This Cash-Machine Stock Is Set to Triple Over the Next 5 Years

Key Points

Taiwan Semiconductor's chips run the world's most powerful technological devices.

The market should keep surging.

- 10 stocks we like better than Taiwan Semiconductor Manufacturing ›

One area where there is a ton of cash being spent is the artificial intelligence sector. AI hyperscalers seem to be tripping over themselves to spend as much money as possible to build out their computing capacity. Several companies are benefiting from this massive spending spree. One of my favorites is Taiwan Semiconductor Manufacaturing Co. (NYSE: TSM), which provides many of the chips used in AI computing units.

I think TSMC is one of the best investment options now, and its stock could be slated to triple in the next five years if the AI buildout projections come to fruition.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Image source: Getty Images.

Taiwan Semiconductor may be the most important company on Earth

If I were to ask you what the most important company on Earth is, you might answer with one of the tech giants, like Nvidia (NASDAQ: NVDA) or Apple (NASDAQ: AAPL). While these are reasonable answers, keep in mind that these businesses only design the product; they don't manufacture it. Both companies outsource their chip production to Taiwan Semiconductor, and the technology these two produce wouldn't be possible without the impressive capabilities TSMC has developed.

In the high-end chip world, there are really only two other foundry options: Samsung and Intel. Intel is struggling to find clients for its foundry division due to its poor long-term performance, and Samsung often competes against its clients in non-foundry businesses, making it a less popular option. That leaves Taiwan Semiconductor in a class of its own, and that is the reason why it's the largest semiconductor manufacturer by revenue.

Taiwan Semiconductor supplies most of the world's high-end chips, and with massive amounts of money being spent on AI data centers, it's slated to benefit from the buildout. Nvidia believes that annual global data center capital expenditure will rise to $3 trillion to $4 trillion by 2030 -- a quintupling at the low end from 2025's expected value of $600 billion. AMD (NASDAQ: AMD), one of Nvidia's chief rivals, believes its data center division can grow at a 60% compound annual growth rate (CAGR) through 2030. A 60% CAGR over five years indicates nearly 10x growth, which is nearly unbelievable.

But if both companies are correct about a huge jump in AI spending, a lot more chips will be needed. And that will put Taiwan Semiconductor in an excellent position to thrive. It could easily triple over the next five years as this spending occurs. It's risen about 260% over the past three years, more than tripling.

Taiwan Semiconductor is increasing production capacity

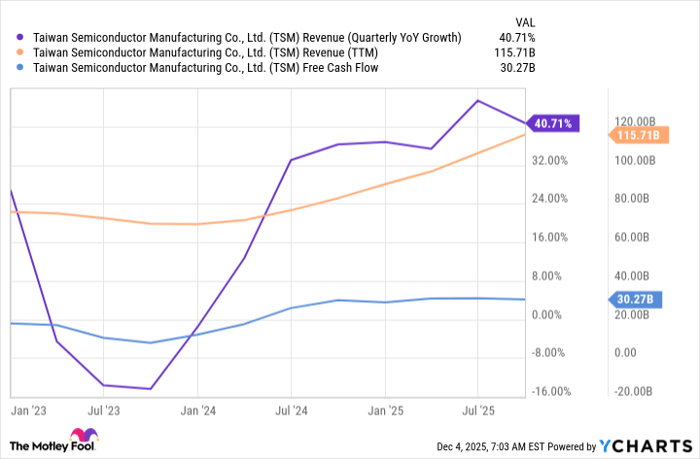

Although Taiwan Semiconductor's revenue has risen as the AI arms race has intensified, its free cash flow has remained fairly steady recently, though it's up 70% over the past three years.

TSM Revenue (Quarterly YoY Growth) data by YCharts

That's because Taiwan Semiconductor has had to increase its production capacities, including investing $160 billion in U.S.-based production facilities. These investments are already paying off big time for Taiwan Semiconductor, as they allow it to sidestep import tariffs by bringing manufacturing to U.S. soil.

Once Taiwan Semiconductor's U.S. facilities are up and running and don't require massive cash investments, Taiwan Semiconductor's free cash flow should explode higher, allowing it to boost share buybacks or pay a dividend. Though it might choose to continue to reinvest in itself by increasing production capacity -- a decision that has already had a great return on investment.

If the AI buildout occurs at the pace that many companies in the know think it will, then Taiwan Semiconductor is a no-brainer buy. I think the stock could easily triple over the next three years, but if the AI market reaches Nvidia's projected levels, the returns could be even greater.

Should you invest $1,000 in Taiwan Semiconductor Manufacturing right now?

Before you buy stock in Taiwan Semiconductor Manufacturing, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Taiwan Semiconductor Manufacturing wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $540,587!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,118,210!*

Now, it’s worth noting Stock Advisor’s total average return is 991% — a market-crushing outperformance compared to 195% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of December 1, 2025

Keithen Drury has positions in Nvidia and Taiwan Semiconductor Manufacturing. The Motley Fool has positions in and recommends Advanced Micro Devices, Apple, Intel, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool has a disclosure policy.