If You'd Invested $1,500 in the Cryptocurrency XRP 10 Years Ago, Here's How Much You'd Have Today

Key Points

XRP's price in 2015 never topped $0.03.

The token's rapid rise this year has greatly accelerated returns for those investors who have held it all these years.

- 10 stocks we like better than XRP ›

The last 10 years have been kind to investors with the foresight to not only buy XRP (CRYPTO: XRP) in 2015 but hold through the many extreme ups and downs in the years since. While Bitcoin remains the largest cryptocurrency and continues to dominate the market, XRP has cemented itself as one of the most valuable projects in the crypto space. With a market cap exceeding $150 billion today, XRP is the fourth-largest cryptocurrency worldwide.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Image source: Getty Images.

Here's how much you would have

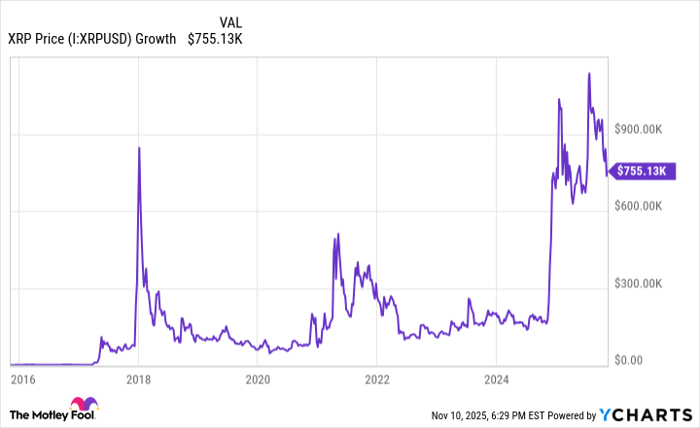

The crypto's more-than-300% run over the past year means the token now trades above $2.50 -- a far cry from the few cents an XRP would have fetched a decade ago. So, what would you have today if you had invested $1,500 in November 2015 and held to today? That initial investment would be worth a whopping $755,000 today. That's quite a return. You can see the incredible performance in the chart below.

XRP Price data by YCharts

Past success does not mean future success

While the return is impressive and XRP's price certainly could spike further this year if the Securities and Exchange Commission (SEC) green-lights XRP exchange-traded funds (ETFs), I believe its value will decline over time. Long-term investors would do well to avoid XRP. The token's value is driven heavily by hype -- hype fueled by a central misunderstanding of the token's underlying economics.

Should you invest $1,000 in XRP right now?

Before you buy stock in XRP, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and XRP wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $612,872!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,184,044!*

Now, it’s worth noting Stock Advisor’s total average return is 1,062% — a market-crushing outperformance compared to 194% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of November 10, 2025

Johnny Rice has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Bitcoin and XRP. The Motley Fool has a disclosure policy.