Is Oklo Stock Yesterday's News?

Key Points

Oklo is designing small nuclear reactors for the AI era.

The company's shares have soared over 270% on the year.

The stock's hefty valuation now should give investors pause.

- 10 stocks we like better than Oklo ›

Here's a number for you: $61 billion. Why's that significant? I'll tell you: It's the amount invested in the data center market in 2025. In short, not a small sum.

Now here's another number for you -- 430 trillion. What's that mean? Well, according to The Washington Post, that's how many watt-hours data centers in the U.S. are projected to consume by 2030. Put differently, that wattage could power 16 Chicagos.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

At its current power generation capacity, the U.S. simply does not have the means to power that many data centers -- at least, not yet. In the meantime, several energy start-ups are seizing the moment to pitch novel technologies that would have likely been met with less market enthusiasm a decade ago.

One of those companies is the nuclear stock Oklo (NYSE: OKLO).

A large-cap stock with small reactors

By now, most investors are familiar with Oklo (if that's you, skip on down to the next section). But if the name doesn't ring a bell (or sounds like a bit like a yogurt company), the company's pitch is pretty simple.

In a nutshell, it's designing a fast-spectrum nuclear reactor with complementary fuel recycling capabilities. Its flagship design -- Aurora powerhouse -- can produce up to 75 megawatts (MWe), enough to power a mid-sized data center. These powerhouses are also small, modular, and can be attached to produce more electricity as needed.

Image source: Oklo.

Some other facts: Aurora is designed to take a special fuel, high-assay low-enriched uranium (HALEU), which could keep it operating for a decade or longer without refueling. The company is going after data centers (indeed, it even has some partnerships lined up), but the compactness of its design could appeal to anyone who needs gridless power, including military zones, mining camps, and research facilities.

Oklo might be yesterday's news

I started investing in Oklo this year, because I thought it had long-term potential to power the future. I still believe in that value proposition. And yet, at this point in 2025, even I'm looking at its market valuation and thinking, "This room is starting to feel a little crowded."

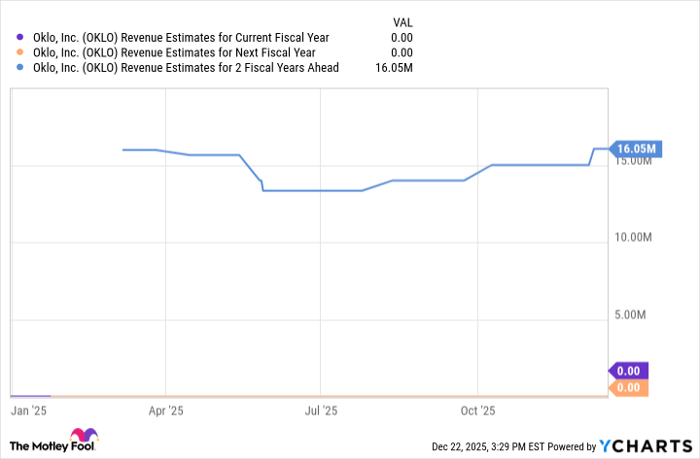

Let's start with the market cap. Almost $13 billion on Dec. 22, and between $24 and $25 billion at its 52-week highs in October. That's a stunningly large value for a company that has zero revenue and a probable two-year gap before any revenue is generated.

OKLO Revenue Estimates for Current Fiscal Year data by YCharts

"OK," the bulls will argue, "but Oklo has $1.2 billion in cash and equivalents and 14 gigawatts in the backlog. That should be enough for it to keep humming before the revenue spigot is turned."

I don't disagree. At the same time, the stock is trading at about 10 times book value, about five times more than the average for the energy sector. In other words, a bullish expectation of growth is already baked in.

Oklo is clearly not a little-known stock anymore. It's a name backed by both Sam Altman and enough investors to push it in large-cap territory. It can be exciting long-term. But at today's price, it's already yesterday's news.

Should you buy stock in Oklo right now?

Before you buy stock in Oklo, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Oklo wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $509,470!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,167,988!*

Now, it’s worth noting Stock Advisor’s total average return is 991% — a market-crushing outperformance compared to 196% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of December 29, 2025.

Steven Porrello has positions in Oklo. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.