Stellar Price Forecast: XLM eyes breakout as bullish momentum builds near key resistance

- Stellar price nears key resistance at $0.297 on Thursday, a decisive close above it likely to trigger a rally.

- Turbo Energy launches a project to tokenize financing in collaboration with Taurus S.A. and the Stellar Development Foundation.

- On-chain data signal strong bullish sentiment, with rising large whale orders and long positions.

Stellar (XLM) price trades in green, nearing its key resistance around $0.297 at the time of writing on Thursday, with a close above this level suggesting a rally ahead. The optimism is fueled by Turbo Energy’s new partnership with the Stellar Development Foundation and Taurus S.A. to tokenize financing for hybrid renewable energy projects. Meanwhile, on-chain and derivatives data indicate rising whale activity and bullish bets, suggesting XLM could be poised for a breakout.

Turbo Energy, Taurus and Stellar join forces to tap into tokenized clean energy financing pilot in Spain

Turbo Energy, a global provider of leading-edge, AI-optimized solar energy storage technologies and solutions, announced on Tuesday that it is launching an initiative to tokenize financing for hybrid renewable energy installations in partnership with institutional blockchain firm Taurus S.A. and the Stellar Development Foundation — beginning with a pilot project in Spain.

The project comes as the global Energy-as-a-Service (EaaS) market was valued at $74.43 billion in 2024 and is projected to reach $145.18 billion by 2030, representing a 12.3% CAGR, according to Grand View Research.

“By integrating tokenization into clean energy financing, Turbo Energy and its partners are positioning themselves to unlock significant opportunities in this rapidly expanding market,” said the company in its press release.

The project will tokenize debt financing for battery-integrated Power Purchase Agreements (PPAs) using Turbo Energy’s SUNBOX solar energy systems. Token issuance and management will occur on the Stellar blockchain, leveraging Taurus-CAPITAL, an institutional-grade tokenization platform, ensuring transparency, security, and scalability.

This news projects a bullish outlook for Stellar’s native token XLM in the long term, as it boosts its real-world relevance, expands its institutional footprint, and drives wider adoption, liquidity, and acceptance.

Stellar’s on-chain and derivatives data show bullish bias

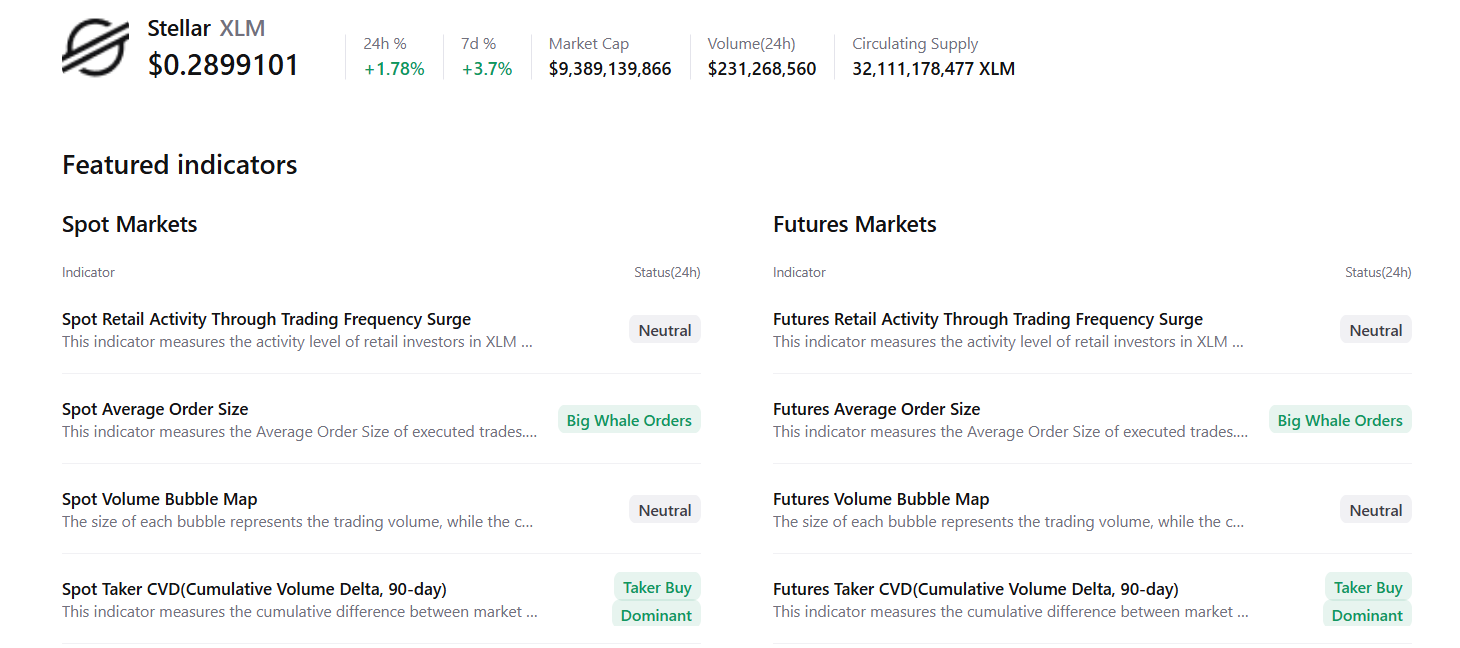

CryptoQuant summary data supports a positive outlook for XLM as both spot and futures markets show large whale orders and buy dominance, signaling a potential rally ahead.

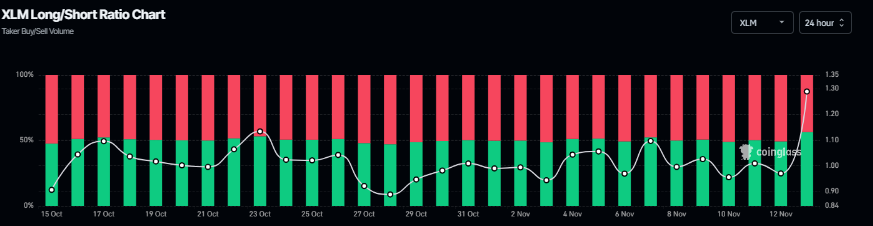

On the derivatives side, Coinglass’s long-to-short ratio for XLM reads 1.30, the highest level over a month. The ratio above one suggests that more traders are betting on XLM’s price to rally.

Stellar Price Forecast: XLM bulls aiming for a breakout

Stellar found support at the daily level of $0.253 on November 5 and rose over 13% in the next 5 days, retesting the $0.297 resistance level on Monday. XLM faced rejection at the $0.297 level and declined 9% by Wednesday. At the time of writing on Thursday, it trades higher, nearing the daily resistance level at $0.297.

If XLM closes above its daily resistance at $0.297, it could extend the rally toward its weekly resistance at $0.321.

The Relative Strength Index (RSI) on the daily chart stood at 45, approaching the neutral 50 level and suggesting a fade in bearish momentum. For the recovery rally to be sustained, the RSI must move above the neutral level. Additionally, the Moving Average Convergence Divergence (MACD) showed a bullish crossover last week, which remains intact, suggesting the continuation of an upward trend.

On the other hand, if XLM faces a correction, it could extend the decline toward the next daily support at $0.253.