Bitcoin Price Forecast: BTC slides below $118,500 as ETFs record three straight days of outflows

- Bitcoin price continues to edge down, trading below $118,500 on Thursday, as it nears its lower consolidation band at $116,000.

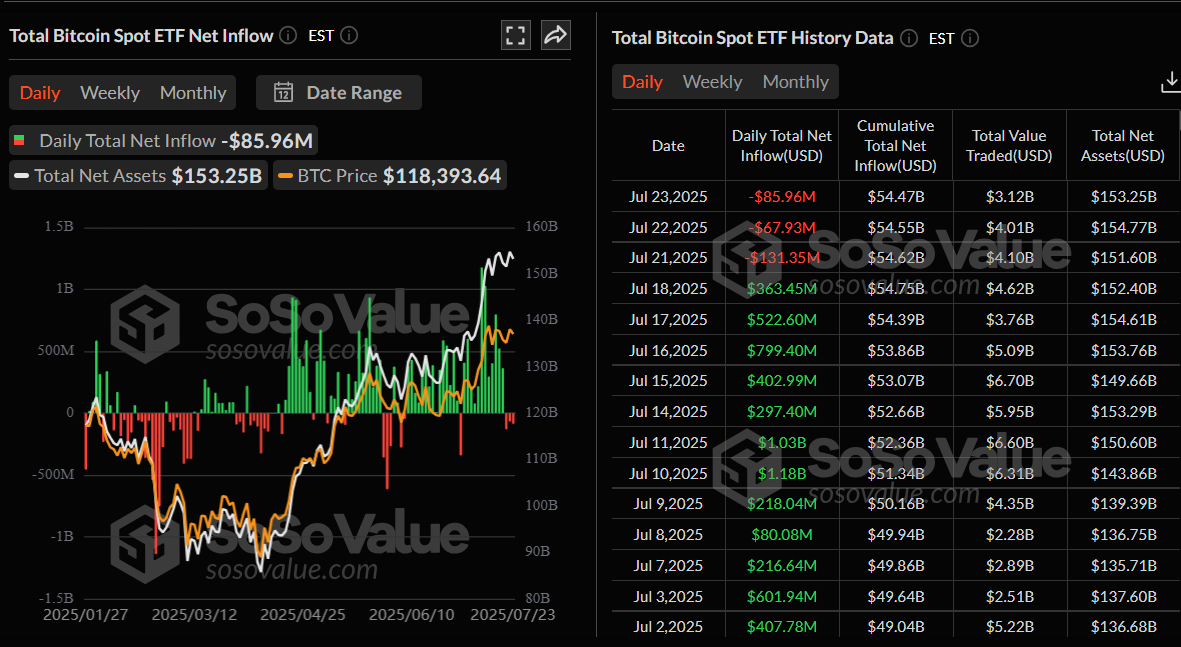

- US-listed spot Bitcoin ETFs record a third straight day of outflows, with $85.96 million exiting on Wednesday.

- Traders should be cautious as momentum indicators weaken, signaling a potential short-term correction.

Bitcoin (BTC) trades slightly down to near $118,500 as of Thursday, approaching its lower consolidation band at $116,000 after facing rejection from its resistance level the previous day. The decline comes amid a third consecutive day of outflows this week from US-listed spot Bitcoin Exchange Traded Funds (ETFs), signaling cautious sentiment among institutional investors. Market participants should exercise caution as momentum indicators weaken, signaling a potential short-term correction.

Bitcoin spot ETFs show mild signs of weakness

SoSoValue data shows that US spot Bitcoin ETFs recorded a third consecutive day of outflows this week, with $85.96 million exiting on Wednesday. However, these outflow values are lower compared to the inflow seen in the last few weeks. Traders should keep a watch; if this trend continues and intensifies, the Bitcoin price could face a correction.

