Prediction: This Hypergrowth AI Stock Will Finish 2026 With the Largest Market Cap in the World

Key Points

Alphabet has multiple levers it can pull to keep growing its market share in AI, which will lead to earnings growth.

Its operating earnings growth will help it achieve the largest market cap in the world in 2026.

- 10 stocks we like better than Alphabet ›

The dominant megacap company of the last few years has been Nvidia (NASDAQ: NVDA). Today, it is worth $4.3 trillion, making it the most valuable company in the world by market capitalization. Riding the wave of spending on artificial intelligence (AI) hardware, the premier supplier of advanced parallel processing chips has seen gargantuan demand from customers, and it has faced relatively little competition.

I believe that has begun to change, and will continue to change in 2026, all due to one company: Alphabet (NASDAQ: GOOGL) (NASDAQ: GOOG). The technology giant has designed its own AI accelerator data center chips, which it both uses for its internal needs and rents access to through Google Cloud. With its growing market share in the AI services space, Alphabet looks poised to dethrone Nvidia as the largest company in the world by market value.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Image source: Getty Images.

Full-stack infrastructure and distribution advantages

Over the past decade, Alphabet has developed its own AI data center chips, which it calls Tensor Processing Units (TPU). Excluding the actual manufacturing of the chips, Alphabet has a vertically integrated solution compared to other AI players, which reduces its need to buy expensive Nvidia hardware.

Alphabet -- which owns Google, YouTube, Google Cloud, and Android, and the Chrome browser, among other things -- uses these computer chips in its data centers to help handle the billions of AI queries it processes daily. It also has its own large language model, Gemini, as well as some of the best data sources in the world to train its AI tools with, thanks to the billions of people using its products. These billions of users also give Alphabet a distribution advantage for its Gemini chatbot.

This distribution advantage explains why Alphabet has been able to grow its market share compared to competitors such as OpenAI (which is also a customer of Nvidia). The Gemini App now has 650 million monthly active users, which is catching up quickly to ChatGPT's estimated 845 million. Not to mention all the existing users of Google services who are receiving answers powered by Gemini today.

Alphabet has multiple growth engines for earnings

As Gemini's capabilities grow, it can be pushed to the billions of people who use an Alphabet product every day. More usage should equate to more revenue growth across all of Alphabet's product lines.

There is the traditional Google Search business, which last quarter grew revenue 14.5% year over year. YouTube's advertising revenue grew 15%. Google Cloud grew by a whopping 34%, and subscriptions (which are where Gemini revenue is segmented) grew over 20%.

Revenue growth should continue through 2026 as Alphabet keeps taking market share in AI and riding a steady wave of sector adoption. In turn, this should lead to more earnings growth.

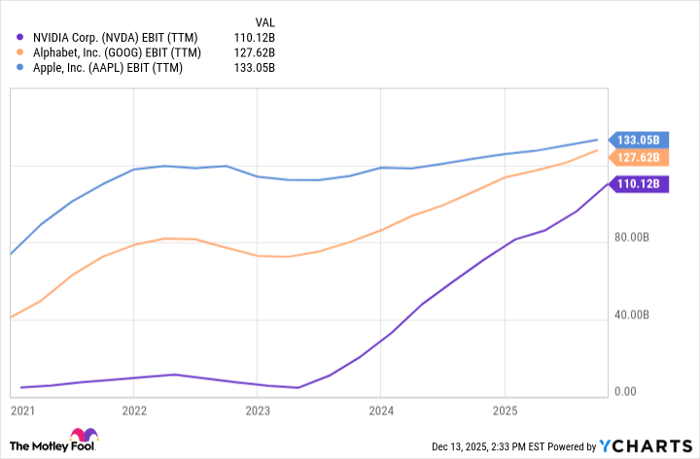

Data by YCharts.

Why Alphabet will have the largest market cap in the world

Nvidia does not generate as much in operating earnings (or earnings before interest and taxes) compared to the two stocks just behind it in the market cap rankings: Apple and Alphabet. However, Wall Street is valuing it at a higher price because of its faster growth. Its operating earnings have been soaring, and its revenue rose 62% year-over-year last quarter.

In 2026, due to increased competition from Alphabet's TPUs, I think Nvidia's revenue growth is going to slow down, causing the stock to trade at a lower earnings multiple. We are already seeing Alphabet make inroads with other big tech and AI customers, making reported deals with Apple for Gemini to power the Siri chatbot and Meta Platforms to utilize Google Cloud for its computing power needs. As it encroaches on Nvidia's turf, the AI chipmaker could lose further market share.

Alphabet generated $127 billion in operating income over the past 12 months, and is growing much faster than Apple, which generates $133 billion. Nvidia is a tad lower at $110 billion. If Alphabet exceeds Apple's earnings power next year while Nvidia simultaneously sees a slowdown in its earnings growth, I think Alphabet will finish next year as the world's largest market cap.

Should you buy stock in Alphabet right now?

Before you buy stock in Alphabet, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Alphabet wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $505,695!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,080,694!*

Now, it’s worth noting Stock Advisor’s total average return is 962% — a market-crushing outperformance compared to 193% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of December 16, 2025.

Brett Schafer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Apple, Meta Platforms, and Nvidia. The Motley Fool has a disclosure policy.