Hedera’s 5% Rally on Shaky Ground as Sell-Side Pressure Soars

Hedera’s native token HBAR has climbed 5% over the past week, driven by increased investor demand and a broader uptick in altcoin activity.

However, despite the short-term rally, technical indicators now suggest the momentum is losing steam, signaling a potential pullback in the days ahead.

HBAR’s Short-Term Rally Threatened by Weakening Bullish Pressure

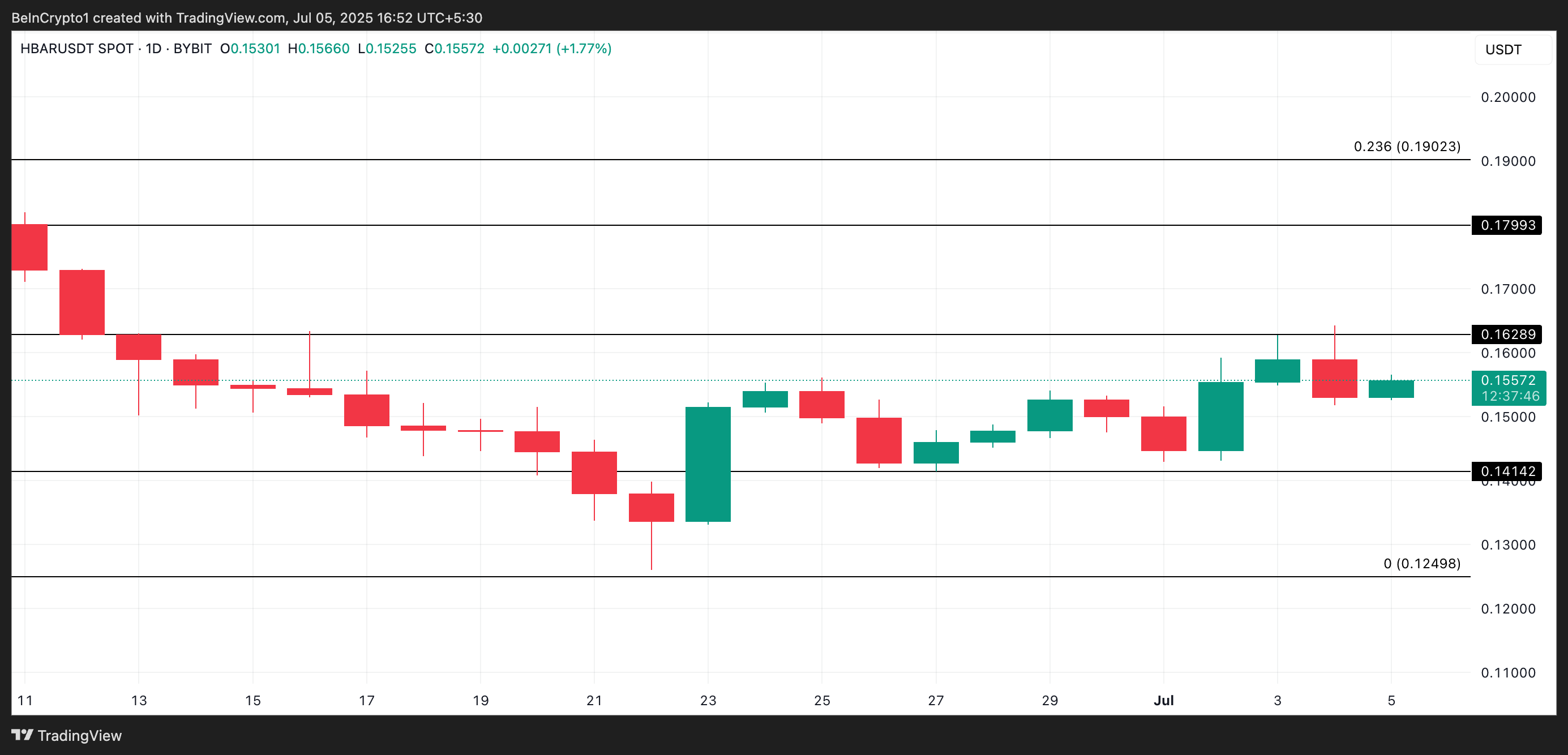

An assessment of the HBAR/USD one-day chart shows the altcoin currently testing a break below its 20-day Exponential Moving Average (EMA). HBAR currently exchanges hands at $0.155, trading above this key moving average, forming dynamic support at $0.153.

HBAR 20-Day EMA. Source: TradingView

HBAR 20-Day EMA. Source: TradingView

The 20-day EMA measures an asset’s average price over the past 20 trading days, giving weight to recent price changes. When an asset’s price is poised to break below its 20-day EMA, it signals weakening short-term momentum.

HBAR’s eventual decline below this key moving average confirms that selling pressure has outweighed buying activity. If no strong buying interest emerges, the asset could enter a corrective phase or even start a new downtrend.

