Bank of America named Bitcoin the top-performing currency of 2025

Bitcoin blew past $120,000, and now Bank of America has officially declared it the best-performing currency of 2025.

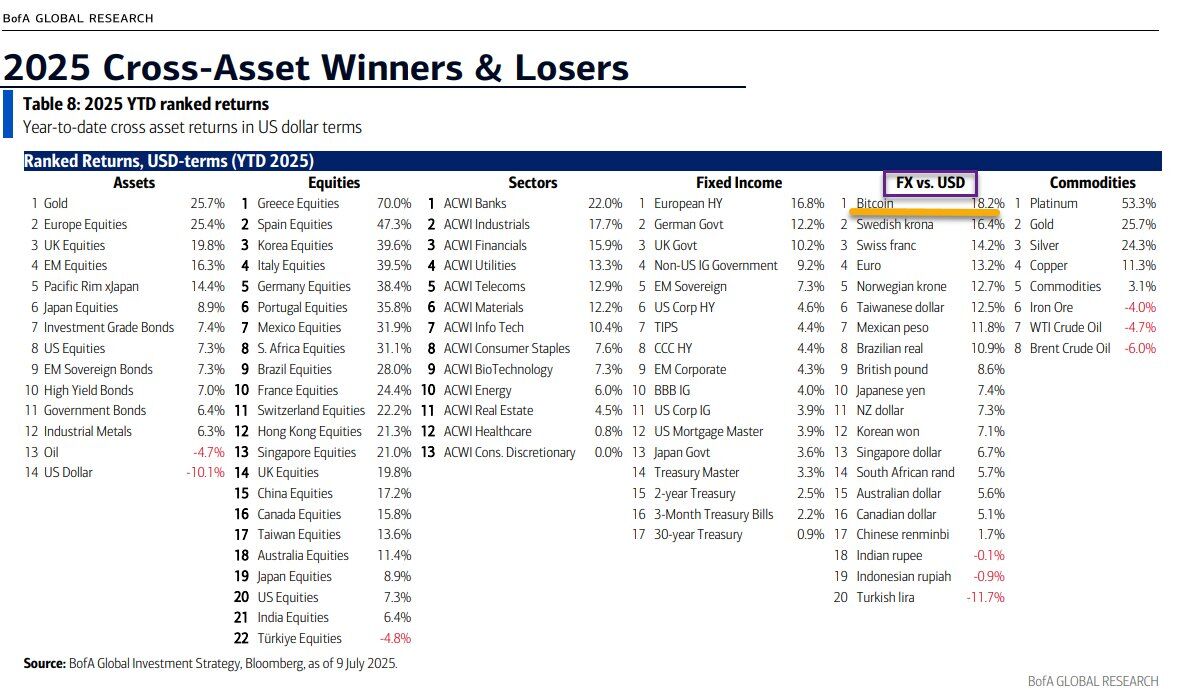

This update came straight from their latest report, Winners and Losers of 2025, which put the crypto ahead of every fiat currency out there.

The bank said Bitcoin has gained 18.2% since the start of the year, outperforming major players like the Swedish krona at +16.4%, the Swiss franc at +14.2%, and the euro, which came in at +13.2%. Meanwhile, the US dollar dropped 10.1%, landing dead last among the 14 asset classes they tracked.

Bitcoin’s RSI rises, dollar crumbles

This recognition came after months of steady gains that started building in early June. Price climbed from the $100,000 range and didn’t look back. Bitcoin surged above its 50-day exponential moving average, now at $106,434, breaking through key levels with real strength.

Trading volume jumped at the same time, confirming what anyone watching the charts already knew, this wasn’t a weak rally. It was backed by actual momentum.

The bank also flagged that Bitcoin’s Relative Strength Index (RSI) rose to 73.56, which signals overbought conditions. The last time RSI hit that level was in late May, when price hovered just under $110,000. Since then, it’s kept climbing.

The structure on the charts shows higher highs and higher lows, and the fact that volume increased during the breakout gives it even more credibility. As of now, it’s sitting at the top of its historical range.

As Bitcoin gained traction, traditional currencies struggled. Analysts at the bank blamed the dollar’s drop on weakening demand for dollar-based assets and growing doubts around where global interest rates are headed under the current administration. Investors are looking elsewhere, and Bitcoin has stepped in to fill that space.

Bank adds list of undervalued stocks

Outside of currencies, Bank of America pointed to several buy-rated stocks that they say have room to run. That includes Disney, Oddity Tech, Bellring Brands, AT&T, and Primo Brands. These companies showed enough upside, according to the analysts, to be listed alongside top-performing assets.

Michael Funk, an analyst at the bank, brought AT&T back into coverage this week. He said, “Given the operational momentum in the business, strong combination of wireless and fiber assets and targeted return of capital over the next many years, we believe T should trade more closely to TMUS than VZ.”

Michael thinks the company is “fundamentally sound, with a stable subscription-based business model.” AT&T shares are already up 19% this year.

Yasmine Deswandhy, who covers Bellring Brands, said, “We believe the current share price undervalues BRBR’s historical sales growth delivery and potential runway.” She pointed to continued strength in health food trends, even with growing competition.

“In our view, increased competition and recent changes in retailer buying teams are only natural in a young category and necessary for the category to expand out of the fringes and into the mainstream.” Despite being down 23% this year, she called the brand “built for endurance.”

On Disney, analyst Jessica Reif Ehrlich wrote, “It appears now Experiences is tracking at least in line with FY25 expectations with the benefit of a robust pipeline of new cruise ships, which should buoy results in the years to come.”

Jessica said short-term growth will likely come from a more profitable streaming business, better numbers from theme parks, and a film slate strong enough to drive other units. Disney stock is up 8% year-to-date.

Primo Brands was included because of what analysts described as a strong consumer movement toward bottled water. The team gave it a Buy rating, saying the company is benefiting from favorable long-term demand and short-term synergy gains that help grow EBITDA.

Finally, Oddity Tech stood out for its edge in tech. Analysts said, “We see opportunity for ODD to use its enhanced technological capabilities to capture share from legacy players.” The report mentioned 20%+ annual sales growth, with more growth expected from two new brand launches set for 2025 and 2026, aimed at expanding their reach to newer customers.

Your crypto news deserves attention - KEY Difference Wire puts you on 250+ top sites