Down 60%, Should You Buy the Dip on QUBT Stock?

Key Points

Quantum computing stocks have pulled back in recent months on concerns about an AI bubble.

Quantum Computing Inc. is the smallest of the major quantum computing stocks.

There have not been any insider purchases of the stock this year.

- 10 stocks we like better than Quantum Computing ›

Quantum computing stocks have been one of the biggest surprises of 2025.

The emerging industry, which was virtually unheard of a little more than a year ago, began to gain steam after President Trump was elected, and surged last December when Google announced a breakthrough with its quantum chip, Willow.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

On the heels of the AI boom, which has driven hundreds of billions of spending on capital expenditures on data centers and chips and added trillions in market value, investors are hopeful that quantum computing could be the next transformative technology.

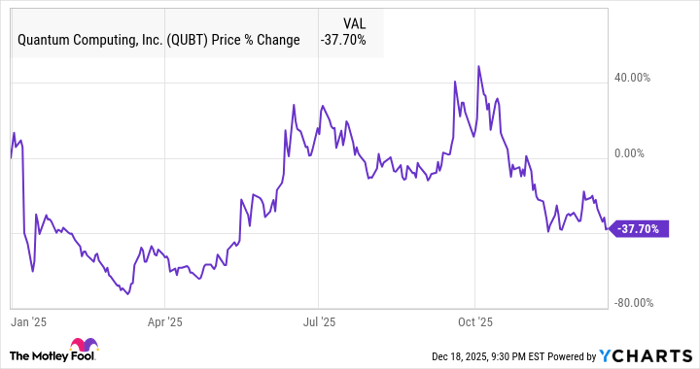

Quantum computing is still in its infancy, but the technology has a lot of potential. One of the quantum stocks that has gotten attention from investors this year is Quantum Computing Inc. (NASDAQ: QUBT), also known as QCi. As you can see, it's been a rocky year for QCi, and the stock is now down 38%, which includes an early sell-off in the year as the sector gave up some of the gains from Google's Willow announcement.

QUBT data by YCharts

QCi is the smallest of the four major quantum computing stocks, and it currently has a market cap of $2.3 billion. However, Quantum Computing Inc. still isn't generating material revenue as it only had revenue of $546,000 over its last four quarters, and $384,000 in the third quarter.

After the pullback following its peak in early October, QCi is now down 60% from its high. Is this a buying opportunity for the quantum stock or a warning sign that it could fall further? Let's explore.

Image source: Getty Images.

What you need to know about Quantum Computing Inc.

With less than $1 million in revenue over the last four quarters, QCi is still a development-stage company.

There are a lot of different ways quantum computing is being applied by the different quantum computing companies. QCi's specialty is photonics, or fabricating photonic computing engines using thin-film lithium niobate (TFLN).

The company opened its photonic chip foundry in Arizona, known as Fab 1, in February, and it's aiming to build a second, larger facility. It's also making progress in commercialization, having received a purchase order from a top 5 U.S. bank for its quantum security solutions. It also took a step forward with its collaboration with NASA.

QCi looks adequately capitalized at the moment with $352.4 million and no debt, and its operating expenses are modest, at $28.9 million through the first three quarters.

The company aims to scale up to industrial-scale manufacturing production, and named Yuping Huang as its permanent CEO after he joined as interim chief in April. Management hasn't given guidance for its production ramp or a revenue target, but Wall Street expects the company to reach revenue of $2.8 million in 2026, more than tripling from 2025.

Why investors may want to be cautious

While Quantum Computing Inc. appears to be making progress toward its goals, there are some reasons to be skeptical of the stock.

First, it trades at a sky-high price-to-sales multiple of more than 2,000, and it looks like it will take years of growth before that ratio starts to look reasonable.

Second, the investors who know the company best, the management team, have been busy selling the stock this year, perhaps taking advantage of the surge that took place late last year. In fact, there have been no insider buys. Insiders have sold more than 2 million shares of QCi this year. That's only about 1% of shares outstanding, but these insiders understand the company better than anyone else, considering the technical and difficult-to-understand nature of quantum computing. The gap in understanding the business between management and retail investors is unusually large. It seems notable then that there was no insider purchasing of the stock.

Is Quantum Computing Inc. a buy?

Concerns about an AI bubble have pushed the whole quantum computing sector lower since its peak in early October, and that response seems fair.

It's still very early with this technology, and the emergence of AI may have led to exaggerated hopes for quantum computing. Quantum Computing Inc. could eventually scale to a meaningful size, but that's likely to take years.

At this point, investors are better off on the sidelines, waiting for more clarity from the business or a better entry point. Even as QCi has fallen 60% from its peak, it can still go a lot lower from here.

Should you buy stock in Quantum Computing right now?

Before you buy stock in Quantum Computing, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Quantum Computing wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $511,196!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,047,897!*

Now, it’s worth noting Stock Advisor’s total average return is 951% — a market-crushing outperformance compared to 192% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of December 18, 2025.

Jeremy Bowman has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.