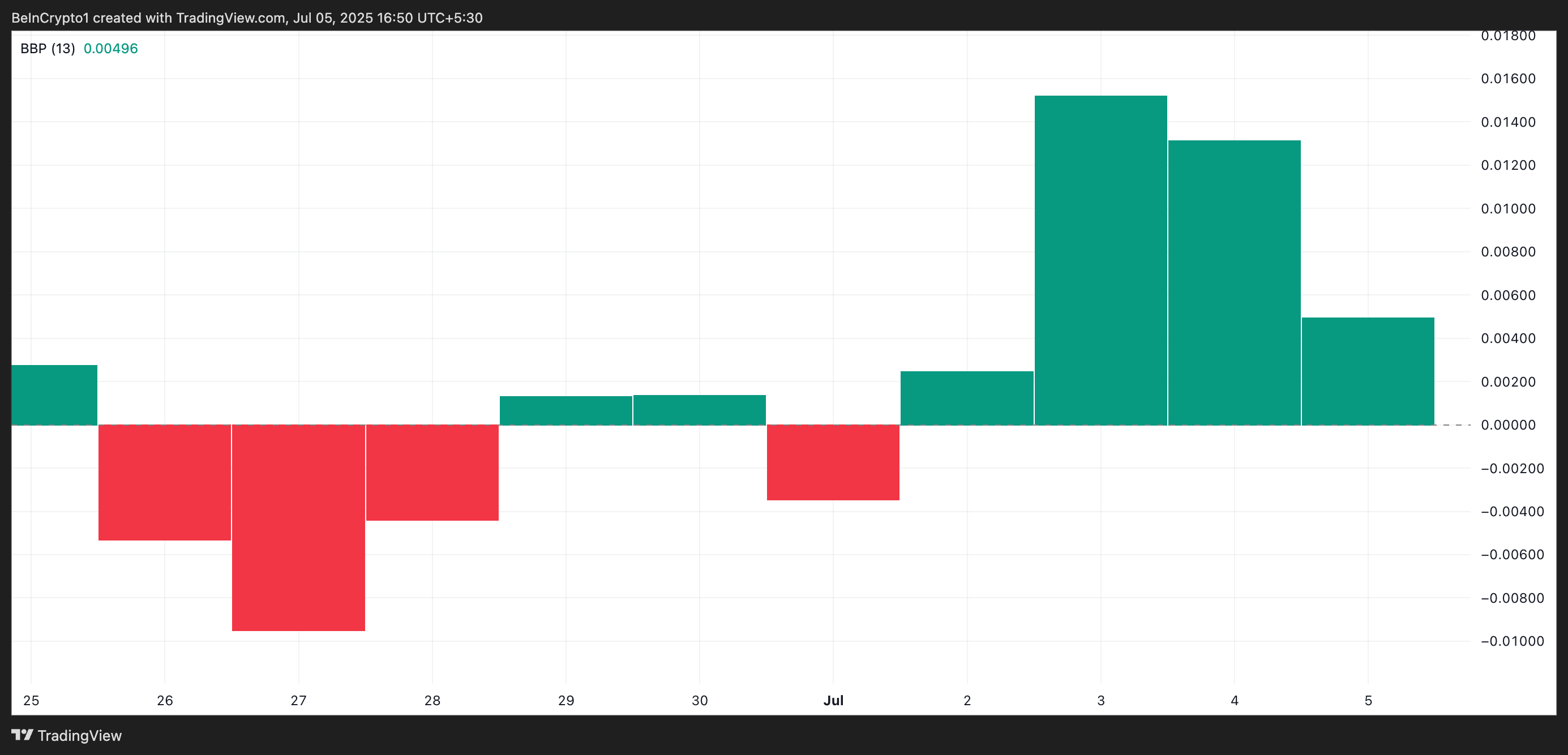

Moreover, readings from the altcoin’s Elder-Ray Index indicator support this bearish outlook. Over the past three trading sessions, the green bars that make up the indicator have seen their sizes shrink. This contraction reflects fading bullish conviction, reinforcing the risk of a near-term reversal.

HBAR Elder-Ray Index. Source: TradingView

HBAR Elder-Ray Index. Source: TradingView

The indicator gauges the strength of bulls and bears in the market. When it prints green histogram bars, it indicates strong buyer dominance and rising upward momentum.

However, when these bars contract like this, it signals a dip in token accumulation, which is the case with HBAR.

HBAR’s Fragile Gains Under Threat

These trends suggest that HBAR could struggle to maintain its gains unless fresh buying momentum returns. In the meantime, it could see a retrace. If selloffs spike, HBAR’s price could fall to $0.141.

If bearish pressure strengthens at this support level, the token’s price could plunge to $0.124.

HBAR Price Analysis. Source: TradingView

HBAR Price Analysis. Source: TradingView

Conversely, a resurgence in new demand for HBAR could invalidate this bearish outlook. If new buyers enter the market, they could propel the altcoin’s value above $0.162.