Prediction: With or Without Warner Bros., Netflix Will Crush the S&P 500 From 2026 Through 2030.

Key Points

Netflix is putting a lot on the line to buy Warner Bros. Discovery.

HBO’s content and pricing model complement Netflix well.

Netflix is a high-margin cash cow that can grow steadily, regardless of the state of the economy.

- 10 stocks we like better than Netflix ›

On Dec. 5, Netflix (NASDAQ: NFLX) shocked investors with plans to acquire Warner Bros. Discovery for an enterprise value of $82.7 billion, with $72 billion in cash and stock.

The deal would boost Netflix's content library with several well-known television and film titles and franchises, including HBO and HBO Max programming. It would also bolster Netflix's original content creation capabilities.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

But investors reacted negatively to the news, with the stock down over 6% since the announcement. To make matters more complicated, Paramount Skydance (NASDAQ: PSKY) announced a hostile takeover bid for Warner Bros., which makes the Netflix deal less of a sure bet.

With the deal now up in the air and Netflix down around 22% in the last three months, investors may be wondering how to approach the streaming giant for 2026 and beyond.

Here's why Netflix remains a high-conviction buy, and why it has what it takes to outperform the S&P 500 over the next five years.

Image source: Netflix.

Netflix doesn't need Warner Bros.

Netflix isn't known for splashy acquisitions.

Outside of content licensing and a few smaller deals here and there, Netflix has essentially built its streaming empire from scratch, disrupting the entire movie and television industry in the process. Investors took notice, as Netflix is worth more than twice as much as Walt Disney and more than four times the value of Comcast.

Netflix has achieved considerable success in developing its own content, particularly in the series category. Netflix has produced several standout films as well, the most recent example being KPop Demon Hunters. KPop Demon Hunters is Netflix's most successful film ever -- animated or live action. That's without even factoring in the effect of music, merchandise, and potential sequels.

Netflix is producing several hits, steadily boosting its subscriber base even as people reduce their spending, and it's growing sales, margins, and cash flow. All told, Netflix is a well-oiled machine that has become a staple in many households.

Buying Warner Bros. could pay off in the long run

Netflix's stock price dropped after the initial Warner Bros. announcement, likely because investors wondered why Netflix needed to expand its content library at all. It has fallen since, probably because investors don't want to see Netflix enter a bidding war with Paramount Skydance.

Content is crucial, but so is content distribution. Netflix has the best content distribution platform in the industry, so leveraging Warner Bros. franchises on its platform could be widely successful.

If the deal goes through, Netflix would gain access to the Harry Potter franchise, the DC universe, and HBO content, which opens the door to tons of legacy franchises and sequel/spin-off potential through shows like Game of Thrones, The Sopranos, Friends, and more.

The simplest reason to be optimistic about the Warner Bros. deal is that it provides Netflix with more options when allocating its content budget. Unlike a traditional film studio that relies on box office hits, Netflix's goal is to provide a sufficient quantity and quality of content to keep users engaged, so that they will renew their subscriptions or be willing to accept price hikes. Netflix implemented several price hikes in recent years and cracked down on password sharing, which could have led to a slowdown in sales growth. But subscribers mostly accepted those hikes and opened new accounts to avoid password-sharing restrictions -- showcasing Netflix's value.

Netflix hasn't been shy about its intent to expand its content breadth, mainly through live sporting events such as WWE. In the coming weeks, Netflix has the rights to air two NFL games on Christmas. In this vein, it's not surprising to see Netflix want to expand its content further with a major acquisition.

Netflix is a reasonable value

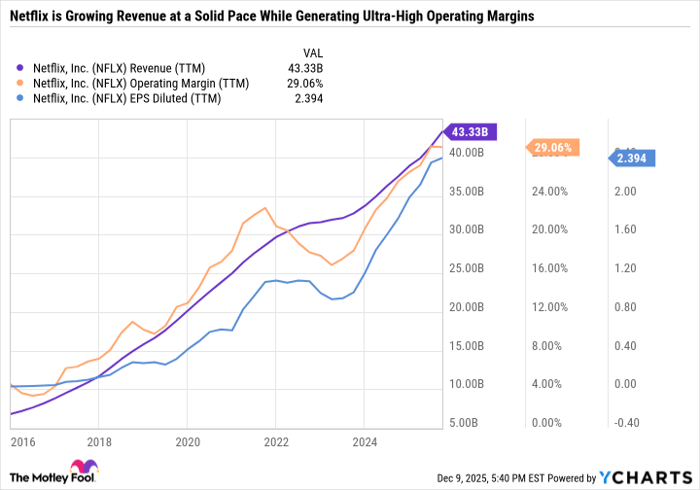

Netflix used to be valued based on its sales. However, now that it is consistently profitable, it is easier to value it based on its earnings and free cash flow (FCF). The sell-off in recent months has pushed Netflix's price to FCF down to 47, and its price-to-earnings ratio is now 40.4. That's still on the expensive side. But for context, consider that Netflix's 10-year median price-to-sales (P/S) ratio is 8.1, and its current P/S ratio is 9.7. That's a much better value for Netflix, as the company is converting those sales into bottom-line earnings at the most efficient rate in its history.

NFLX Revenue (TTM) data by YCharts. EPS = earnings per share.

Producing content is a capital-intensive business. But unlike many entertainment giants with leveraged balance sheets, Netflix exited its most recent quarter with around $5.2 billion in long-term debt net of cash and cash equivalents, which is very little for a company of its size. So Netflix can afford to make the Warner Bros. deal without derailing its financial health.

A foundational growth stock to buy and hold

If the Warner Bros. deal is finalized, Netflix should be able to expand its subscriber base and justify higher prices. Similar to Netflix, HBO offers ad-supported and ad-free pricing tiers, providing subscribers with various options to choose from, including stand-alone HBO services or bundled ad and ad-free pricing for existing Netflix subscribers.

If the deal doesn't go through, Netflix remains a high-margin industry leader at a reasonable valuation. It has continued to grow earnings even as people have pulled back on discretionary goods and services, which is a testament to the value of its content.

Given its reasonable valuation, Netflix should be able to outperform the S&P 500 over the next five years if it can grow annual earnings by double digits, which it can do with or without Warner Bros.

All told, Netflix is a no-brainer buy on its recent dip for long-term growth stock investors.

Should you invest $1,000 in Netflix right now?

Before you buy stock in Netflix, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Netflix wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $507,421!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,109,138!*

Now, it’s worth noting Stock Advisor’s total average return is 972% — a market-crushing outperformance compared to 195% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of December 8, 2025

Daniel Foelber has positions in Walt Disney and has the following options: short December 2025 $110 calls on Walt Disney. The Motley Fool has positions in and recommends Netflix, Walt Disney, and Warner Bros. Discovery. The Motley Fool recommends Comcast. The Motley Fool has a disclosure policy.