OKX CEO: Binance’s USDe Yield Campaign Caused the October 10 Crash

OKX CEO Star Xu has accused Binance of fueling the October 10 crisis that erased nearly $19 billion from crypto markets.

Xu alleges that the turmoil was driven by Binance’s aggressive marketing of Ethena’s USDe synthetic dollar.

OKX CEO Slams Binance’s ‘Irresponsible’ USDe Marketing

In a January 31 post on X (formerly Twitter), Xu claimed that the market crash was not a random accident of complexity but a foreseeable failure of risk management.

“No complexity. No accident. 10/10 was caused by irresponsible marketing campaigns by certain companies,” he stated.

Xu claimed that the Binance user-acquisition campaign for Ethena’s synthetic dollar, USDe, encouraged excessive leverage. He argued that this created a systemic fragility that collapsed under market stress.

According to the OKX chief executive, Binance offered a 12% annual yield on USDe. This allowed users to collateralize the asset on terms comparable to those of traditional stablecoins such as USDT and USDC.

Xu argued that this created a “leveraged loop” in which traders converted standard stablecoins into USDe to farm yield. He claimed this activity artificially inflated the token’s perceived APY to rates as high as 70%.

“This campaign allowed users to leverage USDe as collateral with the same treatment as USDT and USDC without effective limits,” Xu wrote.

Unlike traditional stablecoins backed by cash equivalents, USDe employs a delta-neutral hedging strategy that Xu described as carrying “hedge-fund-level structural risks.”

When volatility struck on October 10, Xu asserts that this leverage unwound violently. The resulting depeg of USDe triggered a cascade of liquidations that risk engines could not contain, particularly affecting assets like WETH and BNSOL.

According to him, some tokens briefly traded at near-zero levels, and USDe’s “artificial” stability masked the accumulation of systemic risk until it was too late.

“As the largest global platform, Binance has outsized influence—and corresponding responsibility—as an industry leader. Long-term trust in crypto cannot be built on short-term yield games, excessive leverage, or marketing practices that obscure risk,” Xu concluded

Binance, Ethena Rebut OKX’s Theory

However, leading industry stakeholders have forcefully rejected Xu’s narrative, citing transaction data that contradicts his timeline.

Haseeb Qureshi, managing partner at Dragonfly, argued that Xu’s theory fails to account for the order of events. According to Qureshi, Bitcoin’s price bottomed a full 30 minutes before the USDe deviated from its peg on Binance.

“USDe clearly can’t have caused the liquidation cascade,” Qureshi stated, calling the accusations a misplacement of cause and effect.

He further noted that the USDe depeg was an isolated event on Binance’s order book, whereas the liquidation spiral was market-wide.

“If the USDe ‘depeg’ did not propagate across the market, it can’t explain how every single exchange saw huge wipeouts,” Qureshi added.

Ethena Labs founder Guy Young also disputed Xu’s claims. He cited order-book data that proves that the USDe’s price discrepancy occurred only after the broader market had already crashed.

Binance, meanwhile, maintained that the issue stemmed from a “liquidity vacuum” rather than its product offerings.

The exchange released data indicating that Bitcoin liquidity was “zero or near zero” across most major venues during the crash. This thin market created a scenario in which mechanical selling drove prices down disproportionately.

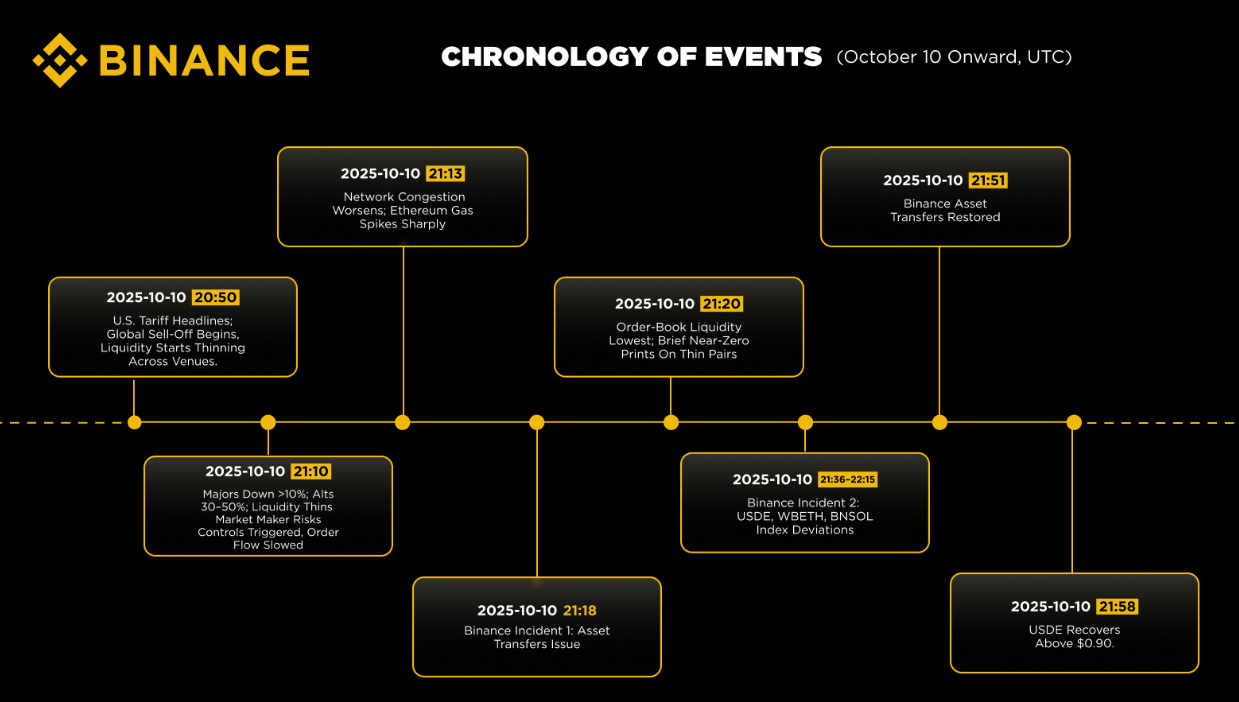

Binance Chronology of Events on October 10. Source: Binance

Binance Chronology of Events on October 10. Source: Binance

The exchange also denied any systemic manipulation, attributing the chaotic price action to market makers pulling inventory in response to extreme volatility and API latency.

Nonetheless, this conflict highlights the intensifying blame game between top crypto exchanges as they face continued scrutiny over the structural fragility revealed during the October 10 incident.