Is AI Still a Market Tailwind as We Head Into 2026?

Key Points

Focusing on high-quality cash-generating companies always makes sense.

There might be a need for some higher AI-related valuations to come down, but that doesn't mean AI spending is in a bubble that's about to burst.

- 10 stocks we like better than Alphabet ›

The headline of this article poses a serious question that investors should think about, especially given how excited the market got about artificial intelligence (AI) spending in 2025. There are genuine concerns about whether an AI bubble is about to burst.

As we enter 2026, here's what you need to know about the AI investing theme and its durability this year.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

The AI market entering 2026

It's important to distinguish between the outlook for AI spending and stock valuations. Just because individual stocks like Palantir Technologies trade at 167 times forward earnings doesn't mean the overall AI market is in a bubble. While some AI-related stocks may be overvalued, it doesn't necessarily follow that a bubble is about to burst. In fact, evidence from companies with exposure to early cycle AI spending shows no signs of a slowdown.

Image source: Getty Images.

The companies I'm referring to are mechanical and electrical contractor Comfort Systems (NYSE: FIX) and semiconductor test equipment maker Teradyne (NASDAQ: TER). Comfort is an early-cycle company because it installs the electrical and cooling infrastructure needed for AI data centers to function. Teradyne is also an early-cycle company, as it manufactures automated test equipment that helps ensure AI chips are manufactured without defects.

The good news is Comfort's backlog grew 15.5% sequentially in its third quarter. CEO Brian Lane noted that, "There's still more opportunities than probably can be handled out there in the market at the moment. So we've seen no let-up at all in the opportunities," when he discussed the pipeline in the fourth quarter.

It was a similar story in Teradyne's third quarter, with CEO Greg Smith noting, "Our Semiconductor Test Group delivered third quarter sales that exceeded expectations," and "Growth was driven primarily by System-on-a-Chip (SOC) solutions for artificial intelligence applications." He guided investors to a 25% sequential increase in overall sales for the fourth quarter. All told, the evidence from early cycle companies is that all lights remain green for AI-related spending.

Image source: Getty Images.

Investing in the AI sector in 2026

That said, valuations still matter, and investors need to be mindful that history suggests companies will stretch themselves and overinvest in a "me too" effort to be part of the AI zeitgeist. That's why it makes sense to consider the words of Asit Sharma, Motley Fool AI Stock Analyst, who argues that "AI is a generational investment opportunity. Consistent investing in quality leaders helps you ride out short-term volatility and capture long-term gains" as noted in The Motley Fool's 2026 AI Investor Outlook Report.

AI stocks to buy and avoid

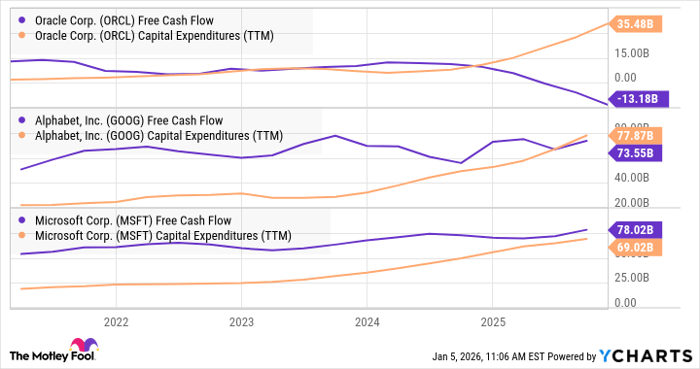

One way investors can buy into quality companies is by distinguishing between companies with ample cash flow to cover their AI investments and proven winners in building profitable cloud computing businesses. For example, in terms of the hyperscaler plays, Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) and Microsoft (NASDAQ: MSFT) are exactly such companies, and Oracle (NYSE: ORCL), with its reliance on a $300 billion deal with the heavily loss-making and cash-burning OpenAI, is a lot less attractive.

Data by YCharts.

All told, based on what companies with early-cycle AI spending exposure are saying, AI looks likely to be a tailwind for companies in 2026. Still, investors need to be mindful of valuations and focus on companies with solid finances and a clear long-term strategy.

Should you buy stock in Alphabet right now?

Before you buy stock in Alphabet, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Alphabet wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $488,653!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,148,034!*

Now, it’s worth noting Stock Advisor’s total average return is 971% — a market-crushing outperformance compared to 196% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of January 8, 2026.

Lee Samaha has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Comfort Systems USA, Microsoft, Oracle, and Palantir Technologies. The Motley Fool recommends Teradyne and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.