1 Incredible Reason to Buy Archer Aviation Stock in November

Key Points

Archer Aviation is making progress on its FAA certification.

In October, it had two successful demonstrations of its Midnight craft.

The company is still pre-revenue and needs government certification to commercialize its aircraft.

- 10 stocks we like better than Archer Aviation ›

Archer Aviation (NYSE: ACHR) is one of the leading companies in the electric vertical takeoff and landing (eVTOL) space.

The company's flagship aircraft, the Midnight, is expected to fly four passengers and a pilot on short urban hops of about 100 miles. Its biggest market opportunity is also a driver's biggest vibe-killer: traffic. If it can put paying passengers in the air, it could capture a piece of this market, which Morgan Stanley values at about $9 trillion.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Largely because Archer doesn't have regulatory approval to fly its aircraft, its stock has been volatile, with a 27% decline since hitting a high in early October. That pullback, however, may be giving long-term investors an entry point before the company takes off again.

Commercialization could be in Archer's grip

The single most compelling reason to invest in Archer today is that its road to commercialization is starting to look real.

Last month, Archer demonstrated the Midnight at the California International Airshow (its rival, Joby Aviation, also demonstrated its craft). This came on the heels of a 55-mile test flight, which was the Midnight's longest piloted flight to date.

Image source: Archer Aviation.

Since Archer is still in the process of getting Federal Aviation Administration (FAA) certification for the Midnight, both demonstrations were crucial steps to proving the reliability of its aircraft.

Besides these tests, Archer recently inked a big agreement with Korean Air. The partnership could see the airline buying up to 100 Midnight aircraft, which are rumored to cost about $5 million each, which would result in about $500 million in revenue.

Strong idea, but valuation is still on the tarmac

At roughly $9 to $10 per share in early November, Archer carries a market cap north of $6 billion, which puts it at roughly 4 times book value. As such, its valuation looks pretty ambitious for a pre-revenue company that lacks regulatory approval.

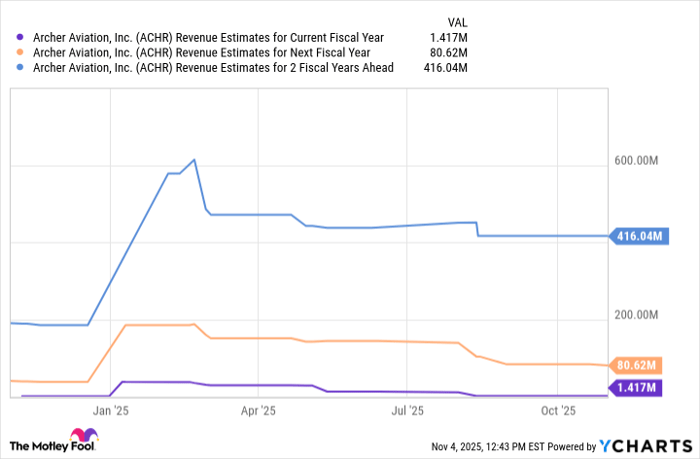

Even if its annual revenue hits $416 million by 2027 -- as some analysts predict -- its price-to-sales multiple (P/S) at today's valuation would be near 14, which is still considerably high.

ACHR Revenue Estimates for Current Fiscal Year; data by YCharts.

Another thing to consider is Archer's cash burn. The company typically burns between $95 million and $110 million per quarter, or about $400 million annually. Given that it has a strong cash position ($1.7 billion at the end of the second quarter), the company can cover operating expenses for a couple of years.

If the regulatory process takes longer than expected, however, or its research and development expenses climb, it may need a fresh cash injection sooner.

Still, Archer is seeing several key developments converging, all of which point to commercialization. In a few years, it could reasonably go from pie in the sky to eVTOLs, from sci-fi idea to paying customers. It still has a lot of ground to cover -- and it needs that FAA certification -- but for long-term investors, today's price could be a buying window.

Should you invest $1,000 in Archer Aviation right now?

Before you buy stock in Archer Aviation, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Archer Aviation wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $595,194!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,153,334!*

Now, it’s worth noting Stock Advisor’s total average return is 1,036% — a market-crushing outperformance compared to 191% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of November 3, 2025

Steven Porrello has positions in Archer Aviation and Joby Aviation. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.