Security benefits.

Both prior to and after his November 2024 election, Trump promised to end the taxation of benefits. Ultimately, he failed to do so.

Changing the Social Security Act would require 60 votes in the Senate, and neither of America's two major political parties has held a supermajority of seats in the upper house of Congress since the late 1970s. With virtually no path to garner bipartisan support for this measure, Trump's proposal was left out of his flagship tax and spending bill (which is now law), the "big, beautiful bill."

Image source: Getty Images.

Trump's failed reform effort led to a consolation prize for most seniors

Given that an overwhelming majority of seniors dislike the taxation of Social Security benefits, you'd expect that they'd be disappointed with President Trump's failed effort to reform the program. But in many cases, this couldn't be further from the truth. That's because a consolation prize in the president's "big, beautiful bill" will benefit many aged recipients.

The tax and spending law Trump signed on Independence Day last year comes with several temporary tax breaks. This includes the ability for some workers to deduct up to $25,000 for qualified tips and up to $12,500 for overtime pay, depending on their modified AGI from tax year 2025 through 2028. It also introduced an enhanced deduction of $6,000 per eligible senior aged 65 and above ($12,000 for couples filing jointly). This $6,000 (or $12,000) is in addition to the existing standard deduction and is effective for tax years 2025 through 2028.

If the taxation of Social Security income had been eliminated, only the top half of recipients, in terms of provisional income, would have benefited. In other words, low earners wouldn't have received any benefit from President Trump's original promise.

However, the senior deduction directly benefits low- and middle-income recipients -- i.e., those who are likeliest to rely on Social Security to make ends meet. Trump's failure to reform Social Security has resulted in most seniors winning, thanks to this consolation prize.

Furthermore, eliminating the tax on benefits would have created big problems for America's leading retirement program. Taxing benefits is one of Social Security's three sources of income, and its elimination would have almost certainly widened the program's funding obligation shortfall and sped up the timeline to projected benefit cuts.

To be fair, an analysis from the SSA's Office of the Actuary estimated that Trump's "big, beautiful bill" is going to increase combined costs for the OASI and DI by $168.6 billion from 2025 through 2034. Nonetheless, this is a considerably smaller figure than what ending the tax on benefits would have produced.

Ultimately, Trump's failure will be a boon for most seniors over the next three years.

The $23,760 Social Security bonus most retirees completely overlook

If you're like most Americans, you're a few years (or more) behind on your retirement savings. But a handful of little-known "Social Security secrets" could help ensure a boost in your retirement income.

One easy trick could pay you as much as $23,760 more... each year! Once you learn how to maximize your Social Security benefits, we think you could retire confidently with the peace of mind we're all after. Join Stock Advisor to learn more about these strategies.

View the "Social Security secrets" »

The Motley Fool has a disclosure policy.