Bitcoin Price Forecast: BTC could head toward $100K as profit-taking activity reaches record levels

- Bitcoin price faces rejection around the $106,406 key level on Wednesday, hinting at a potential correction ahead.

- On-chain data shows that BTC’s profit-taking activity reached record levels on Tuesday, signaling growing selling pressure.

- CME exposure from institutional players and leveraged ETFs has increased modestly but remains below previous peaks.

Bitcoin (BTC) price faces rejection from a key level and trades below $106,000 at the time of writing on Wednesday. BTC’s on-chain data suggests weakness and indicates a potential correction, as profit-taking activity reached record levels on Tuesday. Moreover, Bitcoin’s exposure on the Chicago Mercantile Exchange (CME) from institutional players and leveraged Exchange Traded Funds (ETFs) has increased modestly. Still, it remains below previous peaks, indicating a cooler, more cautious market sentiment.

Bitcoin profit booking activity and dormant wallet activity rise

Santiments’ Network Realized Profit/Loss (NPL) metric indicates that BTC holders are booking profits around $106,000.

As shown in the graph below, the NPL experienced a significant spike on Tuesday, marking the highest profit booking to date. The spike indicates that holders are, on average, selling their bags at a significant profit and increasing the selling pressure.

[15-1749029688323.04.24, 04 Jun, 2025].png)

BTC NPL chart. Source: Santiment

Examining Santiment’s Age Consumed index also reveals bearish signs. The spikes in this index suggest dormant tokens (tokens stored in wallets for a long time) are in motion, and it can be used to spot short-term local tops or bottoms. As in BTC’s case, history shows that the spikes were followed by a fall in Bitcoin's price as holders moved their tokens from wallets to exchanges, thereby increasing the selling pressure.

The most recent uptick on Tuesday was the highest spike since mid-May 2024, which forecasted that BTC was ready for a downtrend.

[12-1749029815919.40.35, 04 Jun, 2025].png)

BTC Age Consumed chart. Source: Santiment

Bitcoin’s CME exposure reflects broad market caution

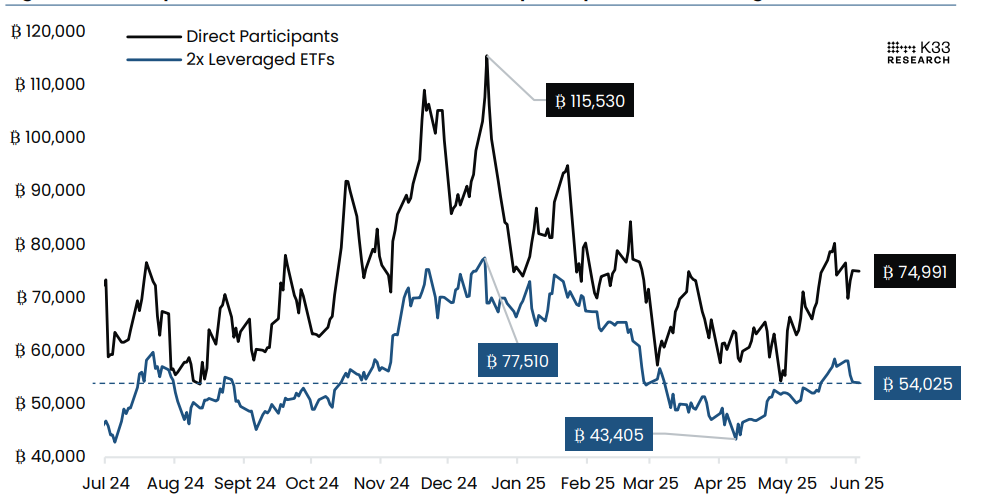

A K33 Research report released on Tuesday highlights that the Bitcoin exposure on the Chicago Mercantile Exchange (CME) from both direct participants and leveraged Exchange Traded Funds has risen modestly but remains well below previous peaks, reflecting broad market caution despite Bitcoin’s recent strength.

As shown in the chart below, the VolatilityShares 2x leveraged BTC ETF holds a combined BTC exposure of 54,025 BTC (blue line), up 10,620 BTC from its April 8 lows of 43,405 BTC but still down 23,485 BTC from its December 17 all-time high. Additionally, the direct market participant exposure (black line) also follows a similar pattern.

“A lack of inflows to these instruments softens the buoyant effect on premiums and thus reduces the appeal from direct participants to commit to the basis trade,” says K33 analyst

This low relative exposure of CME traders indicates a cooler, more cautious market sentiment.

BTC CME Open Interest Cohorts: Active market participants and leveraged ETFs Source: K33 Research

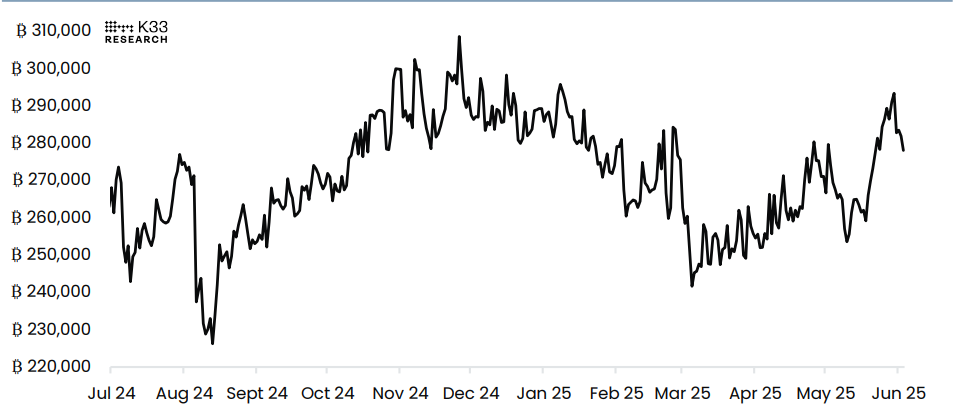

The report further explains that, compared to these cohorts on CME, there is a higher relative activity in offshore perps. The notional Open Interest (OI) in BTC perpetual, as shown below, has risen to levels last seen in November and December by the end of May.

“This growth in OI has occurred during a highly ambiguous funding rate regime,” says the K33 analyst.

The analyst continued: “While there is a vibrant demand to add leveraged exposure in the market, there is no clear one-directional bias to read into this activity. In essence, this creates a structure that enhances liquidation risks in either direction, thus setting the stage for accelerated volatility ahead.”

BTC Notional Open Interest BTC perps chart. Source: K33 Research

Bitcoin Price Forecast: BTC rejects and falls below the $106,400 resistance level

Bitcoin price declined and closed below its daily level of $106,406 last week. However, it recovered slightly during the weekend and also on Monday. BTC faced resistance again around the $106,406 level the next day. At the time of writing on Wednesday, it hovers around $105,400.

If BTC fails to close above the $106,406 daily resistance and continues its correction, it could extend the decline to retest its next key support level at $100,000, a psychological level.

The Relative Strength Index (RSI) on the daily chart reads 53 and points downward toward its neutral level of 50, indicating fading bullish momentum. If the RSI falls below its neutral level of 50, it would suggest increasing bearish momentum and a decline in Bitcoin's price. Moreover, the Moving Average Convergence Divergence (MACD) indicator showed a bearish crossover. It also shows a rising red histogram bar below its neutral level, suggesting the continuation of the downward trend.

BTC/USDT daily chart

On the other hand, if BTC recovers and closes above $106,406, it could extend the rally toward its all-time high of $111,980.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.