Should You Buy Lululemon Stock at a Once-in-a-Decade Valuation?

Key Points

Sales in its home market have stalled, leading to fears that profits are on the verge of collapse.

The company's margins haven't buckled under pressure yet, and revenue growth is still strong in China.

- 10 stocks we like better than Lululemon Athletica Inc. ›

How a story is framed can dramatically change how it's perceived and received.

For example, I can tell you about a consumer brand with strong and stable popularity. It enjoys profit margins better than its peers', sales are at an all-time high, and management continues to eye a large opportunity to expand its presence worldwide. That all sounds exciting.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

But if I tell you about a consumer brand that's facing competitive pressures from upstart brands, uncertainty due to disruptions in global trade, weakness in its largest market, and modest single-digit growth, investors might have second thoughts.

Image source: Getty Images.

In both cases, I'm describing athletic apparel company Lululemon (NASDAQ: LULU). And whether the stock is a buy today has a lot to do with how one balances these two opposing narratives.

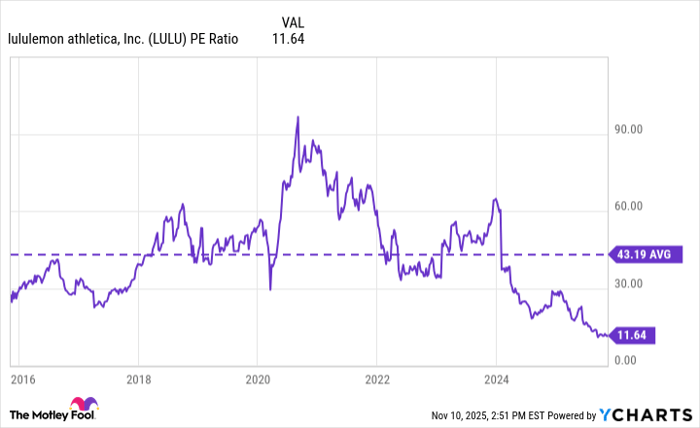

Furthermore, Lululemon stock is trading at a once-in-a-decade valuation -- less than 12 times earnings.

Data by YCharts.

That's a dirt-cheap entry point for the stock if things go right from here. That's why it's worth taking a closer look at Lululemon, despite the fact shares have lost more than half their value year to date.

Why is Lululemon stock performing poorly?

I don't wish to sugarcoat things: Lululemon has reported some troubling trends in recent quarters. The biggest problem is the company's slowing growth rate.

In its fiscal 2025 second quarter, revenue grew just 7% year over year to $2.5 billion. And for the full year, management's latest guidance implies a paltry 2% to 4% growth rate.

The slowing growth is stoking fears among investors that competitive pressures are becoming too much for Lululemon. For example, up-and-coming brand Vuori reportedly grew more than 20% in 2024 compared with just 10% net revenue growth for Lululemon during its fiscal 2024.

In Q2, net revenues in Lululemon's biggest market -- the Americas -- were only up 1% year over year, and comparable sales fell 4%. Sales in China were fortunately a bright spot, up 25%. But if sales are down in the company's core market, perhaps it's just a matter of time before the competition impacts its international sales as well.

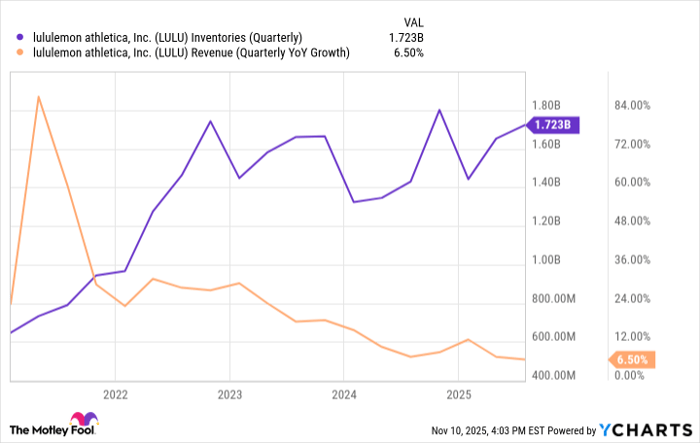

To go along with slumping revenue growth, Lululemon's inventory levels have been increasing as you can see below. This is a red flag for apparel companies.

Data by YCharts.

The fear is that Lululemon will struggle to sell through its existing inventory, which will erode profitability. The stock may look cheap today trading at 12 times earnings, but if earnings decline as management expects in fiscal 2025, that bargain valuation is not quite as attractive.

Why Lululemon could perform better

Despite these struggles, I believe it's premature to say Lululemon is buckling to competitive pressure. Comparably, a platform providing workplace culture and compensation data, tracks companies' net promoter score (NPS) -- a measure of customer loyalty and satisfaction. As of this writing, Lululemon has a strong NPS of 41, which hasn't gone down a single point over the last year.

The NPS data shows that Lululemon's popularity is highest among consumers who have used its products for five to 10 years. This suggests the existing customer base is most loyal to the brand, which could help support profit margins. But the NPS data also shows Lululemon is least popular with customers of one year or less, suggesting the company is struggling to win over new shoppers.

Ideally, a business would have both loyal customers and a growing base. However, if only one is possible, I'd argue it's better to keep the loyal customers. There will always be opportunities to win new customers, but old customers are hard to win back once they leave.

In short, Lululemon has a strong foundation with longtime customers who love its products. Its struggle to attract new buyers is a headwind to be sure, but the business isn't collapsing -- an important point for long-term investors.

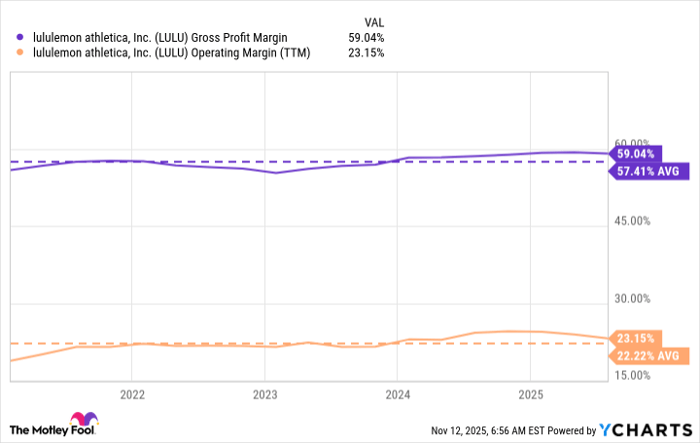

This conclusion is further supported by Lululemon's profit margins. Both its gross margin and operating margin are still above their five-year averages. Lululemon's business is more resilient than the stock's trading this year would have you believe.

Data by YCharts.

Many investors may consider Lululemon a turnaround play after its 55% sell-off in 2025, but this is far from a company in crisis. Lululemon can still prove to be a good long-term buy for those willing to give management the time it needs to build on the company's international growth while reigniting demand in its home market.

Should you invest $1,000 in Lululemon Athletica Inc. right now?

Before you buy stock in Lululemon Athletica Inc., consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Lululemon Athletica Inc. wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $599,784!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,165,716!*

Now, it’s worth noting Stock Advisor’s total average return is 1,035% — a market-crushing outperformance compared to 191% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of November 10, 2025

Jon Quast has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Lululemon Athletica Inc. The Motley Fool has a disclosure policy.