TORN Jumps 75% As US Treasury Removes Tornado Cash From Sanctions List

The US Treasury removed TORN, the native asset of Tornado Cash mixer, from the Office of Foreign Assets Control’s sanctions list. As a result, TRON has rallied 75% in the past hour.

The sanctions were previously caused by allegations of North Korean money laundering.

US Treasury Reverses Tornado Cash Sanctions

Tornado Cash, the decentralized privacy protocol, has been in many disputes over allegations that it enables North Korean money laundering.

In 2022, the US government sanctioned many of its wallets and brought charges against co-founder Roman Semenov the following year. Today, however, the US Treasury removed these sanctions on Tornado Cash:

“Based on the Administration’s review of the novel legal and policy issues raised by use of financial sanctions against financial and commercial activity occurring within evolving technology and legal environments, we have exercised our discretion to remove the economic sanctions against Tornado Cash,” the Treasury’s press release read.

The US Treasury’s sanctions against Tornado Cash are only one element of the continuing legal dispute. A Dutch court convicted another co-founder last year, although he was released on house arrest.

Last November, a US federal appeals court struck down the sanctions on Tornado Cash, prompting a 400% price spike. TORN jumped again when a Texas District Court concurred with this decision.

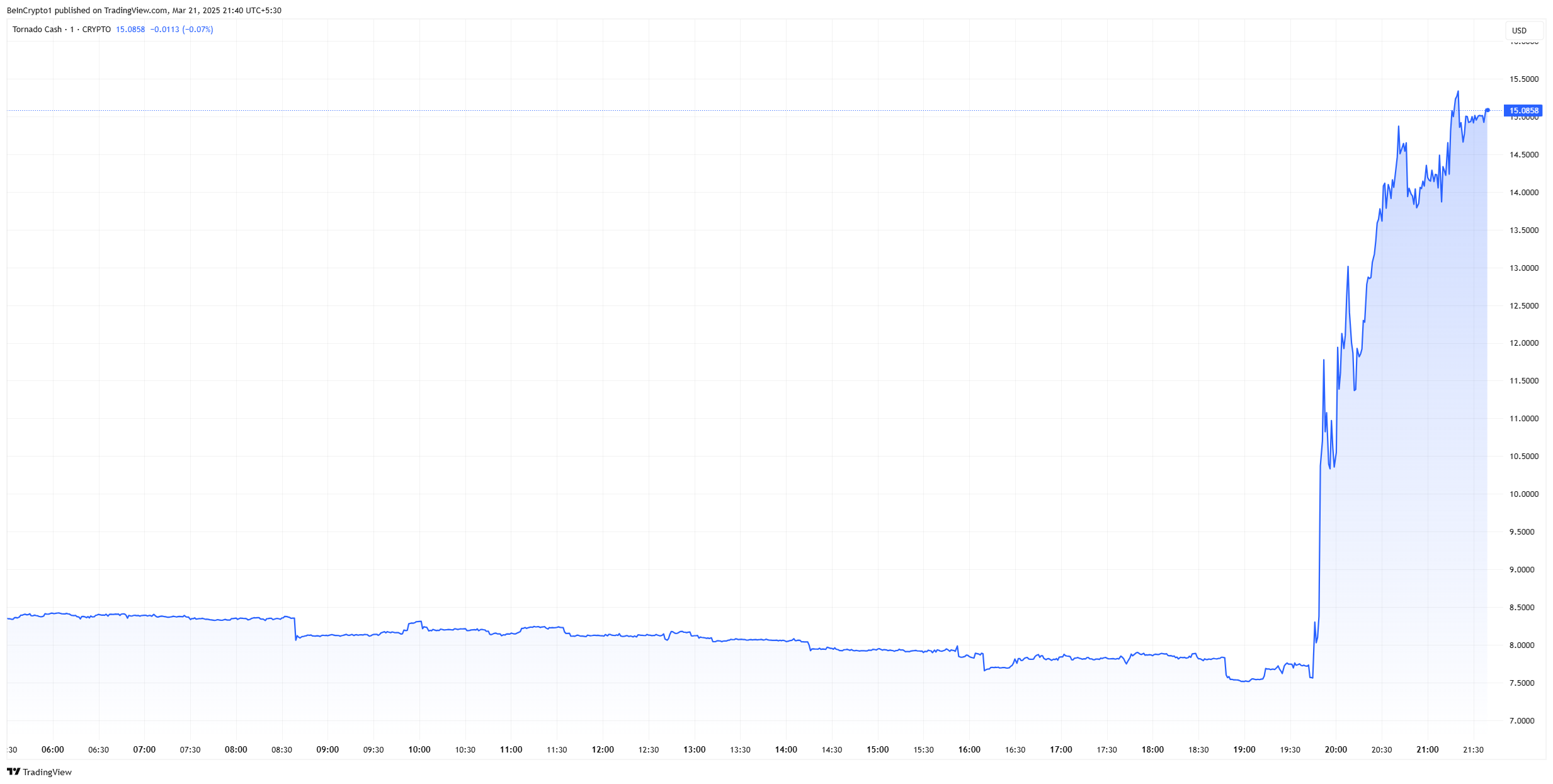

The Treasury officially removed the sanctions against Tornado Cash today, and TORN has already jumped over 75% and counting:

Tornado Cash (TORN) Daily Price Chart. Source: TradingView

Tornado Cash (TORN) Daily Price Chart. Source: TradingView

Despite the positive developments, there are still plenty of unaddressed concerns. As crypto sleuth ZachXBT recently noted, North Korean money laundering is an epidemic in the space right now.

The Treasury’s statement expressed its “deep concern” about continued laundering, even from Secretary Scott Bessent:

“Digital assets present enormous opportunities for innovation and value creation for the American people. Securing the digital asset industry from abuse by North Korea and other illicit actors is essential to establishing US leadership and ensuring that the American people can benefit from financial innovation and inclusion,” claimed Bessent.

Ultimately, it’s up to Tornado Cash to address the Treasury’s concerns. Even though the Trump administration is significantly backtracking on crypto enforcement, Trump allies like Bessent are clearly uneasy.

If further North Korean money laundering continues on the platform, it may damage all this recent progress.