Should You Forget Teva Pharmaceutical and Buy These Unstoppable Stocks Instead?

Key Points

Shares of Teva -- a generic-drug maker with a history of losses and high leverage -- have rallied strongly.

Pfizer and Merck, which make branded drugs, are financially strong and are rebuilding their drug pipelines.

- 10 stocks we like better than Teva Pharmaceutical Industries ›

Shares of Teva Pharmaceutical Industries (NYSE: TEVA) rallied after it reported earnings on Nov. 5. The stock is now higher by a whopping 45% in roughly a month. The company reported strong results, and it appears that the business is well positioned.

However, after such a large price advance, you may be better off looking at two still-struggling makers of branded drugs instead. Here's why.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Teva Pharmaceutical has moved very far, very fast

Teva's big business is selling generic drugs. Essentially, it's the competition for makers of branded drugs once their patented medications lose patent protection. Teva and its peers are what cause the patent cliffs that branded-drug companies are constantly trying to manage around.

Image source: Getty Images.

It's not a bad business to be in, and Teva is a leader in the industry. In addition to its generic drugs, the company has been developing its own branded products. It has also been focusing on more-complex-to-produce generics as a means of differentiating itself from its generic peers. When it reported third-quarter earnings, Teva beat Wall Street expectations on both the top and bottom lines of its income statement.

The stock's 45% rally following the earnings release shows that investors are excited about Teva's future. However, it also prices in a lot of good news in a very short period of time. There are still some concerns to address, including the company's substantial debt load, a history of operating losses, and the fact that it hasn't paid a dividend in years.

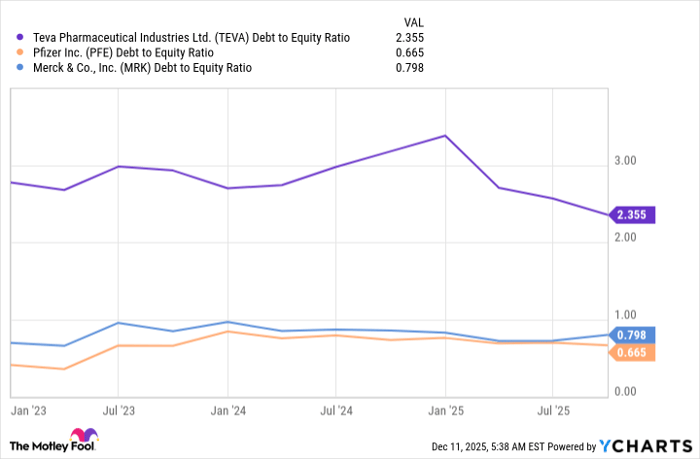

TEVA Debt to Equity Ratio data by YCharts.

Some drugmaker alternatives may be more attractive

While Teva produces what are essentially knockoffs, Pfizer (NYSE: PFE) and Merck (NYSE: MRK) manufacture originals. They both have long histories of success in this area, despite the intense competition and highly technical nature of the pharmaceutical industry. They are both facing patent cliffs in the coming years, which makes investors worry about their future prospects.

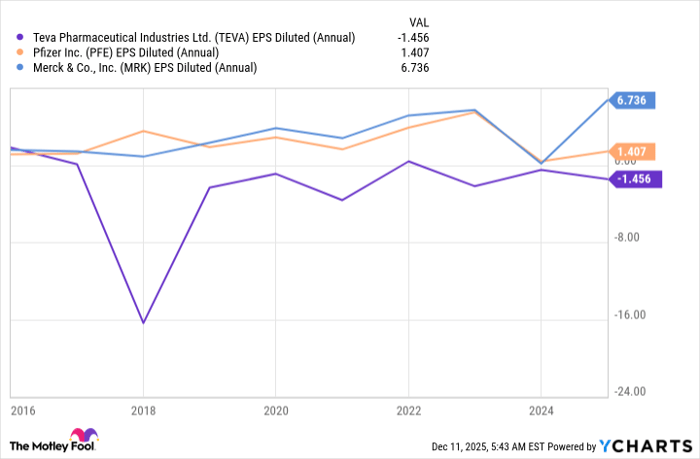

However, both are financially strong companies, with materially less leverage than Teva, as the chart above highlights. Moreover, both have consistently been profitable, while Teva has a history of losses, as the chart below shows:

TEVA EPS Diluted (Annual) data by YCharts.

The strong profits that Pfizer and Merck enjoy enable them to invest in new drugs to replace those that are losing patent protection.

Pfizer has been working aggressively to get its drug pipeline back on track after its own weight-loss drug failed. It acquired a company with a promising GLP-1 candidate, and has partnered with another to market a GLP-1 drug (assuming it proves effective). Pfizer is proving that even a drug setback isn't enough to stop the company.

Merck, meanwhile, recently made its own acquisition, agreeing to buy Cidara Therapeutics. The purpose of the deal was to get access to Cidara's influenza drug candidate. Like Pfizer, Merck is demonstrating that it can effectively manage the challenges of patent expirations.

For investors who think in decades, not days, the lagging performance of Merck and Pfizer presents a buying opportunity. Dividend lovers will likely prefer Merck and its current 3.5% yield, because its dividend payout ratio is a very reasonable 45% or so. Pfizer's 6.7% yield is now much higher, but it comes along with a worrying payout ratio of 100%.

Teva looks expensive after a big rally

There's no reason that Teva's stock price couldn't keep running higher, but long-term investors should keep its valuation in mind. The price-to-earnings ratio is currently sitting just shy of 50, indicating exactly how much good news investors have priced into the shares. Pfizer's P/E ratio is 15 and Merck's is 13.

You can buy the market darling with the mediocre history, or get a bargain price on two well-respected industry leaders as they continue to successfully navigate the drug industry's normal ups and downs. Most long-term investors should probably go with the still-out-of-favor Pfizer or Merck.

Should you invest $1,000 in Teva Pharmaceutical Industries right now?

Before you buy stock in Teva Pharmaceutical Industries, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Teva Pharmaceutical Industries wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $513,353!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,072,908!*

Now, it’s worth noting Stock Advisor’s total average return is 965% — a market-crushing outperformance compared to 193% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of December 8, 2025

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Merck and Pfizer. The Motley Fool has a disclosure policy.