Meet the 2.5% Yield Dividend Stock That Could Soar in 2026

Key Points

UnitedHealth Group stock is trading at an attractive price-to-earnings ratio right now.

UnitedHealth's management has a solid plan to improve profit margins.

- 10 stocks we like better than UnitedHealth Group ›

I love buying beaten-down stocks when they're bottoming out -- particularly when I know it's just a matter of time before they bounce back. During the COVID-19 pandemic, I grabbed shares of both Delta Air Lines and Royal Caribbean Cruises when they were trading for pennies on the dollar because I knew they would both rebound when travel restrictions lifted and vacations were possible once again. I held both stocks for two years and more than doubled my investment in both.

Looking at the market today, one name that I can put in a similar category is healthcare giant UnitedHealth Group (NYSE: UNH). The primary difference I see compared to Delta and Royal Caribbean is that those travel stocks were victims of circumstance, while UnitedHealth Group's stock suffered this year because the company made some bad decisions.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

But either way, I feel really confident that UNH stock will rebound in 2026. Considering the stock also has a strong dividend yield of 2.5%, I'll strongly consider picking up shares when I rebalance my portfolio at the end of the year.

Image source: Getty Images.

About UnitedHealth Group stock

UnitedHealth Group is a Minnesota-based managed care company that generates revenue by offering Medicare and Medicaid supplemental plans, including Medicare Advantage, as well as health insurance plans for individuals and businesses. The company is the largest managed care company in the U.S., boasting roughly 23% of the market share. CVS Health (NYSE: CVS) at 19.9% and Cigna Group (NYSE: CI) at 13.5% are the only other two companies with a market share of more than 10%.

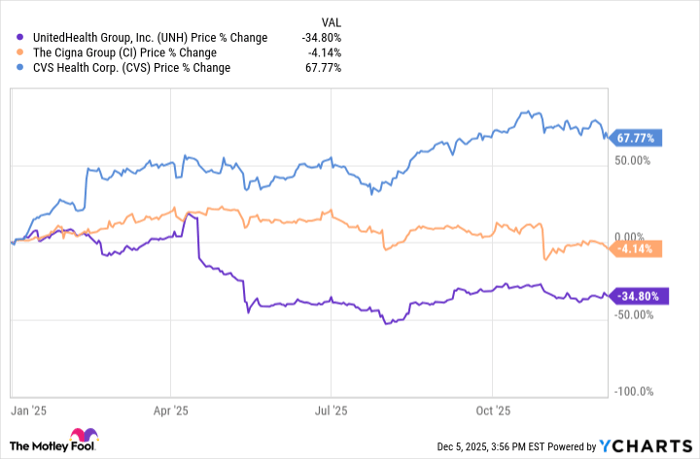

Share prices are trading down about 35% so far this year, with much of the drop happening after UnitedHealth Group's shockingly bad first-quarter earnings report, in which it missed analysts' expectations for the first time since 2008. The stock's performance this year is far worse than either CVS, which also has a robust retail business, or Cigna.

Data by YCharts.

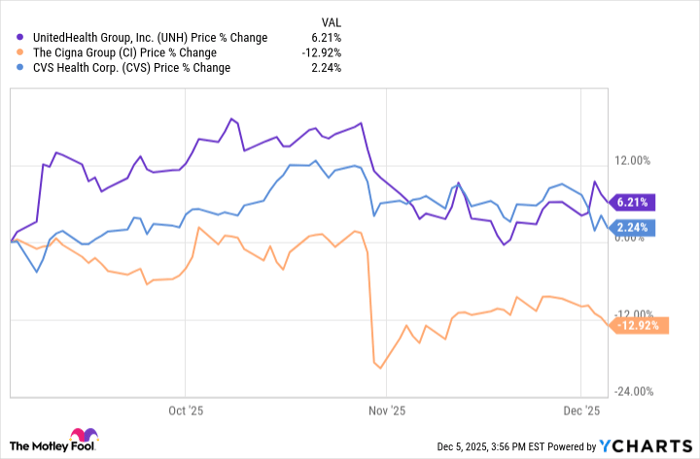

But in today's what-have-you-done-for-me-lately world, I'm more focused on the short-term performance. Over the last three months, UNH stock has actually outperformed its competitors, suggesting that the company has hit bottom -- and the recovery has yet to begin in earnest.

Data by YCharts.

Why I'm confident in a UnitedHealth Group rebound

The biggest problems facing UNH are solvable; they just require time. Management acknowledged that it had badly misjudged how much it would be charged for services by hospitals and doctors when setting 2025 customer premiums. When it realized its mistake, it adjusted its 2025 full-year guidance to note an increase in medical costs by $6.5 billion. It also raised 2026 premiums.

However, that doesn't really help things this year. As much as UNH can try to cut costs, it's unable to achieve the profit margin this year that it had expected due to that mistake. Management announced that it plans to rectify the problem in 2026 and 2027 by adjusting its Medicare Advantage bids and working with Medicare so it can expect a target margin range between 2% and 4%. It's also planning to drop some Medicare Advantage plans and will consider exiting some commercial markets if it can't negotiate the rates that it wants.

Earnings in the third quarter showed revenue of $113.2 billion, up 12% from last year. But earnings of $4.3 billion were down sharply from the $8.7 billion that UnitedHealth Group achieved in Q3 2024, and the margin dropped to 2.1% from 6%.

In short, UnitedHealth Group is generating more revenue, but its inflated costs are eroding its profits. That's what UNH needs to fix in 2026.

"We remain focused on strengthening performance and positioning for durable and accelerating growth in 2026 and beyond, and our results this quarter reflect solid execution toward that goal," CEO Stephen Hemsley said in a release.

UnitedHealth Group is a stock that pays you back

That brings us to one of the best reasons to have UnitedHealth Group stock -- the dividend yield of 2.25%, or $2.21 per share. That's significantly better than the average yield in the healthcare sector, which is only 1.6%.

Healthcare companies are some of the best places to find reliable dividends because they are established, stable companies, rather than being in hypergrowth mode like many tech stocks. Even with UnitedHealth Group's falling margins, the stock's payout ratio is only 50%, so I'm comfortable knowing that it won't go away. In fact, UnitedHealth Group has increased its dividend annually for the last 16 years.

As the stock price increases in 2026 -- as I fully expect it will after UnitedHealth Group addresses its profit margin problem -- you can expect the dividend yield to decrease. But the quarterly payout remains the same, with another likely increase to come, meaning that you'll have extra money to reinvest in your portfolio or to use elsewhere.

UnitedHealth Group is far from the perfect stock, but it is an appealing buy because it can learn from its errors and negotiate better prices in 2026 and 2027. The current price-to-earnings ratio of 17.2 indicates that the stock is a huge bargain right now, trading below its five-year P/E mean of 25.2.

The market will show UNH stock some love when those margins improve, but buying now means getting in at a lower price and enjoying the ride higher. And that's always a fun trip for any investor.

Should you invest $1,000 in UnitedHealth Group right now?

Before you buy stock in UnitedHealth Group, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and UnitedHealth Group wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $521,982!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,137,459!*

Now, it’s worth noting Stock Advisor’s total average return is 981% — a market-crushing outperformance compared to 194% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of December 8, 2025

Patrick Sanders has no position in any of the stocks mentioned. The Motley Fool recommends CVS Health, Delta Air Lines, and UnitedHealth Group. The Motley Fool has a disclosure policy.