Prediction: Nvidia Stock Is Going to Soar After Nov. 20

Key Points

Nvidia's upcoming earnings report should contain valuable information related to the company's new Blackwell and Blackwell Ultra GPUs.

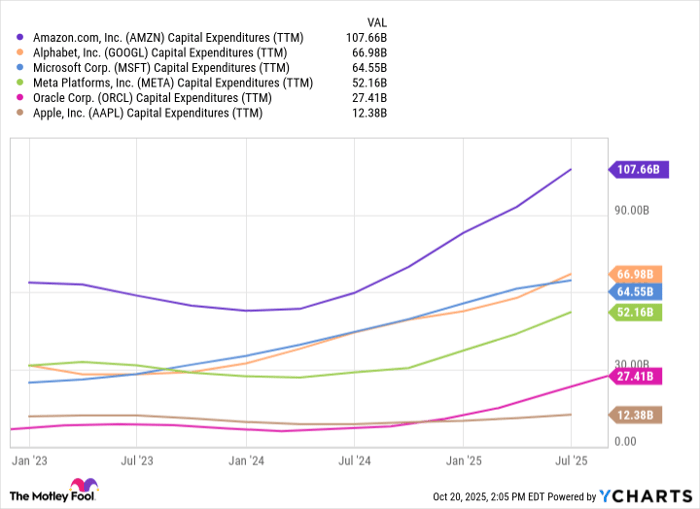

Big tech continues to pour unprecedented sums into capital expenditures, a strong tailwind for Nvidia's data center business.

Nvidia's current valuation leaves room for meaningful upside should the company impress Wall Street.

- 10 stocks we like better than Nvidia ›

Nvidia (NASDAQ: NVDA) is gearing up to report its fiscal third-quarter results on Nov. 19, and expectations couldn't be higher.

After a brief pullback earlier this year -- sparked by President Donald Trump's "Liberation Day" tariff announcement and renewed competitive pressure from China -- the artificial intelligence (AI) leader may be setting the stage for another explosive rally.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

With GPU demand surging, AI infrastructure buildouts accelerating across the globe, and valuation multiples still leaving room for expansion, Nvidia's upcoming report could reignite investor enthusiasm and send the stock powering higher into 2026.

Image source: Nvidia.

Blackwell demand is off the charts

Nvidia's newest Blackwell and Blackwell Ultra architectures -- designed to succeed the market-dominant Hopper series -- represent a major leap forward in computing performance. The GB200 and GB300 GPUs are purpose-built for large language models (LLMs), inference workloads, and next-generation AI applications in robotics and autonomous systems that enterprises are racing to deploy.

Orders for Blackwell systems remain exceptionally strong, fueled by cloud hyperscalers such as Microsoft, Amazon, and Alphabet, as well as tech titan Meta Platforms, all of which are integrating Nvidia GPUs into their rapidly expanding AI clusters.

Beyond the hyperscalers, Nvidia has forged major partnerships with companies including CoreWeave, xAI, and OpenAI, each building dedicated GPU clouds and supercomputers to train increasingly complex AI models. Even enterprise customers like Oracle and Dell are embedding Nvidia's new systems into turnkey infrastructure solutions.

With such broad-based, diversified demand, Nvidia enjoys a level of revenue visibility that's exceedingly rare in the historically cyclical semiconductor industry -- underscoring its dominant position at the heart of the AI revolution.

AI infrastructure spending is accelerating

Global AI infrastructure buildouts are in full swing, and Nvidia sits firmly at the center of this movement. Industry forecasts from management consulting firm McKinsey & Company suggest that AI data center spending could reach $7 trillion by the end of the decade -- spanning GPUs and networking hardware to the massive energy systems required to power model training and inference workloads.

Naturally, the hyperscalers are leading the charge -- with big tech collectively expected to invest nearly $500 billion in AI infrastructure next year alone.

AMZN Capital Expenditures (TTM) data by YCharts

Yet the demand doesn't stop there. AI compute needs are rapidly expanding beyond the hyperscalers -- reaching start-ups, research labs, and even sovereign customers. Notably, countries across the Middle East are launching their own versions of Project Stargate -- signing multibillion-dollar agreements for Nvidia-powered data centers to accelerate their domestic AI and technology ambitions.

Image source: Getty Images.

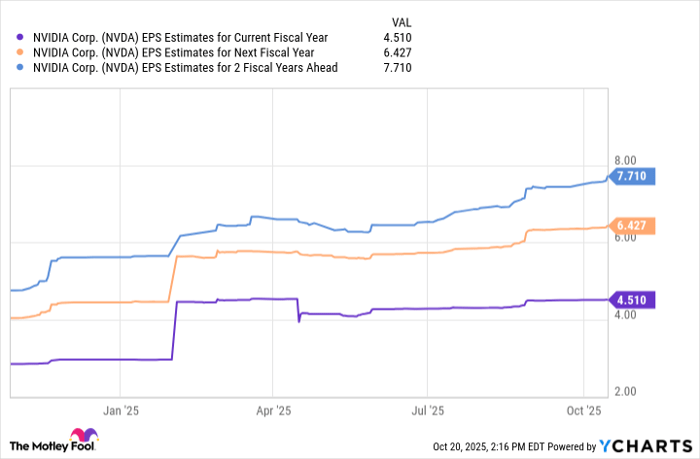

Valuation still has room to expand

At roughly $4.5 trillion in market capitalization, Nvidia now stands as the world's most valuable company. Yet, its earnings trajectory still fuels extraordinary optimism. Analysts expect earnings per share (EPS) to surge by more than 70% over the next two years -- a pace of growth almost unheard of for a company already generating hundreds of billions in annual revenue.

NVDA EPS Estimates for Current Fiscal Year data by YCharts

Despite its massive scale, Nvidia trades at roughly 40 times forward earnings -- a valuation that could be argued as surprisingly reasonable given the company's growth profile, dominant market position, and structural advantages.

Nvidia boasts a gross margin exceeding 70%, unmatched pricing power, and a software ecosystem moat refined over decades of developer adoption and CUDA integration. If the company once again delivers record-breaking results and raises guidance when it reports on Nov. 19, the stock could easily rerate higher as investors recalibrate expectations.

With accelerating GPU shipments, expanding enterprise partnerships, and unrivaled leadership across AI and compute workloads, Nvidia appears well positioned to extend its rally into 2026 and beyond.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $600,550!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,116,616!*

Now, it’s worth noting Stock Advisor’s total average return is 1,032% — a market-crushing outperformance compared to 192% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of October 20, 2025

Adam Spatacco has positions in Alphabet, Amazon, Apple, Meta Platforms, Microsoft, and Nvidia. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Oracle. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.