Prediction: These 2 Artificial Intelligence Stocks Could Be Worth More Than Palantir by 2026

Key Points

Palantir's valuation levels are far too high.

AMD believes it can grow at a rapid pace.

Salesforce's stock is reasonably priced for the growth it provides.

- 10 stocks we like better than Advanced Micro Devices ›

Palantir (NASDAQ: PLTR) has been on a remarkable run since the artificial intelligence (AI) arms race began in 2023. Its stock is up over 2,700% since 2023, and has doubled in each year since then.

However, there is a bit of a problem with Palantir's stock. It has become drastically overvalued, and I think it could be ripe for a pullback in 2026, opening the door to other companies to surge past it.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Two AI companies that could be larger than Palantir by the end of 2026 are AMD (NASDAQ: AMD) and Salesforce (NYSE: CRM). Palantir currently sports a $435 billion market cap, while AMD and Salesforce are much smaller at $343 billion and $250 billion, respectively. Through a combination of these stocks rising and Palantir's falling, I think the order could be shaken up in 2026.

Image source: Getty Images.

Why is Palantir overvalued?

As mentioned, Palantir's stock has risen by over 2,700% since 2023. However, its revenue is only up a mere 104%. That's because investors are willing to pay more for Palantir's stock now than they were three years ago. There is a limit to how much investors should be willing to pay, and Palantir is well beyond that threshold.

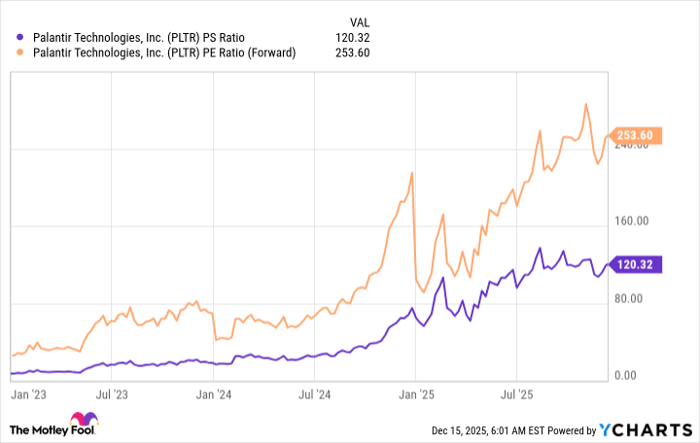

PLTR PS Ratio data by YCharts

At 120 times sales and 254 times forward earnings, Palantir is among the most expensive stocks in the market. These levels also convey massive growth expectations that Palantir may not be able to live up to. As a result, I think a large pullback may be coming in 2026, as these levels are impossible to sustain unless Palantir's growth rate continues to accelerate.

I think Palantir's growth rate will moderate in 2026, which will send investors running. That opens the door for AMD and Salesforce, as each is slated to have a strong 2026 as well, but at a much more reasonable price tag.

The case for AMD

AMD has played second fiddle to Nvidia throughout the AI arms race. Its graphics processing units (GPUs) and the technology that supports them aren't nearly as advanced as Nvidia's, although that gap is starting to close. Management is bullish about its progress over the next few years and has released a bold projection for its business through 2030. They believe that their data center revenue growth rate will be around a 60% compounded annual growth rate (CAGR).

That's a huge step forward compared to Q3's 22% growth rate, and if AMD can deliver on these expectations, there's no doubt it will be a strong stock pick for 2026 and beyond. AMD isn't all data center computing, and its other two segments are expected to deliver a 10% CAGR. Overall, that will lead to a 35% CAGR through 2030, but that will be plenty to push AMD to become an excellent pick.

AMD's valuation isn't cheap at 11 times sales and 54 times forward earnings, but it's far more reasonable than Palantir's. If Palantir stumbles and AMD stays steady, AMD should be a larger company by the end of 2026.

The case for Salesforce

Salesforce has advertised its AI prowess, but has yet to see huge impacts in its financials. Salesforce is the industry leader in customer relationship management (CRM) software, and has saturated the market. It isn't easy to acquire new customers when you're only able to grow at the pace of the broader economy, so Salesforce has to create new products and upsell existing clients.

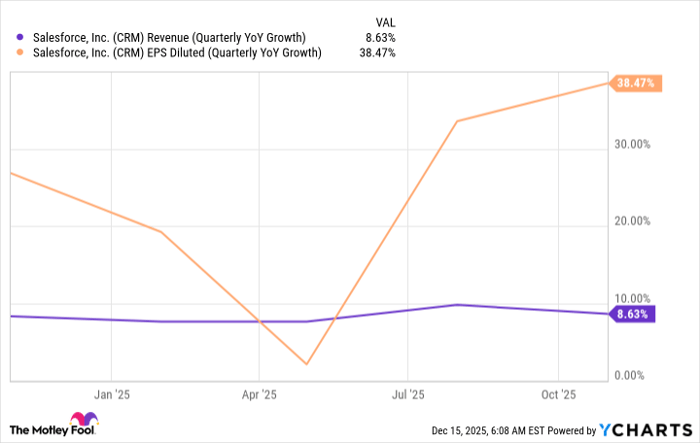

CRM Revenue (Quarterly YoY Growth) data by YCharts

Although its revenue growth has struggled to cross the double-digit mark, its diluted earnings per share (EPS) have been phenomenal. This is a sign of a maturing business and has also brought Salesforce's valuation to a reasonable level. The stock trades for 22 times forward earnings, making it the cheapest stock on this list.

If Palantir stumbles due to high expectations and Salesforce continues chugging along with incremental growth, I wouldn't be surprised to see Salesforce at a higher market cap than Palantir by the end of 2026.

Should you buy stock in Advanced Micro Devices right now?

Before you buy stock in Advanced Micro Devices, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Advanced Micro Devices wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $506,935!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,067,514!*

Now, it’s worth noting Stock Advisor’s total average return is 958% — a market-crushing outperformance compared to 192% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of December 19, 2025.

Keithen Drury has positions in Nvidia and Salesforce. The Motley Fool has positions in and recommends Advanced Micro Devices, Nvidia, Palantir Technologies, and Salesforce. The Motley Fool has a disclosure policy.