Ethereum Bears Sold $2.5 Billion: Will It Impact ETH Price?

Ethereum has seen some sideways movement this week, helping the altcoin break out of a nearly three-week-long downtrend. Despite facing bearish cues, including whale selling, Ethereum’s price has managed to hold steady.

This stability is raising expectations of an upcoming breakout, potentially setting the stage for a rise.

Ethereum Whales Move To Sell

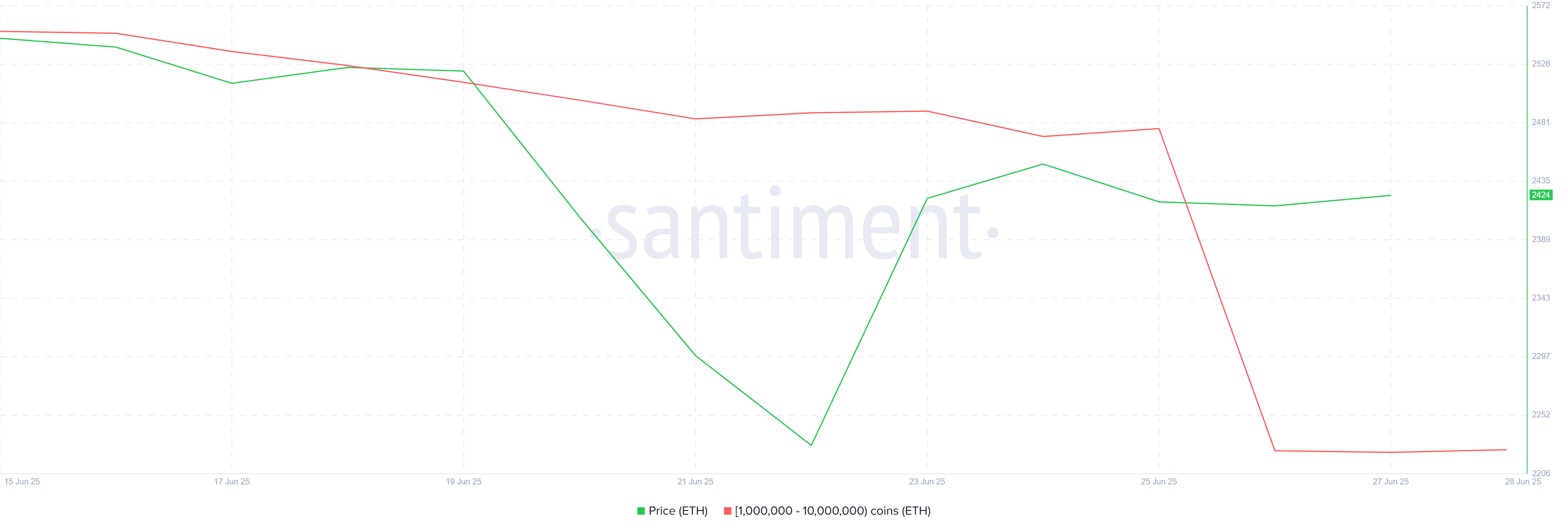

Whale addresses are exhibiting bearish sentiment at the moment, as several large holders have started to liquidate their positions.

In the last 48 hours, addresses holding between 1 million and 10 million ETH sold over 1.06 million ETH worth approximately $2.57 billion.

Whale selling typically exerts downward pressure on the price, signaling potential bearishness. However, in this case, Ethereum’s price has continued to sustain itself, which indicates market resilience.

Ethereum Whale Holdings. Source: Santiment

Ethereum Whale Holdings. Source: Santiment

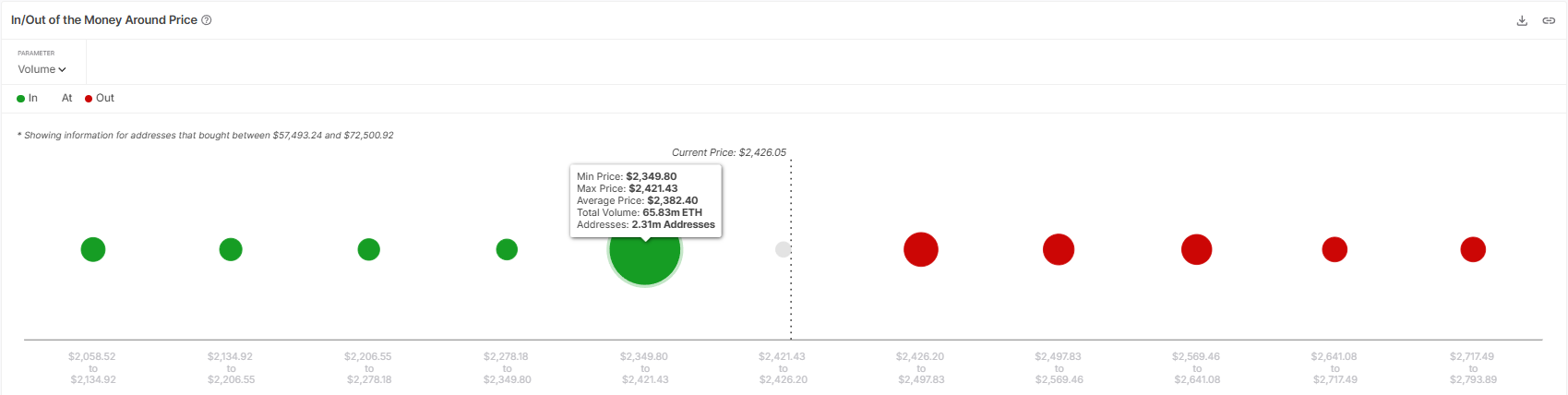

Looking at Ethereum’s macro momentum, the IOMAP (In/Out of the Money Around Price) chart reveals a significant demand zone for ETH. The zone holds 65.83 million ETH, valued at over $159 billion.

