This Stock Is Up 22% in a Week. Are We About to See a GameStop-Level Short Squeeze?

Key Points

Beyond Meat's short squeeze happened after a massive share issuance.

The increase in outstanding shares is the key in comparing the Beyond Meat short squeeze to GameStop's.

- 10 stocks we like better than Beyond Meat ›

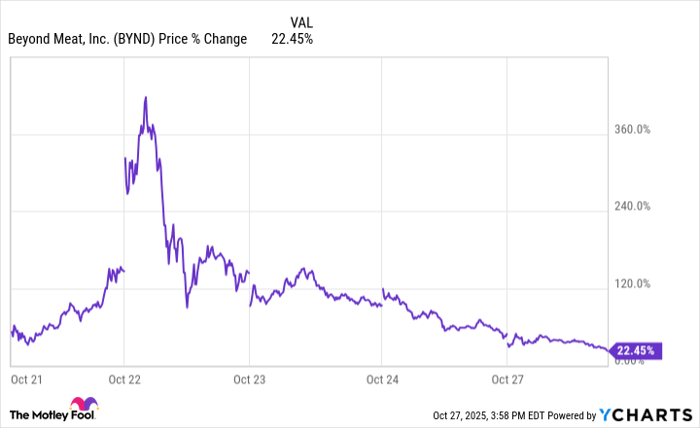

Perhaps one of the most surprising stocks in recent trading sessions has been Beyond Meat (NASDAQ: BYND). Although the food stock peaked dramatically in the middle of the Oct. 22 trading session and pulled back, it is still up by 22% over the last week amid a short squeeze.

This price action may come as a surprise amid the plunging popularity of its plant-based meat. Instead, the stock is likely influenced by behavior reminiscent of GameStop's (NYSE: GME) short squeeze in 2021. Knowing this, should investors buy Beyond Meat stock in hopes the short squeeze will resume or stay on the sidelines?

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Image source: Getty Images.

Beyond Meat stock today

Until a few days ago, Beyond Meat stock looked like it was on the path to bankruptcy. Plunging sales had pushed share prices into penny stock territory, and investors had long soured on the stock as consumers turned against the plant-based meat the company had hoped would change the way consumers view proteins.

However, the catalyst for the recent rally began on Oct. 10 when Beyond Meat made a tender offer to exchange shares for convertible senior notes. That led to the issuance of more than 316.1 million additional shares, a massive increase considering the number of outstanding shares was just 76.7 million before this deal.

Not surprisingly, the stock initially fell on this news. Between Oct. 10 and Oct. 16, the share price plunged from $2.01 per share to the aforementioned $0.52 per share low as the sudden increase in the supply of shares pushed prices down.

However, short interest rose to almost 82% amid these actions. That prompted investors on sites such as Reddit to buy the heavily discounted shares. After rising to a high of $7.69 per share on Oct. 22, the stock closed at $3.58 per share later that day, and it had fallen to a closing price of $1.81 per share as of the time of this writing.

BYND data by YCharts

Comparing Beyond Meat to GameStop

Nonetheless, before assuming Beyond Meat is the next GameStop, investors need to compare the situations. Unfortunately for Beyond Meat bulls, the conditions are significantly different in one critical respect.

As previously mentioned, Beyond Meat just experienced a massive increase in its outstanding share count, which rose more than fourfold instantaneously as it exchanged its considerable debts for shares.

Amid the short interest, investors began to buy. Nonetheless, they now have to buy more than four times the number of shares to influence the price. That likely explains why the current rally peaked at just $7.69 per share.

Looking back to GameStop in early 2021, there had been no significant increases in the number of shares outstanding, which stood at a split-adjusted 261 million.

That lower share count for the retail stock meant that GameStop bulls were fighting over what was a fixed number of shares, forcing share prices much higher as demand rose. Consequently, in January 2021, GameStop's share price rose by as much as 1,740% before eventually pulling back.

Looking at Beyond Meat intra-day trading, the $0.52-per-share low to the intra-day peak of $7.69 per share amounted to a 1,379% gain. Additionally, the stock has lost 76% of its value in less than four trading days, suggesting that the higher share count has made the stock's rise less sustainable.

Does the Beyond Meat short squeeze compare well to GameStop's?

Beyond Meat just experienced a historic short squeeze, but unfortunately for the stock's bulls, it has not and probably will not match GameStop's short squeeze gains in 2021. This means investors should stay on the sidelines.

Admittedly, both short squeezes were driven by traders organizing on sites like Reddit. However, unlike GameStop, Beyond Meat bulls had to contend with a massive increase in the number of shares outstanding. That meant that short squeezers needed significantly higher demand for shares to raise share prices.

Although this share squeeze nearly matched GameStop on an intra-day basis, Beyond Meat's gains were more modest and, in the end, more elusive. Now, with Beyond Meat's share prices continuing to fall, the short squeeze will probably not match GameStop's without a second, more substantial rally in shares.

Should you invest $1,000 in Beyond Meat right now?

Before you buy stock in Beyond Meat, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Beyond Meat wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $590,357!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,141,748!*

Now, it’s worth noting Stock Advisor’s total average return is 1,033% — a market-crushing outperformance compared to 193% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of October 27, 2025

Will Healy has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Beyond Meat. The Motley Fool has a disclosure policy.