Ripple Price Prediction: XRP bulls relaunch push for $3.00 as fundamentals strengthen

- XRP bulls eye support above $2.40, piggybacking on growing risk-on sentiment in the broader cryptocurrency market.

- The number of addresses on the XRP Ledger hit record highs, averaging 7.3 million.

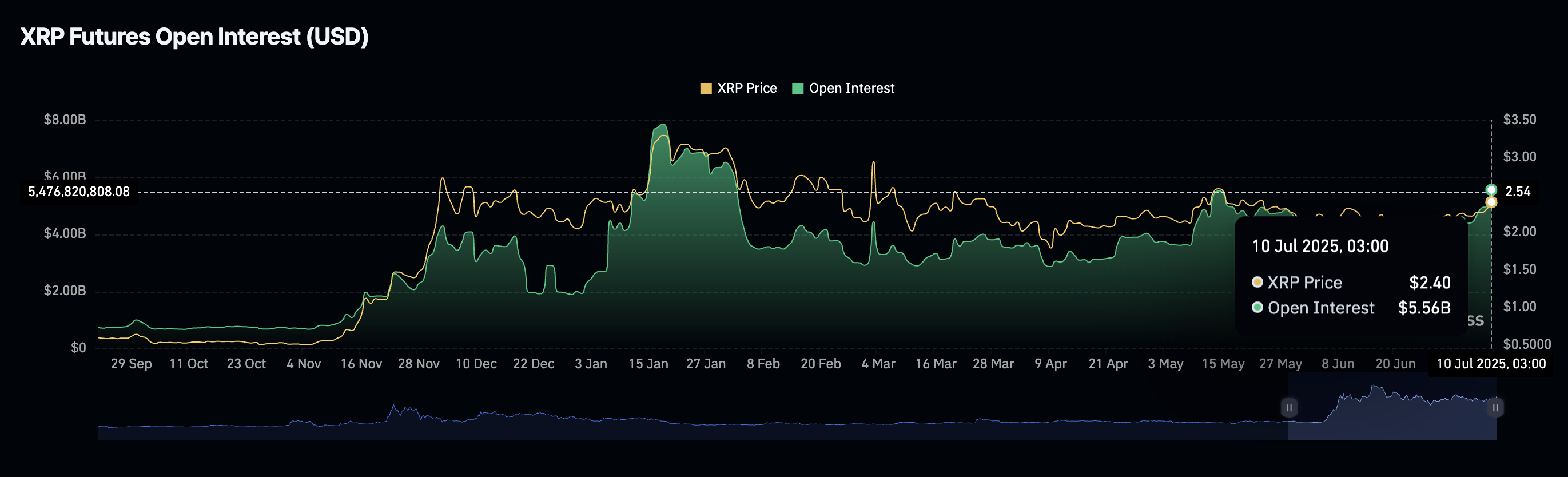

- Interest in XRP derivatives steadily rises, backed by a surge in futures Open Interest, reaching $5.56 on Thursday.

Ripple (XRP) price extends recovery, reaching highs of around $2.46 and corrects to trade at $2.44 on Thursday. The bullish wave cut across the cryptocurrency market, underpinning rising risk-on sentiment, as investors seek refuge in riskier assets like Bitcoin (BTC), Ethereum (ETH) and XRP due to mounting macroeconomic uncertainty amid tariff developments in the United States (US).

Meanwhile, XRP shows that it has the potential to accelerate the uptrend, targeting highs above $3.00 in the short term, backed by a recent breakout from an inverse Head-and-Shoulders (H&S) pattern and strong fundamentals.

XRP bulls tighten grip amid steady fundamentals

The number of addresses on the XRP Ledger (XRP) has progressively increased over the past two years. According to Glassnode, addresses on the protocol currently average 7.3 million compared to 6.3 million on January 1 and 5.7 million on July 10, 2024.

A surge in the Number of Addresses metric indicates increased participation from both retail and institutional investors. As network usage increases with more transactions, there is a corresponding upswing in trading fees and interactions on the XRP Ledger.

Number of Addresses metric | Glassnode

The derivatives market paints a clear picture of the rising interest in XRP, particularly with the futures Open Interest (OI) steadily rising to $5.56 billion from $3.54 billion, posted on June 23.

XRP futures Open Interest | Source: Coinglass

A subsequent increase in the trading volume by nearly 30% to approximately $9 billion signals heightened market activity. In other words, traders are betting more on future price increases than XRP declining.

Liquidations surged in the past 24 hours, reaching $10 million, with short positions accounting for the lion’s share at $8 million. The long-to-short ratio also ticked up, averaging 0.9904 at the time of writing, which emphasizes a bullish bias.

XRP derivatives market data | Source| CoinGlass

Technical outlook: XRP offers bullish signals

XRP price flaunts a robust technical structure backed by growing institutional and retail interest. Bulls appear to have the upper hand, with a buy signal from the Moving Average Convergence Divergence (MACD) steadying risk-on sentiment.

The MACD indicator has maintained the buy signal since Sunday (see the 8-hour chart below), with the green histogram bars indicating bullish momentum. With a breakout from the inverse H&S pattern confirmed, XRP could extend the uptrend to $2.76 and significantly close the gap to the round-figure resistance at $3.00.

XRP/ISDT 8-hour chart

A Golden Cross pattern, established when the 50-period Exponential Moving Average (EMA) crossed above the 200-period EMA on Wednesday, backs the bullish structure.

Traders should also look for a break and close above the immediate resistance at $2.46 to ascertain the strength of the uptrend. On the contrary, potential profit-taking and the possibility of market dynamics changing, especially with tariff uncertainty in the US, could lead to a pullback.

Key areas likely to serve as support lie at the 50-period EMA ($2.25) and the confluence formed by the converging 100-period EMA and 200-period EMA at $2.23.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.