Dogecoin Price Prediction: DOGE bulls defend lifeline support as risk-off sentiment continues

- Dogecoin price stays below three major daily moving averages after Elon Musk severed perceived ties to D.O.G.E., the agency.

- Uncertainty in global markets over Trump’s tariff war heightens risk-off sentiment.

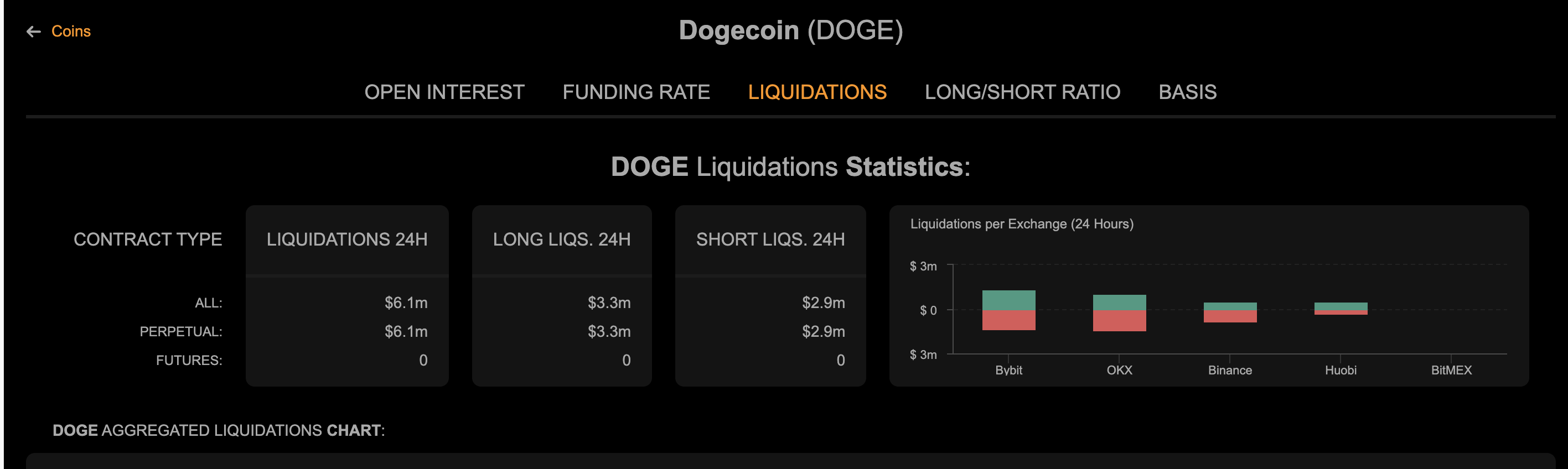

- DOGE derivatives’ long liquidations hit $3.3 million on Tuesday compared to $2.9 million in short liquidations.

- The RSI’s rebound above 40 points to a potential falling wedge pattern breakout targeting $0.25.

Dogecoin (DOGE) trades at $0.1731 during early American hours on Tuesday after recovering from Monday’s support at $0.16. The leading meme coin faced negative headwinds early in the week as investors reacted to comments by Tesla CEO Elon Musk, who heads the special Department of Government Efficiency (D.O.G.E.) in the US.

Across global markets, traders are bracing for US President Donald Trump’s Liberation Day on Wednesday. A spike in Gold prices to new all-time highs on Tuesday implied that investors prefer the yellow metal as a hedge against the impending global tariff war and economic uncertainty.

The US government has no plans to use Dogecoin – Elon Musk

Dogecoin shot to fresh limelight with the introduction of Musk-led US agency D.O.G.E in January, triggering speculations within the community and the crypto industry that the token could be adopted as an official government cryptocurrency. Musk’s close association with the memecoin further fueled this sentiment. However, the billionaire helping the federal government to cut spending and bridge the deficit gap made it clear that the similarity between the two names was nothing but a coincidence.

“There are no plans for the government to use Dogecoin or anything as far as I know,” Musk said during a town hall meeting in Green Bay, Wisconsin, on Sunday.

“They happen to be similar names, but really, we’re literally just trying to make the government 15% more efficient,” Musk added.

In his explanation, Musk reckoned that the name D.O.G.E was chosen after an online survey. “I was going to call it the Government Efficiency Commission, but that’s a super boring name,” he said.

Doge price action signals market indecision

Dogecoin price has been downtrend since Wednesday, March 26, when it was $0.20. This trend was fueled by risk-off sentiments ahead of Trump’s “Liberation Day” tariffs across the crypto market. The down leg extended to $0.16 as investors reacted to Elon Musk’s comments on Monday.

A spike in long liquidations per Coinanalyze data to $3.3 million in the last 24 hours suggests that bears have the upper hand.

Dogecoin liquidations chart

The token’s position below the three daily Exponential Moving Averages (EMA), including the 50-day, 100-day and 200-day, shows potential for a spike in sell-side pressure. Traders could anticipate resistance at $0.20, where the Dogecoin price was rejected on Wednesday.

DOGE/USDT daily price chart

If bulls hold steady following the rebound from support, DOGE may validate a breakout beyond $0.2. The Relative Strength Index (RSI) sloping higher at 42 shows signs of easing bearish momentum, leading to a continuing recovery and increasing buy-side pressure.

The falling wedge pattern on the daily chart is worth watching in the short term. A confirmed breakout above the upper trend line may invalidate the bearish outlook to support at $0.16 and the November 3 anchor at $0.14. Above $0.2, Dogecoin bulls are likely to target $0.25, an area that flipped into resistance in February.