Bitcoin Price Forecast: BTC takes a breather as markets await outcome of US-China trade talks

- Bitcoin price retreats slightly on Tuesday after a sharp 4.3% increase on Monday.

- Markets focus on the second day of US-China trade talks after Monday's little breakthroughs promped a pause in global risk appetite.

- KURL announces plans to raise $300 million to buy BTC, signaling increasing interest from corporates.

Bitcoin (BTC) price declines to around $109,000 on Tuesday, just inches away from its all-time high. Sentiment in the crypto market is mixed sentiment due to the absence of substantive breakthroughs in US-China trade talks, which continue in London.

Bitcoin rally fades as no breakthrough in US-China trade talks

QCP Capital’s report on Tuesday noted that the absence of substantive breakthroughs in US-China trade talks led to a pause in global risk assets. The largest cryptocurrency by market capitalization had soared from a low of $105,300 to a high of $110,530, closing above $110,263 on Monday, just 1.56% shy of its all-time high.

“Markets remain in limbo,” says QCP’s analyst. The analyst added that investors are treading cautiously ahead of the US Consumer Price Index (CPI) data to be published on Wednesday. The risk is that continued diplomatic ambiguity morphs into a headwind for broader risk sentiment.

Any positive outcome in US-China trade talks would fuel the risk-on sentiment as trade uncertainty between the two major global economic powers would ease. On the contrary, failure to reach any common ground would likely hurt crypto markets.

Bitcoin institutional demand continues to strengthen

The demand for BTC from public companies continued to strengthen at the start of this week. On Monday, KULR Technology Group, Inc. announced that it would raise $300 million in capital through an at-the-market (ATM) offering of its common stock to support its Bitcoin treasury reserve, following a similar move followed by Strategy.

The interest from public companies in Bitcoin indicates a growing acceptance of BTC as a strategic asset, helping to boost its legitimacy and potentially driving long-term adoption.

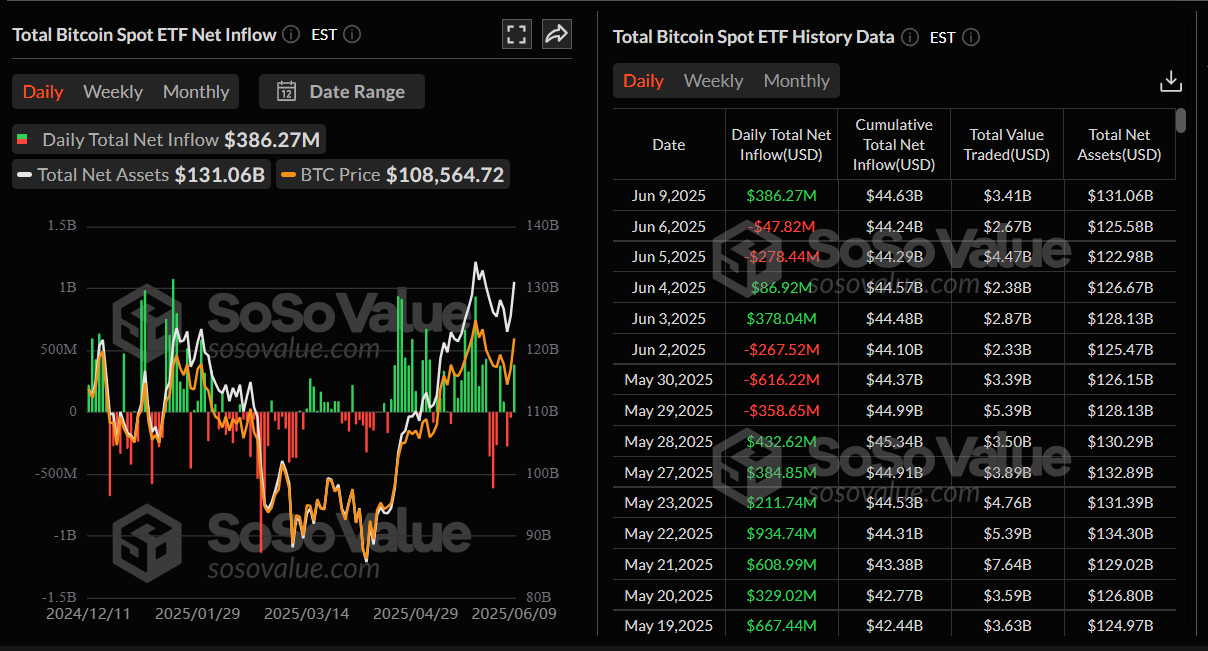

Apart from public companies, the institutional demand saw a slight increase on Monday. According to SoSoValue data, Bitcoin spot ETFs experienced a mild inflow of $386.27 million on Monday, breaking a two-day streak of outflows seen last week.

Total Bitcoin Spot ETFs daily chart. Source: SoSoValue

Bitcoin Price Forecast: BTC closes above its key resistance

Bitcoin price retested and found support around its 50-day Exponential Moving Average (EMA) at $101,977 on Friday and then recovered sharply over the next three days. BTC closed above its key resistance level of $106,406 on Monday. At the time of writing on Tuesday, it hovers at around $109,000.

If BTC continues its upward trend, it could extend the rally to retest its May 22 all-time high of $111,980.

The Relative Strength Index (RSI) on the daily chart reads 61, above its neutral level of 50, indicating strong bullish momentum. Moreover, the MACD indicator on the daily chart is about to flip a bullish crossover . If the MACD generates a this bullish crossover, it would provide a buying signal.

BTC/USDT daily chart

If the current retreat intensifies, BTC could extend the decline to retest its daily support level at $106,406.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.