Here's why Ethereum stalled despite strong ETF inflows and record-low exchange reserves

Ethereum price today: $2,600

- US spot Ethereum ETFs have seen 12 consecutive days of net inflows totaling $743.8 million.

- Ethereum exchange reserves plunged by 450,000 ETH in one week, reaching its lowest since 2016.

- Increased short positions across ETH futures on CME and Binance have weighed on Ethereum's price.

- ETH sees rejection again at a rising trendline resistance, extending its multi-week consolidation.

Ethereum (ETH) trades around $2,600 on Wednesday, maintaining its consolidation despite intense buying pressure across ETH exchange-traded funds and crypto exchanges. The flat prices potentially stem from rising short positions neutralizing the impact of buying pressure in the spot market.

Ethereum price stalls despite strong buying pressure

US spot Ethereum ETFs extended their streak of inflows to twelve consecutive days after recording net inflows of $109.43 million on Tuesday — their second-highest since February 4. During the twelve days, the products have seen $743.88 million in inflows, per SoSoValue data.

BlackRock's iShares Ethereum Trust (ETHA) led the pack on Tuesday with a single-day net inflow of $77 million. Notably, BlackRock's ETHA has accumulated 214,000 ETH since May 11, according to data posted by on-chain wallet tracker Lookonchain.

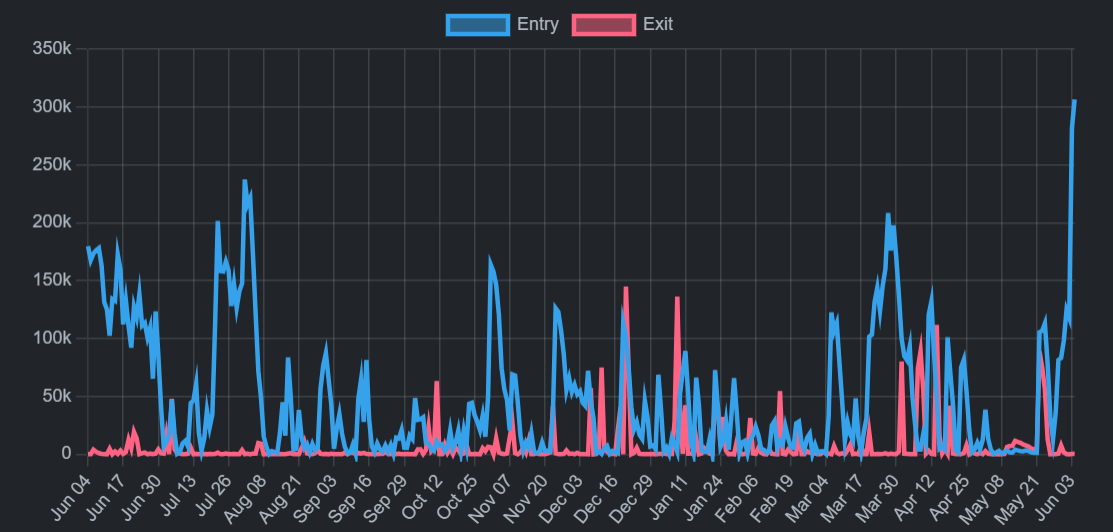

Ethereum has also seen intense buying pressure on crypto exchanges, with investors withdrawing nearly 450,000 ETH to private wallets for potential long-term holding. The large withdrawals have sent Ethereum's exchange reserve to an all-time low of 18.65 million ETH — discounting its first two years of launch.

-1749079530690.png)

ETH Exchange Reserve. Source: CryptoQuant

Most of the withdrawals potentially flowed to staking protocols as ETH's total value staked has risen by 255,000 ETH in the past eight days. However, that value is understated, considering more than 306,438 ETH are waiting in the Ethereum validator activation queue, the highest in over a year, per data from Beaconcha.in. Additionally, 340,533 ETH are in the entry queue, with an average wait time of over five days.

