Bitcoin Options Market Signals Further Upside Potential For BTC Price: New ATH Soon?

Following the return above $100,000 in the previous week, Bitcoin has fought well to maintain its hold above the six-figure mark in recent days. While the flagship cryptocurrency retains its six-figure valuation, there’s still some momentum lacking in its price action, as spotlighted by last week’s performance.

According to recent analysis, the sluggishness and apparent indecision in the BTC market can be attributed to significant selling pressure in the derivatives market. Interestingly, the latest on-chain data shows that the Bitcoin price still has room for additional growth.

Options Market Data Shows Shift In Trader Sentiment

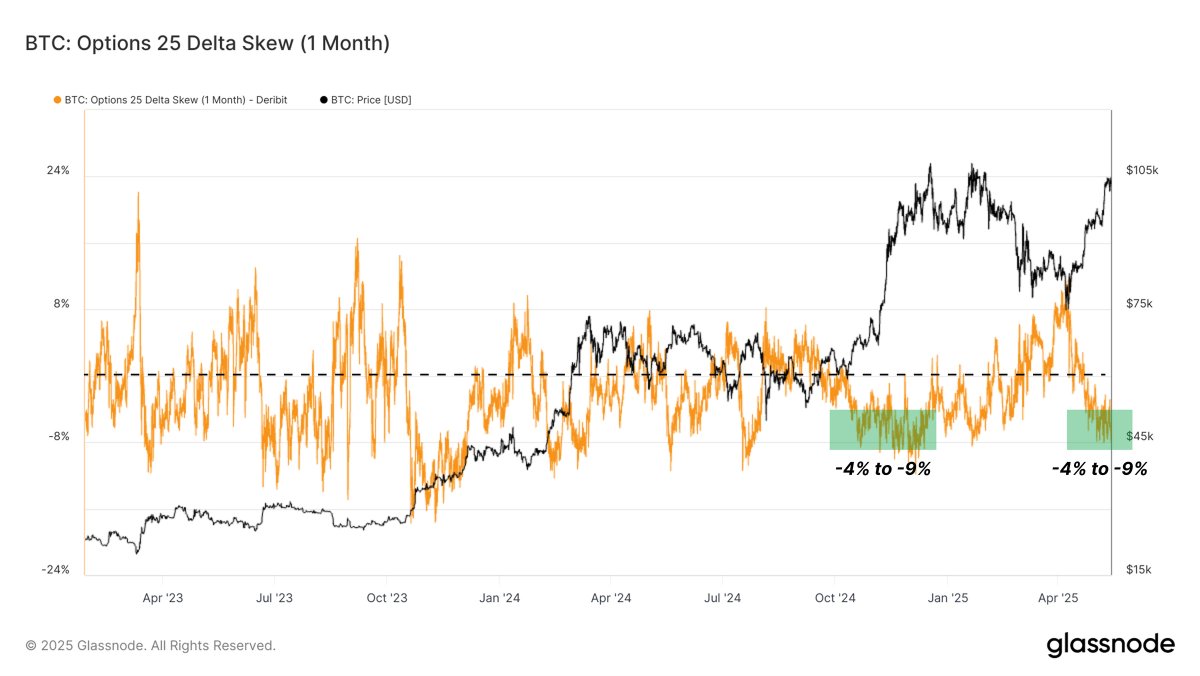

In a May 16 post on the X platform, blockchain analytics firm Glassnode shared fresh on-chain insights suggesting a rise in bullish sentiment amongst Bitcoin options traders. The relevant indicator here is the 1-month 25 Delta Skew, which compares the implied volatility of bullish bets (call options) to the bearish bets (put options).

On the other hand, a negative value for the 1-month 25 Delta Skew indicator signals that calls are more expensive than puts. This suggests that traders are more willing to bet on the price of Bitcoin moving higher than for protection against downside exposure.

According to data from Glassnode, the 1-month 25 Delta Skew metric recently witnessed a drop to around -6.1%. This decline, the analytics platform noted, signifies that call options now carry higher implied volatility compared to put options.

This options market trend means that there is now rising bullish sentiment amongst Bitcoin traders, as they lean more into betting on the BTC price rising. Glassnode also pointed out that this increasing bullish sentiment reflects a risk-on environment, where traders and investors are more willing to risk their funds.

Historically, a negative 25 Delta Skew is a strong bullish sentiment indicator, as it usually precedes further appreciation of the Bitcoin price. Moreover, current options data not only supports BTC’s upward movement, but could also serve as a positive catalyst for more growth as additional long positions enter the market.

Bitcoin Price At A Glance

As of this writing, the price of BTC stands at around $102,800, reflecting an over 1% decline in the past 24 hours.