Worried About the Pullback in AI Stocks? Here's How to Protect Your Portfolio.

Key Points

The Nasdaq just completed its worst week since April.

Investors have worried about the possible formation of a bubble in the artificial intelligence market.

Still, tech companies report ongoing strong demand for their AI products and services.

- These 10 stocks could mint the next wave of millionaires ›

Artificial intelligence (AI) stocks have been almost a sure path to gains over the past two years, but in recent days, investors and analysts have worried about the prices of these players. They've become more expensive, and some market experts have expressed concern about a possible bubble forming -- bubbles generally burst, resulting in significant declines, and this idea has weighed on AI stocks in recent days.

Palantir Technologies saw its shares fall 11% this past week, even after the AI-driven software company reported fantastic earnings growth. And AI bellwether and chip company Nvidia declined 7%, even as other tech players spoke of high demand for AI products and services. This pushed the Nasdaq to its worst week since April, a time when investors sold tech stocks amid concerns about President Donald Trump's import tariff plans.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Though stocks as a whole have become expensive -- the S&P 500 Shiller CAPE (cyclically adjusted price-to-earnings) ratio has reached one of its highest levels ever -- this doesn't necessarily mean AI stocks are heading for a crash. Tech giants from Amazon to Alphabet have wowed investors with their recent earnings reports, and much of their growth has come from strong AI demand. This offers us visibility into earnings potential ahead, and things are looking bright.

Still, if you're worried about the recent pullback in AI stocks and whether declines may deepen, there are a few steps you can take to protect your portfolio and promote strength in any market environment. Let's check them out.

Image source: Getty Images.

1. Favor diversification

Now is a fantastic time to review the contents of your portfolio and ensure that you are well diversified. This means that you're invested in a variety of industries and companies and haven't just gone all in on one company or investing theme. If you find your portfolio is too heavily weighted toward one area -- AI or any other industry -- now is a good time to broaden your investments.

You may, for example, reduce a position in a stock that's already delivered significant gains and reallocate your winnings to an area known for safety, such as pharmaceutical stocks, or add a dividend stock or two to your portfolio. (Pharma companies are considered safe because people need their medicines, resulting in a certain earnings stability regardless of the economic environment.)

2. Go for established players with clear future prospects

The information we have right now points to more revenue growth within the AI industry. As mentioned, cloud service providers such as Amazon and Alphabet are seeing demand from customers aiming to run AI workloads. This supports analysts' predictions that the AI market may grow from billions of dollars today to more than $2 trillion in a few years. We haven't seen a slowdown in spending or interest in AI.

But to protect your portfolio through any turbulence, it's a good idea to go for AI players with a track record of growth and that have what it takes to benefit from the next phases of the AI boom. Potential buys include Nvidia, the dominant AI chip designer that's ensuring its leadership through innovation, and leading cloud provider Amazon (the cloud unit is Amazon Web Services).

Even if these companies experience a decline in their share prices, they have what it takes to recover and grow over the long term.

3. Focus on the long term

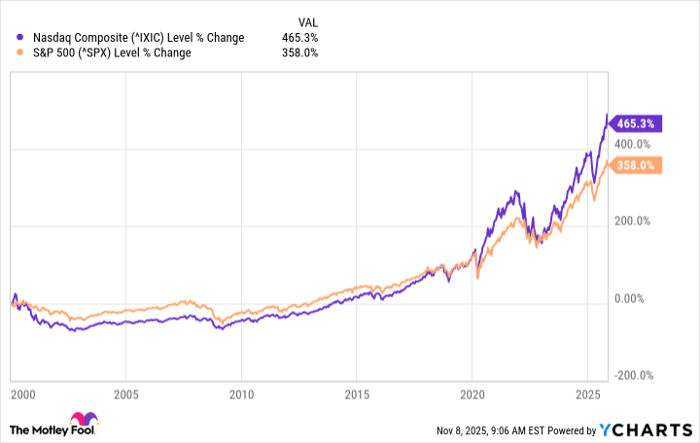

That brings me to my third point. When investing, always focus on the long term, and this will help you manage difficult times. With this in mind, amid AI stock declines, don't panic. Instead, remember that you haven't lost on an investment unless you actually sell it. History shows us that the indexes have always rebounded from tough moments and gone on to gain. The same is true for quality companies.

^IXIC data by YCharts.

So, evaluate the strength of each of your AI stocks, and if a company's long-term story remains positive, hold on to it, as this player may deliver more growth over the long haul. Of course, if you've already gained a lot from a certain position, it may be to your advantage to lock in some profits and, as mentioned above, further diversify your holdings.

Meanwhile, declines in AI stocks offer you a chance to get in on certain quality players at a good price. So, if you're bullish on AI over the long term, seize this opportunity.

By taking these steps and focusing on companies' potential over the coming five to 10 years, you can protect your portfolio and increase your peace of mind.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, Stock Advisor’s total average return is 1,036%* — a market-crushing outperformance compared to 191% for the S&P 500.

They just revealed what they believe are the 10 best stocks for investors to buy right now, available when you join Stock Advisor.

See the stocks »

*Stock Advisor returns as of November 3, 2025

Adria Cimino has positions in Amazon. The Motley Fool has positions in and recommends Alphabet, Amazon, Nvidia, and Palantir Technologies. The Motley Fool has a disclosure policy.