Dow Jones Industrial Average drops as fresh trade fears rattles markets

- The Dow shed 350 points on Wednesday amid fresh trade war threats from the Trump administration.

- The Trump team is weighing introducing additional trade restrictions on software exports to China.

- Subprime lending schemes continue to weaken as another lender files for bankruptcy.

The Dow Jones Industrial Average (DJIA) struggled on Wednesday, declining a little over 500 points at its lowest point on the day. Investors are facing fresh risk-off sentiment as the Trump administration continues to toy with making already-tense trade friction between the US and China even worse. Another subprime lender declared bankruptcy, highlighting growing fissures in the credit and lending segment.

The Trump administration, according to sources, is weighing its options on imposing restrictions on the export of software to China, a move meant to lash out at China in response to its recent move to exert further government control over the export of rare earth minerals from within its borders. Key US industries, specifically the tech sector, are critically reliant on having open access to China rare metals markets.

Subprime lender PrimaLend filed for bankruptcy, adding additional pressure to investor sentiment regarding the health of US lending segments. This bankruptcy follows the collapse of an automotive lender in recent weeks.

US farmers lashed out at US President Donald Trump over his convoluted plan to import beef from Argentina in order to make up a shortfall after his administration imposed a 50% tariff on all Brazilian imports. American cattle farmers decried the move, drawing criticism from President Trump, who claimed that American beef farmers for “not understanding” how his tariffs have benefited them.

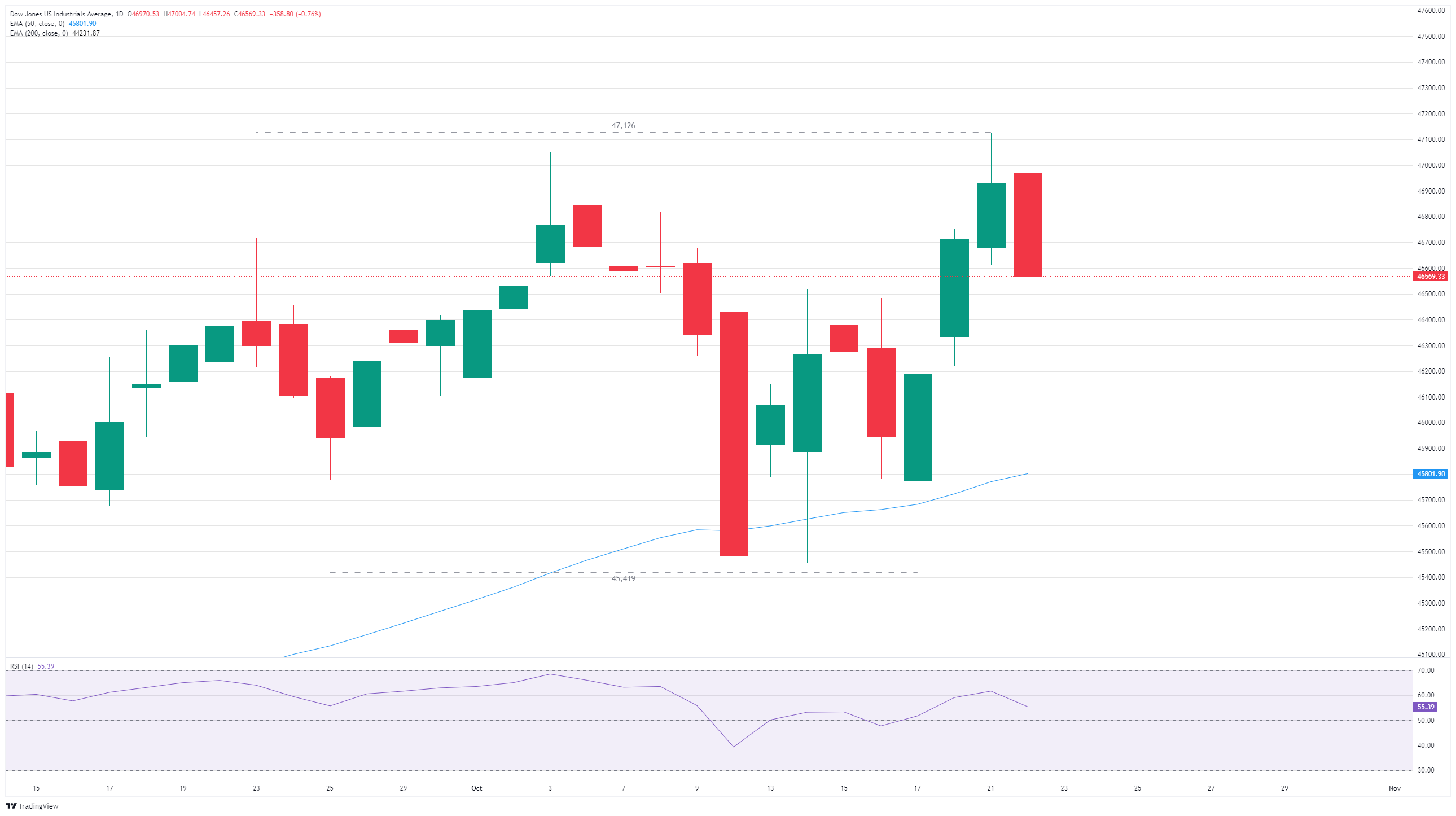

Dow Jones daily chart

Dow Jones FAQs

The Dow Jones Industrial Average, one of the oldest stock market indices in the world, is compiled of the 30 most traded stocks in the US. The index is price-weighted rather than weighted by capitalization. It is calculated by summing the prices of the constituent stocks and dividing them by a factor, currently 0.152. The index was founded by Charles Dow, who also founded the Wall Street Journal. In later years it has been criticized for not being broadly representative enough because it only tracks 30 conglomerates, unlike broader indices such as the S&P 500.

Many different factors drive the Dow Jones Industrial Average (DJIA). The aggregate performance of the component companies revealed in quarterly company earnings reports is the main one. US and global macroeconomic data also contributes as it impacts on investor sentiment. The level of interest rates, set by the Federal Reserve (Fed), also influences the DJIA as it affects the cost of credit, on which many corporations are heavily reliant. Therefore, inflation can be a major driver as well as other metrics which impact the Fed decisions.

Dow Theory is a method for identifying the primary trend of the stock market developed by Charles Dow. A key step is to compare the direction of the Dow Jones Industrial Average (DJIA) and the Dow Jones Transportation Average (DJTA) and only follow trends where both are moving in the same direction. Volume is a confirmatory criteria. The theory uses elements of peak and trough analysis. Dow’s theory posits three trend phases: accumulation, when smart money starts buying or selling; public participation, when the wider public joins in; and distribution, when the smart money exits.

There are a number of ways to trade the DJIA. One is to use ETFs which allow investors to trade the DJIA as a single security, rather than having to buy shares in all 30 constituent companies. A leading example is the SPDR Dow Jones Industrial Average ETF (DIA). DJIA futures contracts enable traders to speculate on the future value of the index and Options provide the right, but not the obligation, to buy or sell the index at a predetermined price in the future. Mutual funds enable investors to buy a share of a diversified portfolio of DJIA stocks thus providing exposure to the overall index.