These holdings were bought between the $2,349 and $2,421 range, establishing a strong support area.

The large number of investors who purchased ETH in this price range are unlikely to sell at break-even or loss, making it difficult for the price to fall below this key support.

This demand zone acts as a solid cushion for Ethereum’s price, protecting it from any sharp declines. The support from these investors provides a foundation for Ethereum’s price to remain stable despite the recent selling pressure.

As a result, the price is less likely to drop sharply below the $2,344 mark, which would otherwise signify a more significant bearish trend.

Ethereum IOMAP. Source: Santiment

Ethereum IOMAP. Source: Santiment

ETH Price Is Consolidating

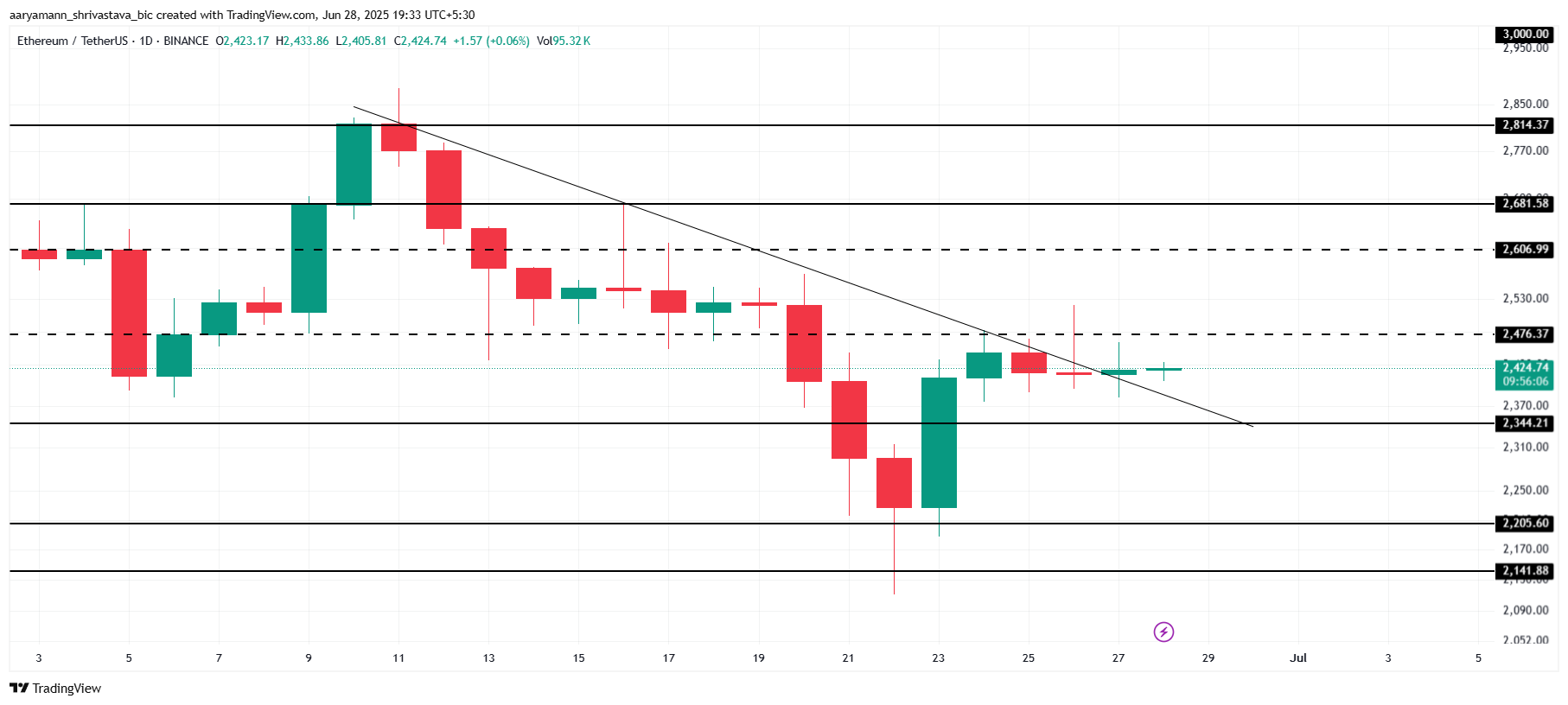

Ethereum’s price is currently trading at $2,424, just under the critical resistance of $2,476.

While there has been no significant rise, the sideways movement has allowed ETH to break out of the three-week downtrend. This consolidation phase is setting the stage for potential upward momentum.

The factors discussed earlier indicate that Ethereum may continue to consolidate between $2,344 and $2,476 or potentially break through the resistance.

If Ethereum successfully flips $2,476 into support, a rise to $2,606 is likely. This would mark a significant breakout and could attract more buyers into the market.

ETH Price Analysis. Source: TradingView

ETH Price Analysis. Source: TradingView

On the other hand, if broader market conditions turn extremely bearish, similar to last week’s sentiment, Ethereum’s price could slip below $2,344 and fall to $2,205.

A drop below this support would invalidate the current bullish thesis, potentially signaling a further decline.