Are Dogecoin Holders Looking to Buy More After 16% Crash?

Dogecoin price dropped sharply over the past several days, triggering concern across the market. The meme coin fell 16% in four days, briefly breaking key psychological levels.

While the move unsettled short-term holders, the decline may support a healthier macro setup. Historically, similar pullbacks have created favorable accumulation zones for DOGE.

Dogecoin Holders Are Sharp

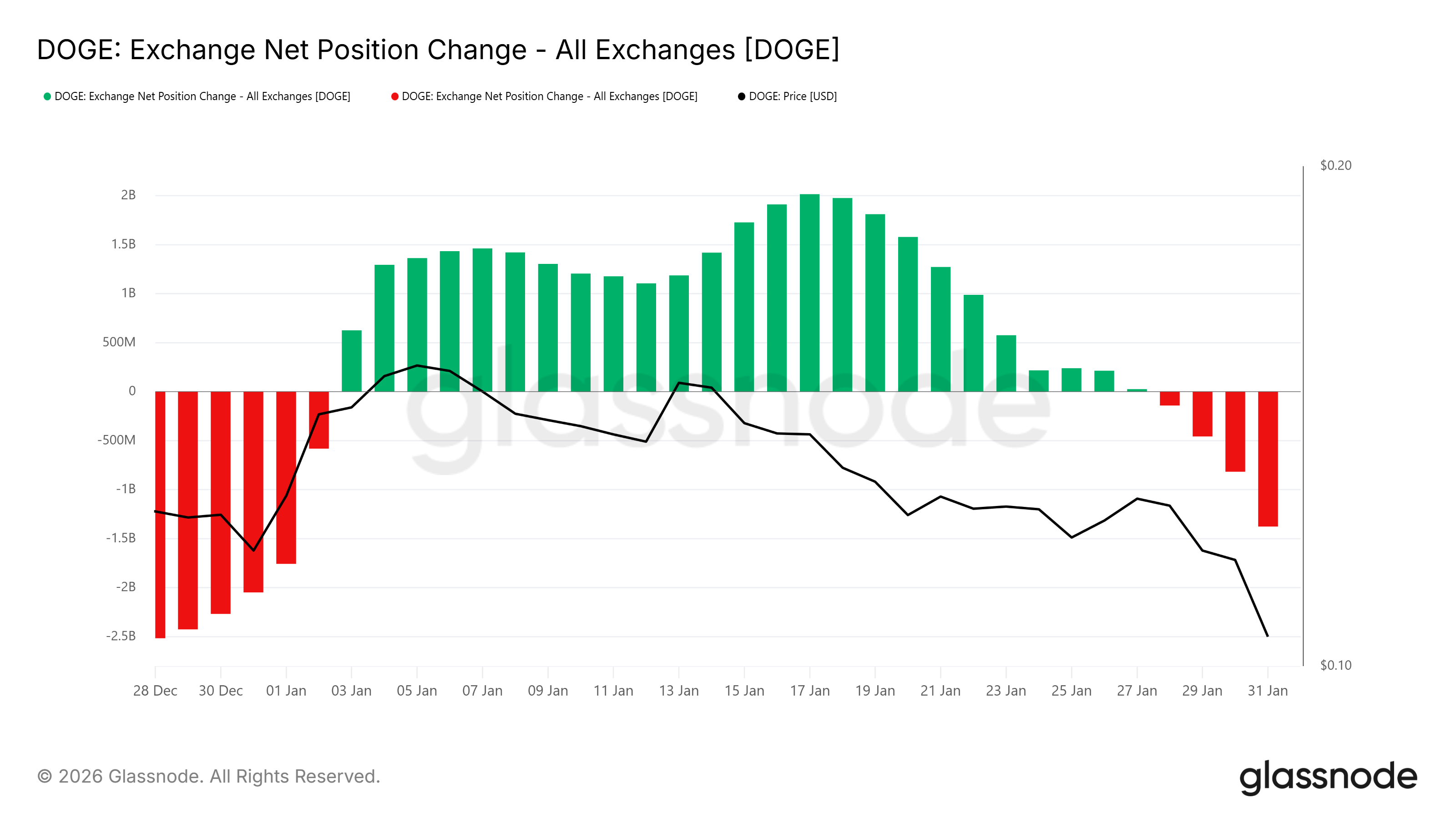

On-chain data shows Dogecoin holders moved quickly as price weakness emerged. Exchange net position change indicates rising accumulation during the sell-off. Buying pressure overtook selling as DOGE dipped below recent averages. This behavior suggests investors viewed the drop as an opportunity rather than a warning.

Such accumulation often reflects confidence among informed participants. Instead of exiting positions, holders increased exposure at lower prices.

This response reduced downside momentum and helped stabilize the price. The pattern aligns with prior DOGE corrections that later produced recoveries.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Dogecoin Exchange Net Position Change. Source: Glassnode

Dogecoin Exchange Net Position Change. Source: Glassnode

Macro indicators further support the accumulation thesis. The Market Value to Realized Value ratio has entered the opportunity zone. DOGE’s MVRV now sits between -17% and -25%. This range signals unrealized losses across the network.

