Prediction: UPS Will Thrive in the AI Boom. Here's the Key Factor Driving Growth.

Key Points

United Parcel Service's profitability has fallen sharply since the pandemic.

The brown-box giant is integrating AI and automation across its network.

This could help cut costs, improve efficiency, and regain investor confidence.

- 10 stocks we like better than United Parcel Service ›

This has been another frustrating year for investors in United Parcel Service (NYSE: UPS). Shares of the transportation stock have dropped about 30% on the year as U.S. revenue and parcel volumes have slipped significantly. Margins aren't nearly as wide as they were during the pandemic, and management hasn't given much guidance for what will come.

That said, UPS isn't exactly up a creek without a paddle. The company has been actively restructuring its logistics network to cut costs and refocus on profitability. While it still has a way to go, several new developments could help speed up its turnaround. One of those is artificial intelligence (AI).

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

The AI boom could help drive UPS' next margin expansion

UPS runs one of the most complex logistics networks in the world, with millions and millions of packages moving through it each day. The more efficient this system runs, the more profit UPS can collect.

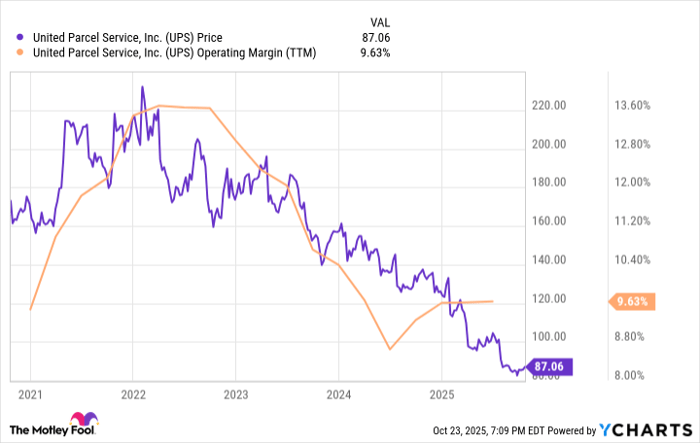

Efficiency, in this case, means lowering the costs associated with transporting and sorting each package, which, in turn, widens operating margin. As seen below, UPS has been struggling to regain the margin it had during the pandemic -- something, I think, artificial intelligence could help it do.

UPS data by YCharts

UPS already uses algorithms like ORION to optimize its delivery routes. But newer AI tools could go even further. Computer vision systems, for example, could speed up package sorting in hubs, while more accurate demand forecasting could prevent routes from being underused.

Automated robots in a UPS warehouse. Image source: UPS.

Likewise, humanoid robots could handle repetitive tasks, like lifting and stacking, that slow down work crews. On that front, UPS has been in talks with the robotics company Figure AI to implement humanoids in UPS' warehouses. These humanoids would be in addition to the sorting robots that already operate in UPS' Velocity warehouses.

If these technologies were to scale successfully, it's not a stretch to see UPS meaningfully lower costs. It may not be an AI pioneer, but it's learning to use automation in the most practical way, which can only be good for its bottom line.

Should you invest $1,000 in United Parcel Service right now?

Before you buy stock in United Parcel Service, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and United Parcel Service wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $590,287!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,173,807!*

Now, it’s worth noting Stock Advisor’s total average return is 1,047% — a market-crushing outperformance compared to 195% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of October 27, 2025

Steven Porrello has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends United Parcel Service. The Motley Fool has a disclosure policy.