ETH Validator Queue. Source: Validatorqueue.com

Despite the intense bullish pressure across ETH ETFs and crypto exchanges, Ethereum has traded largely sideways since May 13, hovering between $2,450 and $2,700.

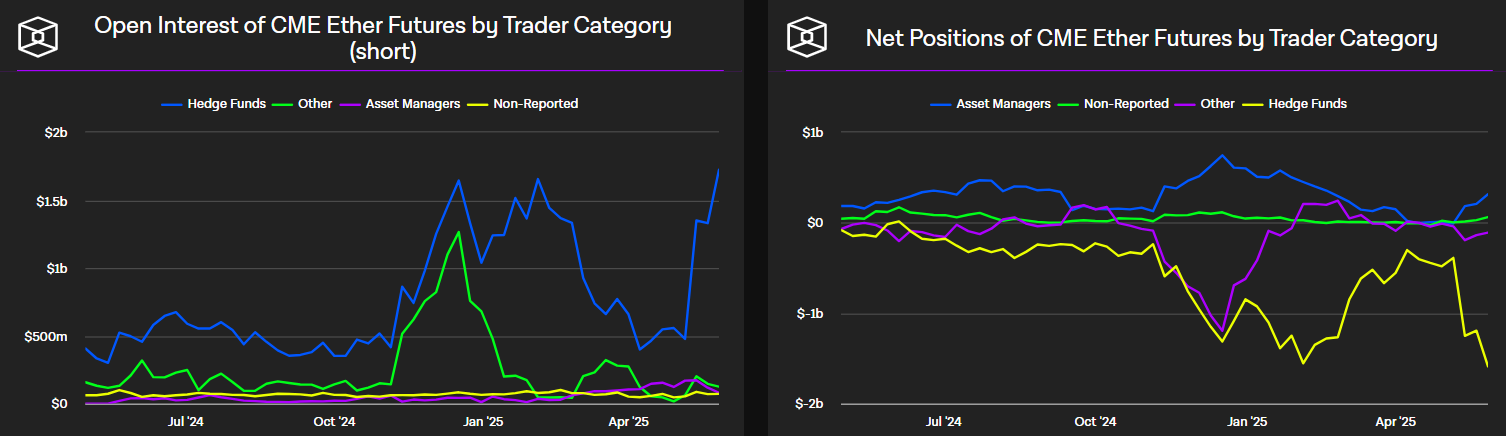

A potential reason for the lag in price is the rise in short positions across Ethereum futures, with US-based hedge funds on the Chicago Mercantile Exchange (CME) expanding their short positions by $1.25 billion in the past three weeks, far outpacing long positions on the exchange, according to CFTC data compiled by The Block.

CME Ethereum Futures. Source: The Block

A similar downside positioning is visible across Binance, where short positions have risen to levels similar to those seen in February, before the post-tariffs market crash that filled those positions.

Investors are potentially leveraging ETH ETFs and staked ETH to run a delta-neutral strategy, similar to the decentralized finance (DeFi) platform Ethena, earning from staking yields, funding rates, or price premiums while using shorts to hedge their bets.

Ethereum Price Forecast: ETH faces rising trendline resistance

Ethereum saw $52.39 million in futures liquidations over the past 24 hours, per Coinglass data. The total amount of long and short liquidations is $26.95 million and $25.44 million, respectively.

ETH bounced off the 50-period Simple Moving Average (SMA) and retested the resistance of a rising trendline from May 18. If ETH sustains the rejection at the rising trendline, it could find support at the lower boundary of the rising wedge — near the $2,500 key level — if the 50-period SMA support fails.

On the upside, the top altcoin could rise to tackle the upper boundary of a slightly rising wedge if it clears the rising trendline and $2,750 key resistance levels.

ETH/USDT 8-hour chart

The Relative Strength Index (RSI) and Stochastic Oscillator are above their neutral levels but trending downwards, indicating a weakening bullish momentum.