Tether outpaces Germany in U.S. Treasury holdings

Tether is now the 19th-biggest owner of US government debt after it surpassed Germany in holding US Treasuries.

As per the attestation report for Q1 2025, Tether has $120 billion in US Treasuries, which is greater than Germany’s $111.4 billion, as reported by the US Department of the Treasury.

“This milestone not only reinforces the company’s conservative reserve management strategy but also shows Tether’s growing role in distributing dollar-denominated liquidity at scale.”

Tether.

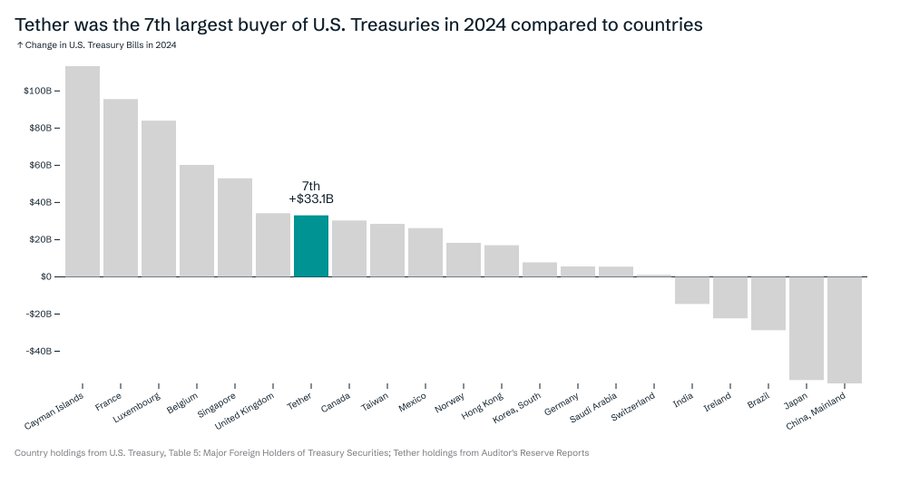

Tether has now positioned itself by relying on more traditional assets to back its USDT stablecoin. In 2024, the USDT issuer was the seventh-largest buyer of U.S. Treasuries, beating Canada, Mexico, Taiwan and Norway.

The aim of these investments is to sustain the stability of the USDT and help maintain sufficient liquidity when markets are volatile.

Tether also reported over $1 billion in profits from conventional investments in Q1, mainly because of the success of its U.S. Treasury assets. With its gold-backed portfolio, the company managed to address the issues that arose from changes in digital assets.

“Q1 2025 showcases Tether’s continued leadership in stability, strength, and vision. With record U.S. Treasury exposure, growing reserves, strong profits, and increased adoption ofUSD₮ worldwide.”

Paolo Ardoino Tether CEO.

USDT supply hits $150 billion

The market cap of USDT recently rose above $150 billion for the first time in history. It has grown rapidly this year, adding over $11 billion to its market capitalization.

During the last year, more than 250 million users completed over $33.6 trillion in stablecoin transactions in only 5.8 billion transactions.

Visa reports that 192.2 million addresses purchased stablecoins, and 242.7 million addresses received them, suggesting more people are using them. Both Citi and Standard Chartered say that the growth is unlikely to stop.

According to Citi, stablecoins could see their value reach $1.6 trillion by 2030. According to Standard Chartered, an increase in institutional interest and better financial regulations may lead to a valuation of $2 trillion in 2028.

XAUt expands to Thailand

Tether is expanding into Thailand by offering its tokenized gold product. Tether Gold (XAUt), a digital form of gold, was listed on Maxbit, a licensed exchange in Thailand, on May 13.

Thailand’s announcement in March 2025 granting permission to trade USD-backed stablecoins, including USDT and USDC, led to this move. Within the Thai digital asset market, USDT can now be used without restrictions.

XAUt currently has a market capitalization of $802 million and is growing popular with investors looking for alternative currency and digital assets.

There are currently two U.S. legislation proposals being studied, and they might play a role in regulating assets like USDT.

In February, the House Financial Services Committee voted in favor of the STABLE Act, moving the decision on a full House vote to the next phase. Its purpose is to ensure that each stablecoin issuer is open in their actions and maintains stability.

The opposition to the GENIUS Act stopped its advance in May.

Cryptopolitan Academy: Tired of market swings? Learn how DeFi can help you build steady passive income. Register Now