Historically, Dogecoin rebounds as MVRV moves into this zone. Loss saturation limits further selling as holders avoid locking in drawdowns. Accumulation typically increases during these phases. Past recoveries followed similar setups once selling pressure faded.

DOGE MVRV Ratio. Source: Santiment

DOGE MVRV Ratio. Source: Santiment

DOGE Price Saved From Further Crash

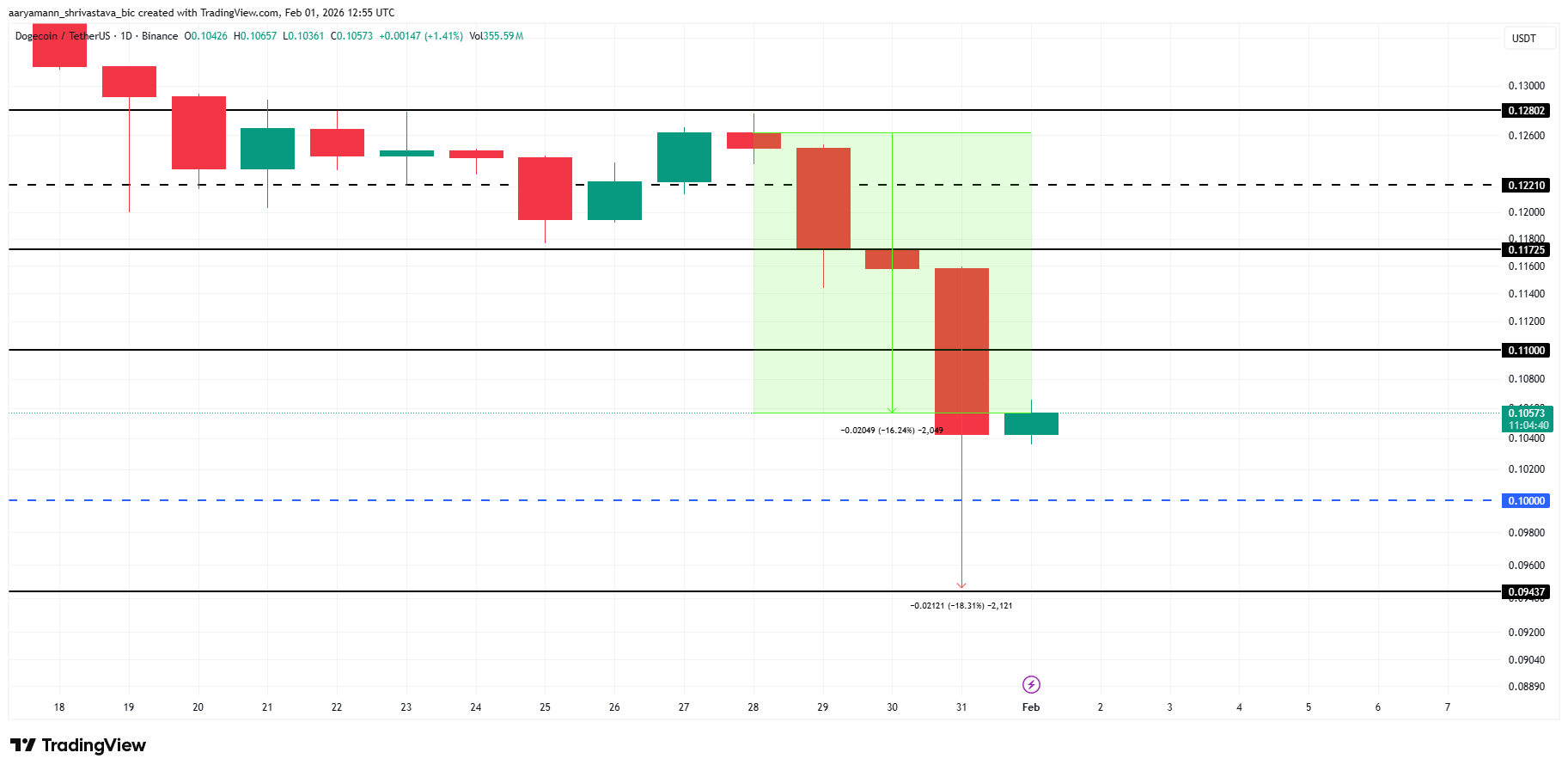

Dogecoin is trading near $0.105 at the time of writing. The price followed a four-day slide that erased 16% of value. During the last 24 hours, DOGE briefly dropped to $0.094 at the intraday low. That move marked the weakest level in recent weeks.

Dip buying helped contain the decline. DOGE quickly reclaimed the $0.100 level, restoring short-term support. Holding above this zone remains critical for recovery. A move above $0.110 would strengthen momentum. Such a breakout could push the price toward $0.117, recovering part of the recent losses.

DOGE Price Analysis. Source: TradingView

DOGE Price Analysis. Source: TradingView

Downside risk persists if momentum weakens again. Failure to hold $0.100 would expose DOGE to renewed pressure. In that case, the price could revisit $0.094 or fall lower. Such a move would invalidate the bullish thesis and delay recovery until demand improves.