2 High-Flying AI Stocks I'd Sell Before 2026 Arrives

Key Points

Palantir's valuation has reached unprecedented levels.

BigBear.ai's lack of growth is a red flag.

- 10 stocks we like better than Palantir Technologies ›

Positioning your portfolio for 2026 is a wise idea in the last few weeks of 2025. While many are focused on buying the stocks they think will succeed in 2026, it's also important to sell any stocks that have reached their full potential as well. Selling locks in gains and frees up cash, and I've got two popular artificial intelligence (AI) stocks that it's time to move on from.

Two stocks that I think investors should sell before 2026 are Palantir (NASDAQ: PLTR) and BigBear.ai (NYSE: BBAI), as both of these stocks have unrealistic expectations heading into 2026. It could be a disappointing year for shareholders.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Image source: Getty Images.

1. Palantir

Palantir makes artificial intelligence-powered data analytics software that has a large usage base among commercial and government clients alike. Demand for Palantir's software has been off the charts and has led to several impressive quarters over 2025. In Q3, revenue rose an outstanding 63% year over year, and its profit margin reached 40%.

Those are dominant results, so why am I advocating selling the stock?

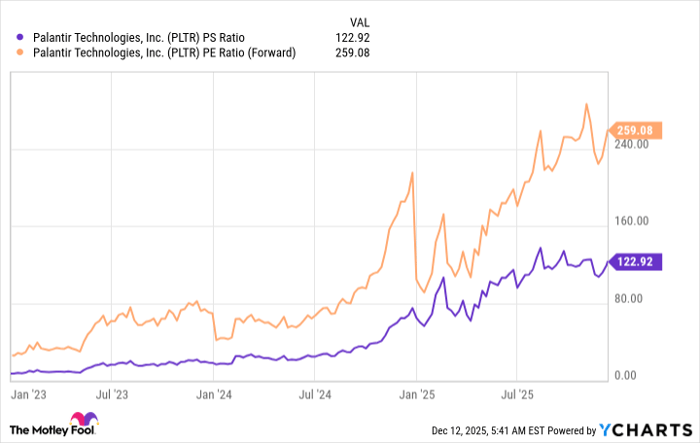

While I love Palantir's business and believe it will succeed in 2026 and beyond, the reality is the stock has gotten far too ahead of the business. Palantir's stock is one of the most expensive in the market, trading for a jaw-dropping 259 times forward earnings and 123 times sales.

PLTR PS Ratio data by YCharts

Few stocks ever trade at this excessive level of a premium, but if they do, they're often doubling or tripling their revenue year over year. For reference, Nvidia, which grew revenue at a 62% rate in Q3 (just shy of Palantir's 63%) and has a profit margin of 56%, trades for 39 times forward earnings and 24 times sales. That means that for essentially the same business, you must pay over five times the cost to own Palantir.

That's an absurd premium to pay, and it only makes sense if Palantir's revenue growth continues to accelerate. The problem is, it's expected to slow down slightly in 2026. Wall Street analysts expect 41% revenue growth in 2026, down from 54% in 2025. Palantir is priced for perfection, and if a slowdown occurs in 2026, its stock could come tumbling down. As a result, selling now to lock in monster gains is a wise idea.

2. BigBear.ai

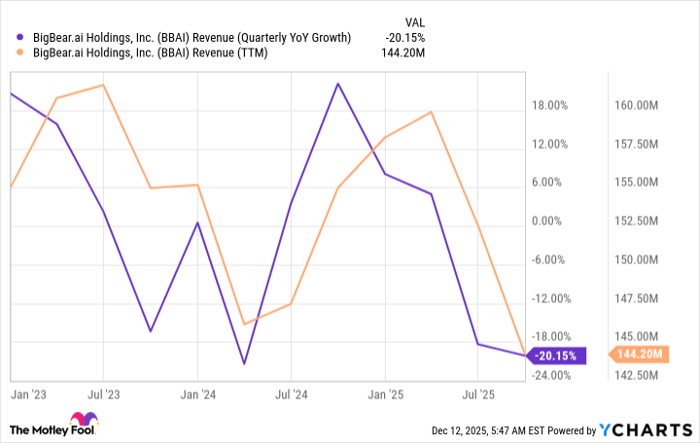

BigBear.ai (NYSE: BBAI) is a much smaller AI stock, but it has an even bigger problem than Palantir: Its revenue is shrinking. BigBear.ai focuses on providing custom AI software solutions to the U.S. government and government-adjacent businesses, such as airport security. With the massive demand for AI software thanks to generative AI power, you'd think that nearly every stock involved in AI would be rapidly growing, but you'd be wrong.

In Q3, revenue declined by 20% year over year. That marks the second straight quarter of revenue decline, and BigBear.ai's revenue hasn't moved higher since the AI revolution began in 2023.

BBAI Revenue (Quarterly YoY Growth) data by YCharts

The conditions aren't going to get any better for BigBear.ai in 2026 versus any of the previous years in terms of AI adoption, so I'm skeptical about BigBear.ai's future.

The company did make a smart acquisition in purchasing Ask Sage, a generative AI platform that specializes in sensitive information, but it could be too little, too late. Recently, the U.S. Department of Defense announced a new AI tool, GenAI.mil. This should have been a contract that BigBear.ai could have competed for, but it lost to Alphabet's (NASDAQ: GOOG) (NASDAQ: GOOGL) Gemini model.

This is just another disappointment in a long line of poor growth efforts from BigBear.ai. There are far too many winning AI stocks out there to bother messing around with BigBear.ai, and I think investors should sell the stock and move on to more promising ones.

Should you buy stock in Palantir Technologies right now?

Before you buy stock in Palantir Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $505,695!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,080,694!*

Now, it’s worth noting Stock Advisor’s total average return is 962% — a market-crushing outperformance compared to 193% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of December 17, 2025.

Keithen Drury has positions in Alphabet and Nvidia. The Motley Fool has positions in and recommends Alphabet, Nvidia, and Palantir Technologies. The Motley Fool has a disclosure policy.