Is Freeport-McMoRan's Recent Stock Slide a Buying Opportunity for Wise Investors?

Key Points

The setback will delay production, but it should not result in a long-term loss of output.

The stock is attractive, but there's near-term risk around the production restart schedule.

Management will give a more definitive view on these matters on an analyst call in November.

- 10 stocks we like better than Freeport-McMoRan ›

The last couple of months have been highly eventful for Freeport-McMoRan (NYSE: FCX). The mining company has revised its full-year and 2026 sales expectations following an incident at a mine in Indonesia in early September. As you might expect, the stock price subsequently dipped -- falling 22% over two days in late September before recovering some of those losses.

But is it enough to justify buying the stock, or is the copper and gold miner better to avoid right now?

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Freeport suffers a setback

The incident occurred on the evening of Sept. 8 at the Grasberg Block Cave (GBC) in Central Papua, Indonesia. A sudden rush of 800,000 tons of wet material occurred at a production drawpoint and entered the mine. It traveled rapidly to multiple mine levels, including the service level of the mine, according to the company's press release.

The severity of the event shouldn't be understated. Not only was it a fatal incident (seven workers died), but the GBC mine is a key part of Freeport-McMoRan's operations. Indonesia is also Freeport's lowest site production and delivery cost region.

The reduction in output from GBC will have a significant effect on the company's revenue. The mining company owns a 48.76% share in PT Freeport Indonesia (PTFI), which is responsible for its Indonesian operations. As a reminder, before the incident, Indonesia was set to provide 39% of Freeport's total mining production in 2025.

Moreover, management stated that "The GBC ore body represents 50% of PTFI's estimated proven and probable reserves as of December 31, 2024, and approximately 70% of PTFI's previously forecast copper and gold production through 2029."

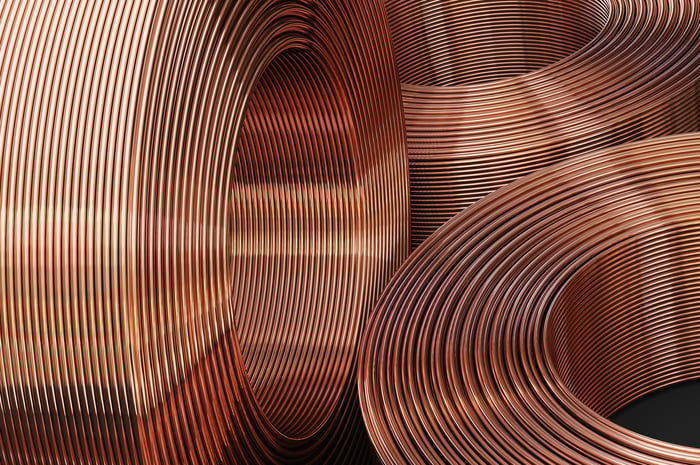

Image source: Getty Images.

Putting numbers to the production cuts

While the incident occurred in just one of the five blocks (PB1C) at GBC, it damaged the infrastructure necessary to support production in other blocks. Management plans to restart operations in two unaffected mines in the GBC area (Big Gossan and DeepMLZ) in the fourth quarter of 2025, followed by the phased restart of three GBC production blocks and the "balance" of PB1C in 2017. Management's current estimates of the effect are as follows:

- A 4% reduction in third-quarter copper sales, compared to previous estimates.

- PTFI fourth-quarter 2025 sales will "be insignificant."

- "PTFI production in 2026 could potentially be approximately 35% lower than pre-incident estimates."

Given that the estimates for PTFI for the fourth quarter were for 445 million pounds of copper and 345,000 ounces of gold, and the full-year total company estimate was for 3.95 million pounds of copper and 1.3 million ounces of gold, the Q4 reduction alone will shave 11.3% from full-year copper production and 26.5% from full-year gold production in 2025.

The effect in 2026 (assuming the 35% reduction in production holds across copper and gold) would lower Freeport's estimated copper production by almost 600 million pounds to a figure of 3.7 billion pounds, and gold by 560,000 ounces to a figure of just over 1 million ounces.

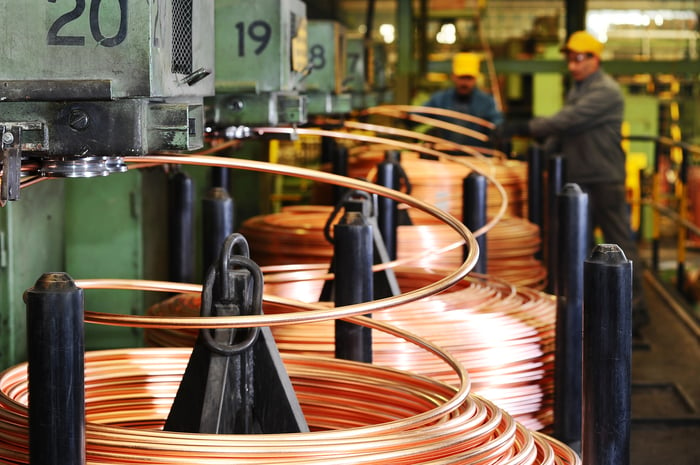

Image source: Getty Images.

What it means to Freeport-McMoRan investors

The copper company's management expects the schedule outlined above to "target the return to pre-incident estimates in 2027." A positive way of looking at it is the loss of revenue from approximately 1 million pounds of copper over the next year or so, and 900,000 ounces of gold, before recovering in 2027.

The copper and gold aren't "lost," and there's unlikely to be any adjustment to PTFI's proven and probable reserves. In this context, long-term investors will see it as a buying opportunity.

On the other hand, it results in a loss of near-term revenue, and there's always a level of uncertainty surrounding the timing and cost of restarting mining operations. An investigation into the event is underway, and management has promised a conference call on the matter in November. It makes sense to wait for that update before deciding whether to buy in or not.

Should you invest $1,000 in Freeport-McMoRan right now?

Before you buy stock in Freeport-McMoRan, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Freeport-McMoRan wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $590,357!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,141,748!*

Now, it’s worth noting Stock Advisor’s total average return is 1,033% — a market-crushing outperformance compared to 193% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of October 20, 2025

Lee Samaha has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.