Ethereum Price Forecast: JPMorgan sees post-Fusaka activity surge fading

Ethereum price today: $2,930

- JPMorgan analysts note that past upgrades have failed to uphold Ethereum's network activity in the long term.

- The bank says that capital shifting to Layer 2 networks, app-specific chains and competitive networks has reduced fees captured on Layer 1.

- ETH could rise above the $3,060 resistance if it continues to hold the $2,860 support level.

Ethereum's (ETH) Fusaka upgrade last December has seen fees plummet to new lows while sparking a surge in transaction counts and active addresses. However, that growth may not last, according to a Wednesday note by JPMorgan analysts led by Nikolaos Panigirtzoglou.

The bank noted that while Fusaka and the Pectra upgrade from May 2025 boosted activity over the past year, such network booms tend to calm over time.

"Historically, Ethereum's successive upgrades have failed to meaningfully enhance network activity on a sustained basis for several reasons," the analysts wrote.

Last week, weekly active addresses and daily transactions reached record highs after rising steadily over the past month, although some have speculated that the rise is due to address and poisoning and not real user growth.

Why Ethereum has failed to maintain sustained network activity growth

The growth gained momentum a few days after the Fusaka upgrade went live, introducing features that significantly boosted throughput for Layer 2 networks, including Peer Data Availability Sampling (PeerDAS), higher gas limits, and blobspace expansion. However, these L2s are pulling activity away from the Layer 1, the analysts noted.

Rival blockchains such as Solana have captured "substantial" market share from Ethereum by offering higher throughput and lower fees, attracting users and developers away from Ethereum, the analysts said.

Another factor is fading speculative activity from memecoins, non-fungible tokens (NFTs) and initial coin offerings (ICOs), which drove activity on Ethereum in previous cycles. The analysts pointed out that much of that activity has declined or moved to other blockchains.

Similarly, the bank highlighted that capital fragmentation across application-specific chains has shifted liquidity and revenue from the L1, citing efforts from decentralized exchanges Uniswap, once a major contributor to ETH burn, and dYdX.

As a result, Ethereum has captured fewer fees, leading to lower ETH burning and boosting circulating supply, which has put downward pressure on prices, JPMorgan wrote.

In contrast, asset manager BlackRock highlighted in its 2026 thematic outlook that Ethereum could be "poised to benefit" from the tokenization boom, citing its 65% market share of the tokenized assets sector.

Ethereum Price Forecast: ETH could force a rise above $3,060 if it continues to hold $2,860

Ethereum saw $156.5 million in futures liquidations over the past 24 hours, driven by $104.4 million in short liquidations, per Coinglass data.

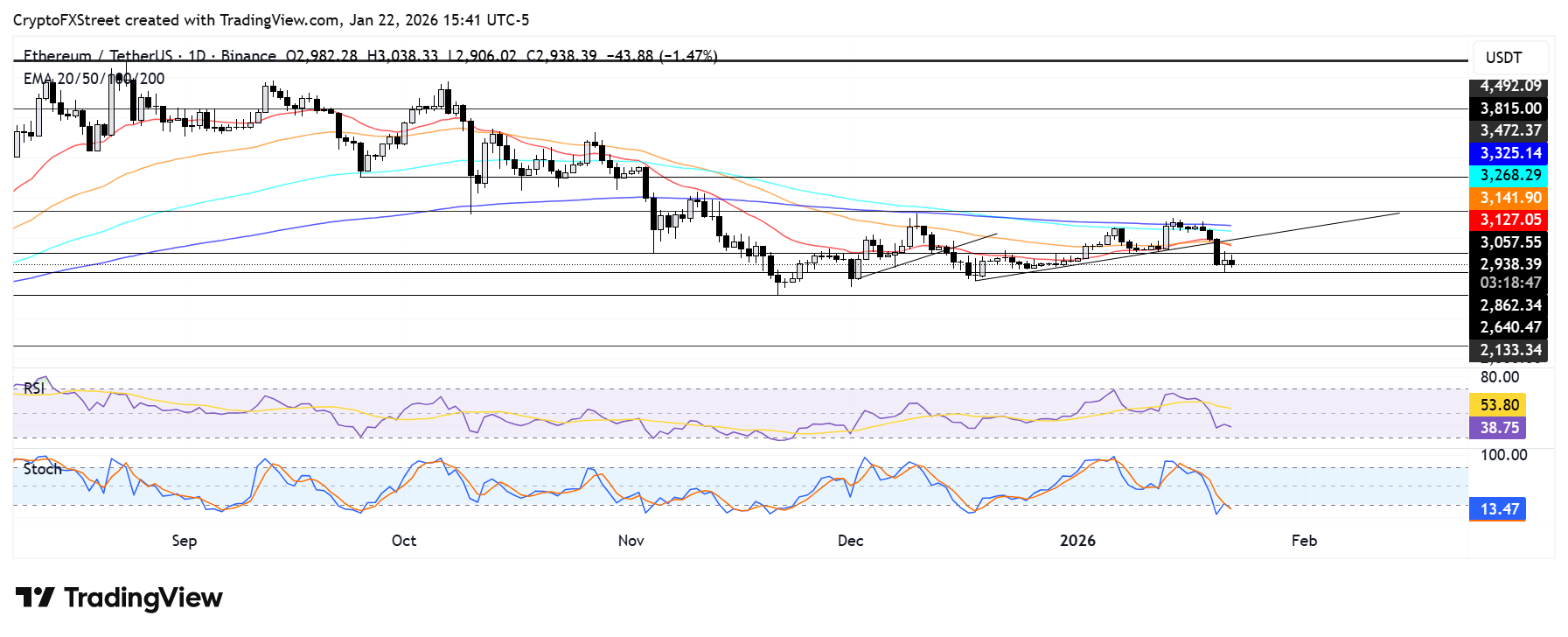

After a steady decline over the past three days, ETH bounced off the support near $2,860 on Wednesday. However, the brief recovery could be short-lived, as the top altcoin was rejected near the $3,060 resistance on Thursday.

If ETH holds $2,860 again, bulls could force a rise above $3,060 to test the 20-day Exponential Moving Average (EMA) or risk another consolidation in the tight range, similar to its move in the last two weeks of December. Further down, ETH could find support at $2,640 if it falls below $2,860.

The Relative Strength Index (RSI) is below its neutral level, while the Stochastic Oscillator (Stoch) remains in oversold territory, indicating a dominant bearish momentum.