3 Altcoins Trending in Nigeria For The Last Week of July

The final week of July has seen a noticeable pullback across the crypto market, with Bitcoin (BTC) trading within a tight consolidation range. This muted performance has dampened broader market sentiment, dragging many altcoins lower.

Despite the cautious tone, retail interest in Nigeria—one of Africa’s most active crypto markets—has remained resilient. On-chain and social data reveal that Bonk (BONK), Sui (SUI), and Pepe (PEPE) have emerged as the top three trending altcoins in the country during the final week of July.

BONK

According to Ayotunde Alabi, CEO of Luno Nigeria, Solana-based meme coin BONK is among the top trending assets in Nigeria this week. The recent resurgence in the demand for meme assets has pushed BONK’s value up by over 150% in the past 30 days.

Alabi told BeInCrypto that BONK’s surge in popularity may be tied to the wider altcoin rally. Still, its appeal among Nigerian investors is also driven by its affordability and perceived upside. In a market where many top coins appear overbought, low-cost tokens like BONK offer speculative traders a chance to enter early and ride potential momentum.

“Interest could be based on the broader altcoin momentum, but investors could also be drawn to the low price entry point and potential for long-term growth,” Alabi pointed out.

The meme coin trades at $0.00003 at press time, up 7% in the past 24 hours. BONK could extend its rally toward $0.000038 if buying pressure is sustained. A successful breach of that resistance could propel the altcoin to reclaim its year-to-date high of $0.000040.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

BONK Price Analysis. Source: TradingView

BONK Price Analysis. Source: TradingView

On the other hand, if demand weakens, BONK’s price could dip to $0.000034.

SUI

This week, layer-1 (L1) coin SUI is another altcoin trending among Nigerian traders. According to Alabi, SUI’s resilience and rising visibility in Nigeria can be linked to its expanding ecosystem and increasing institutional validation.

With big names like Grayscale and VanEck backing the token through new investment vehicles, the CEO mentioned that Nigerian investors are paying closer attention to its long-term potential.

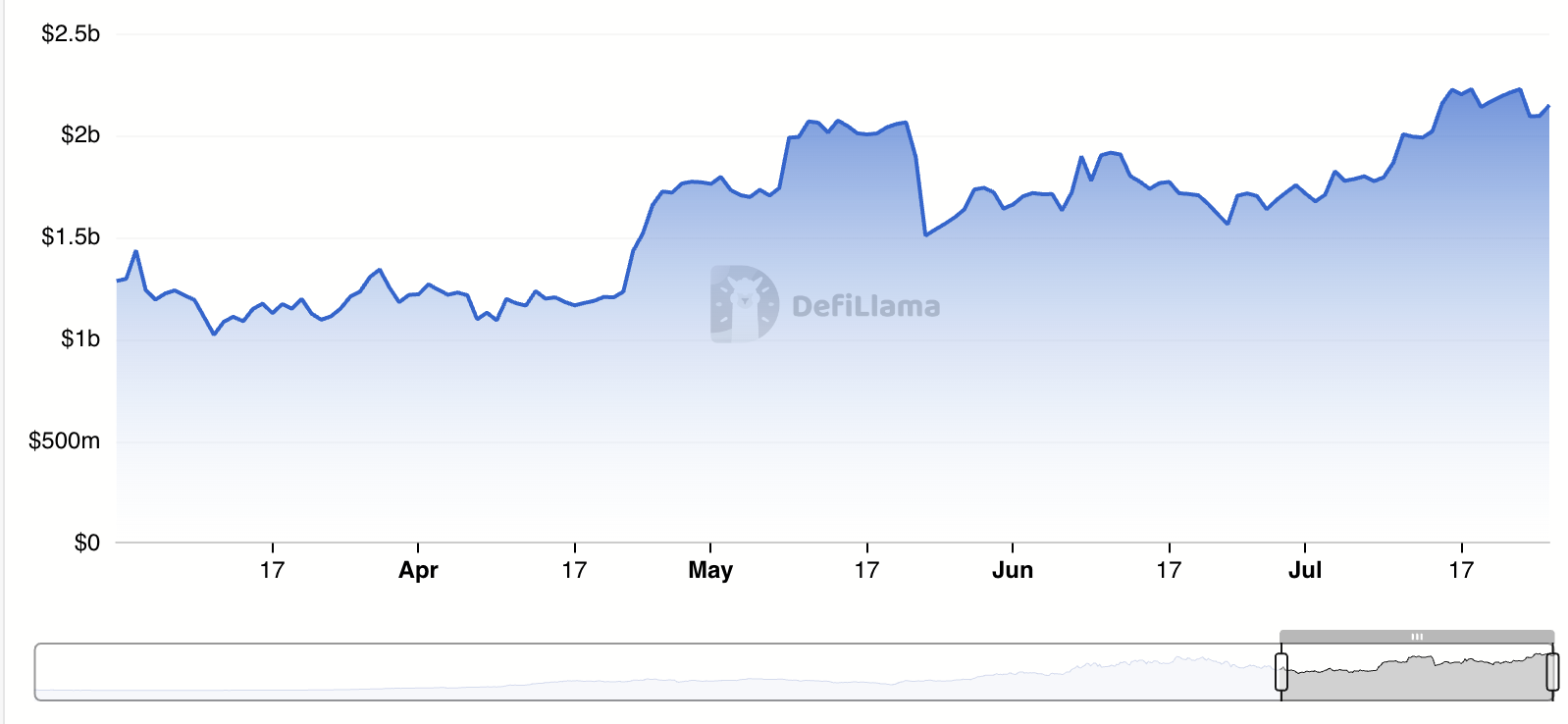

He added that the increase in SUI’s total value locked (TVL) over the past month signals a growing adoption and capital confidence in the network’s infrastructure. According to DefiLlama, this currently stands at $2.148 billion, rising by 25% since the beginning of July.

SUI TVL. Source: DefiLlama

SUI TVL. Source: DefiLlama

This uptick in TVL reflects increased market-wide participation and suggests that more users and developers are actively engaging with the Sui ecosystem.

SUI currently trades for $3.99. If network activity remains high, demand for the SUI coin will increase, pushing its price toward $4.09. A break above this level could trigger a move to $4.29.

SUI Price Analysis. Source: TradingView

SUI Price Analysis. Source: TradingView

However, if profit-taking continues, the coin’s value could dip to $3.68.

PEPE

Despite a slight pullback over the past week, PEPE also remains on Nigerian traders’ radar. According to Alabi, the coin has benefited from the broader memecoin revival, with gains of around 18% over the last 30 days.

He explained that the strong performance of more established tokens like Dogecoin (DOGE)—which gained roughly 30% in the same period—has helped to renew market confidence in smaller memecoins like PEPE.

PEPE trades at $0.000012 at press time, noting a 5% uptick in the past 24 hours. If buy-side pressure strengthens, the meme coin’s rally could reach $0.000014.

PEPE Price Analysis. Source: TradingView

PEPE Price Analysis. Source: TradingView

Converesly, if sellers regain dominance, they could drive a downward trend to $0.0000107.