Total Bitcoin Spot ETFs daily chart. Source: SoSoValue

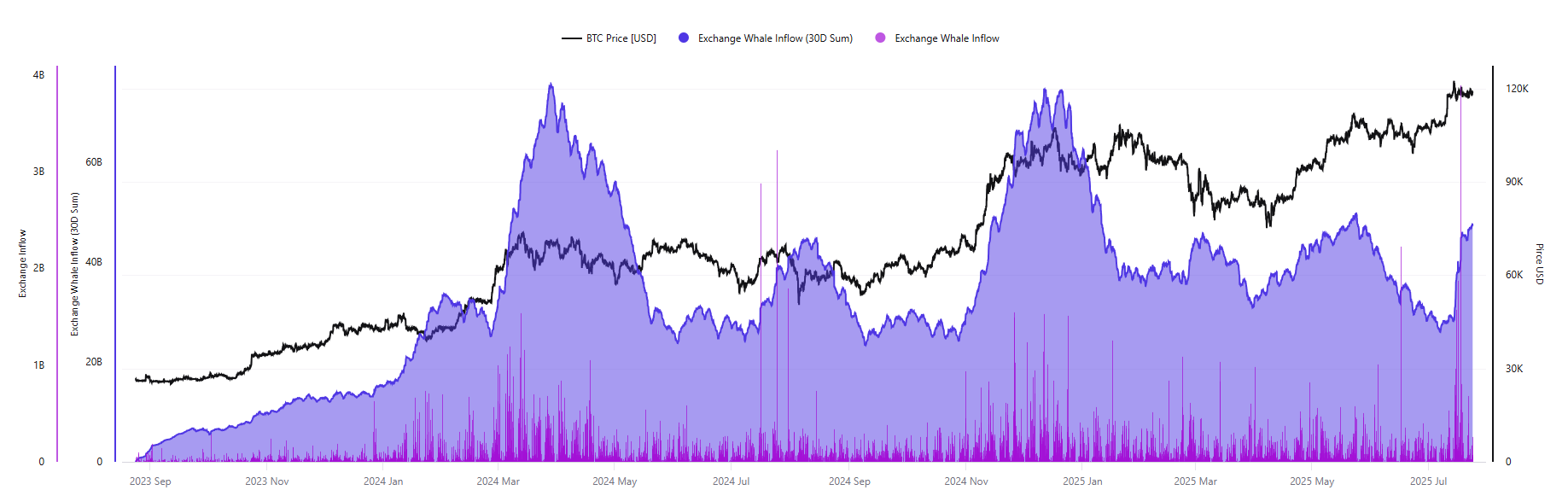

Examining CryptoQuant’s BTC inflows to exchanges (originating from whales or large investors), the data indicates that during the previous two market tops, the 30-day sum of inflows exceeded $75 billion, marking the beginning of a correction or consolidation phase. As of Thursday, the metric stands at $47 billion and has been steadily rising since Bitcoin reached a new all-time high of $123,218 on July 14, indicating that whales are booking some profits at record highs. If this upward trend continues, BTC could see a fall in its prices.

US trade deals could fuel some optimism for crypto

A trade agreement between the European Union and the US could be imminent, as reported by CNBC on Thursday. However, with no guarantees, Brussels continues to prepare retaliatory measures.

“A 15% baseline tariff rate, which includes an around 4.8% duty currently in place, is currently the base-case scenario for EU imports to the U.S.,” said the report.

Moreover, earlier on Tuesday, the Trump administration reached a trade deal with Japan. The ongoing negotiations looking for trade agreements could boost investors’ confidence, as US equities hit record levels on Wednesday, and BTC could follow.

“The markets do not expect an interest rate cut from the US Federal Reserve in July despite Trump’s continuous push for lower borrowing costs,” reports FXStreet analyst Haresh Menghani.

Menghani continued that Trump has been personally attacking Fed Chair Jerome Powell over his stance on holding rates and has repeatedly called for the central bank chief’s resignation.

Traders now look forward to the release of US S&P Global flash PMIs on Thursday, which will provide fresh insight into global economic health and influence the prices of riskier assets, such as Bitcoin.

Bitcoin Price Forecast: BTC momentum indicators weaken

Bitcoin price has been trading broadly sideways between $116,000 and $120,000 after reaching a new all-time high of $123,218 on July 14. On Tuesday, it rebounded from its lower consolidating boundary at $116,000 but faced rejection from the upper consolidation band at $120,000. At the time of writing on Thursday, it hovers at around $118,600.

If BTC falls below $116,000 on a daily basis, it could extend the decline to retest the 50-day Exponential Moving Average (EMA) at $111,269.

The Relative Strength Index (RSI) on the daily chart reads 63, after rejecting its overbought conditions on Tuesday, indicating fading bullish momentum. The Moving Average Convergence Divergence (MACD) also showed a bearish crossover on Wednesday, giving sell signals and indicating a bearish momentum.

BTC/USDT daily chart

However, if BTC closes above the upper boundary of the consolidation range at $120,000 on a daily basis, it could extend the recovery toward the fresh all-time high at $123,218.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.