This "Magnificent Seven" ETF Has Been Beating the Market This Year. Is It Still a Good Buy?

Key Points

The "Magnificent Seven" are some of the best tech stocks in the world.

These stocks are up between 47% and 1,200% in the past five years.

Some of their valuations, however, may be worrisome for investors.

- 10 stocks we like better than Roundhill Magnificent Seven ETF ›

Investing in the best growth stocks in the world can be a recipe for success. The "Magnificent Seven" stocks -- Alphabet, Apple, Amazon, Meta Platforms, Microsoft, Nvidia, and Tesla -- are synonymous with growth. These are the leading companies in the S&P 500, and how they perform can typically be an indicator of the health of the overall market of late.

In 2025, as the S&P 500 has been having another strong year, the Roundhill Magnificent Seven ETF (NYSEMKT: MAGS), which tracks these companies, has been doing even better. Since the start of the year, the exchange-traded fund (ETF) has risen by around 21%, which is better than the S&P 500's gains of just 14%.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

However, the big question is: With valuations being as high as they are, is the fund still a good buy, or is now a good time to pivot to other stocks?

Image source: Getty Images.

Why investing in this Magnificent Seven ETF might still be a good move

The Magnificent Seven stocks may experience declines in value in a market correction, but as long-term investments, they are likely to continue rising in value. These companies have established themselves as strong businesses with great growth prospects. They aren't immune to declines, but they have proved themselves over the long term.

Over the past five years, each one of these stocks has been in positive territory. The worst performer during that stretch, Amazon, is up around 47%, but every other Magnificent Seven stock has at least doubled in value, with Nvidia leading the way, generating returns in excess of 1,100%.

Sticking with the Roundhill ETF, which tracks these top stocks, is a simple way to ensure you're in position to benefit from their continued growth in artificial intelligence (AI) and tech as a whole. These businesses are in strong financial shape and are blue chip stocks that you can buy and hold for years. Doing so inside a single ETF can be an easy way to have exposure to all of them at once.

Why investors may want to consider a different approach

Companies can be great businesses, but that doesn't mean that their stocks make for good investments regardless of price. Take Palantir Technologies as an example. The data analytics company is generating tremendous growth and its profits are rising, but it trades at more than 400 times its trailing earnings.

As great as the company is, that doesn't mean it's a buy at any valuation. Ignoring valuations can prove to be a costly mistake for investors because it can limit their returns (and may even lead to significant losses) in both the short term and the long term.

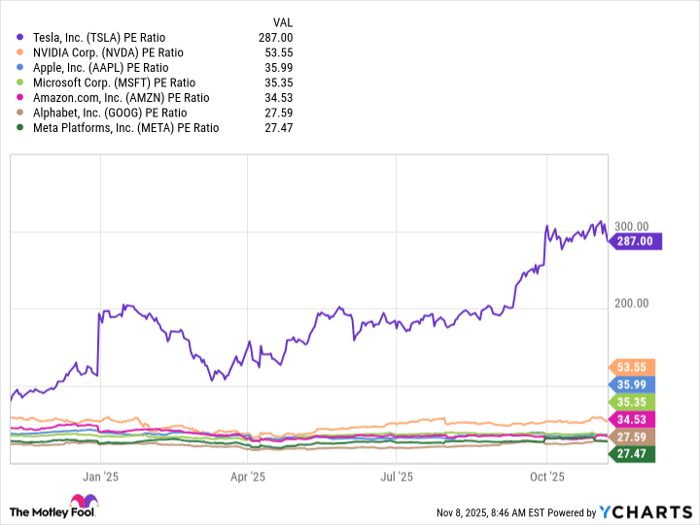

By remaining invested in the Roundhill ETF, which gives you exposure to all of these stocks, the danger is that some high-valued stocks could drag down your overall returns. As you can see from the chart below, a couple of these stocks have price-to-earnings ratios (P/E) of more than 50 right now.

TSLA PE Ratio data by YCharts.

I'd also make the case that Apple, whose business often generates just single-digit growth, isn't worth paying more than 35 times earnings for, either; that, too, looks expensive.

Not all of the Magnificent Seven stocks are wildly overpriced, but they can nonetheless impact your overall returns. That's why it may be a good idea to consider other, more modestly valued investments rather than just going with the Roundhill ETF. It may require more research and effort, but it can lead to better returns for your portfolio.

I would invest in some of the Magnificent Seven stocks, but not all of them

The Roundhill Magnificent Seven ETF has performed well this year, but it could also be vulnerable to a correction if market conditions worsen, particularly because some of the stocks are so highly valued and trading at premiums.

I don't see a big incentive to hold the ETF simply because it focuses on investing in only seven stocks. This is not a fund that holds hundreds of stocks that drastically saves you time in finding good investments and gives you plenty of diversification. Plus, if you buy stocks individually, you could opt to just pick the best-priced among the seven rather than having exposure to all of them.

Buying some of the Magnificent Seven stocks may still be a good move, particularly the ones that aren't excessively overpriced, but I wouldn't simply own all of them, which is why I wouldn't opt to buy the Roundhill ETF, despite its impressive gains this year.

Should you invest $1,000 in Roundhill Magnificent Seven ETF right now?

Before you buy stock in Roundhill Magnificent Seven ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Roundhill Magnificent Seven ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $599,784!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,165,716!*

Now, it’s worth noting Stock Advisor’s total average return is 1,035% — a market-crushing outperformance compared to 191% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of November 10, 2025

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, Palantir Technologies, and Tesla. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.