TrumpRx Explained: Why Markets are Watching This New Pharma Website

President Donald Trump this week launched TrumpRx, a government-backed platform aimed at lowering prescription drug prices for Americans paying out of pocket. While the announcement initially raised concerns about pricing pressure, financial markets have delivered a clear response.

Major pharmaceutical stocks rallied on February 6, signaling that investors do not see TrumpRx as a near-term threat to earnings. That reaction also matters for broader markets, including crypto, because it shapes overall risk sentiment.

What TrumpRx Actually Is

TrumpRx is a pricing and discount portal, not a price-control regime. The platform lists dozens of commonly used drugs and directs users to discounted cash prices offered voluntarily by drugmakers and pharmacies.

Crucially, it targets cash-paying and uninsured consumers. It does not affect insurance-negotiated prices, Medicare reimbursement formulas, or long-term supply contracts, which make up the bulk of US pharmaceutical revenue.

TrumpRx Website

TrumpRx Website

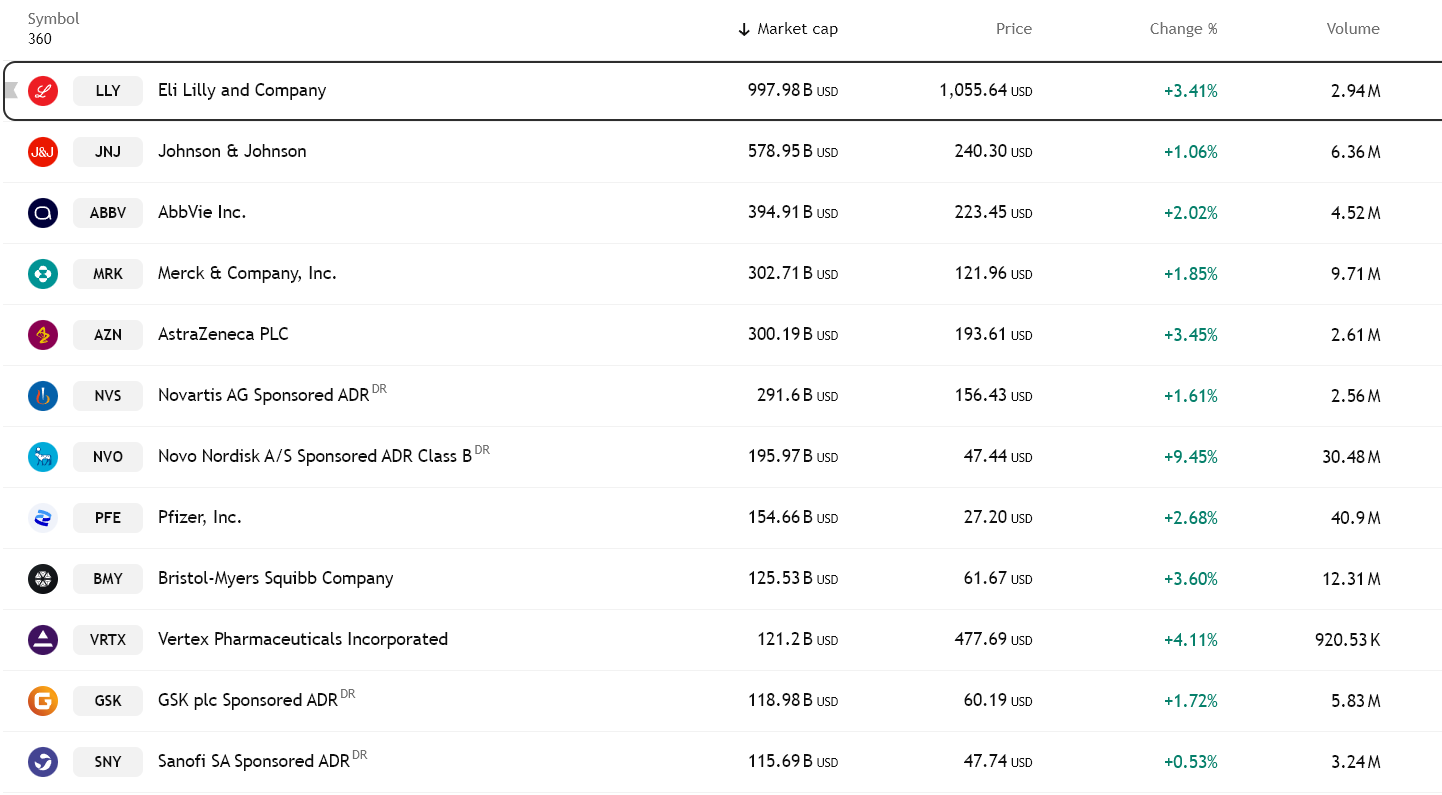

But Investors Aren’t Panicking About Drug Profits

Markets are signaling that TrumpRx trims the edges of pricing, not the core. Most pharmaceutical revenue comes from insured and institutional channels that remain untouched by the program.

For dominant players in high-demand categories like weight-loss and specialty drugs, pricing power remains strong.

In some cases, lower cash prices may even boost volumes without materially hurting margins.

US Big Pharma Stocks Actually Increased After TrumpRx Launch. Source: TradingView

US Big Pharma Stocks Actually Increased After TrumpRx Launch. Source: TradingView

Voluntary Discounts, Not Forced Controls

Another key factor is structure. Participation in TrumpRx is voluntary and tied to broader trade and supply-chain cooperation, including tariff relief.

For global drugmakers, reduced trade and regulatory risk can offset limited pricing concessions. That trade-off helps explain why the sector moved higher instead of lower.

What This Means For Broader Markets

The pharma rally sends a wider signal. Investors are not pricing in aggressive government intervention or profit-destroying regulation.

That matters for equities and crypto alike. When policy actions appear contained and predictable, risk appetite stabilizes across markets.

Crypto Cares, Even Indirectly

TrumpRx has no direct link to digital assets. However, crypto remains highly sensitive to policy uncertainty and financial conditions.

By failing to trigger a regulatory shock or worsen inflation expectations, TrumpRx reduces the chance of a hawkish policy response from the Federal Reserve. Stable rate expectations ease pressure on volatile assets like Bitcoin and Ethereum.

Markets are treating TrumpRx as a political signal, not a systemic shock. The positive reaction in pharma stocks shows investors see the policy as narrow, voluntary, and economically contained.

For crypto and risk assets, the takeaway is simple. TrumpRx does not tighten financial conditions or raise regulatory risk.

Instead, it supports a backdrop of policy stability that allows markets to focus on liquidity, rates, and fundamentals rather than fear.