DUSK Price Forecast: DUSK pauses near $0.20 after explosive rally as on-chain and derivatives activity surge

- DUSK price steadies around $0.20 on Tuesday after surging more than 31% in the previous day.

- Privacy-focused coin gains traction as open interest and trading volume hit record highs.

- DUSK partnered with Chainlink on Monday to enable cross-chain interoperability for tokenized real-world assets, boosting its long-term utility.

DUSK (DUSK) price holds above $0.20 on Tuesday after rallying more than 31% in the previous day. The privacy-focused coin has surged more than 1.75 times in the previous week as DUSK’s Open Interest (OI) and trading volume reached record highs. In addition, DUSK announced a partnership with Chainlink (LINK) on Monday to enable cross-chain interoperability for tokenized real-world assets, highlighting its growing long-term utility.

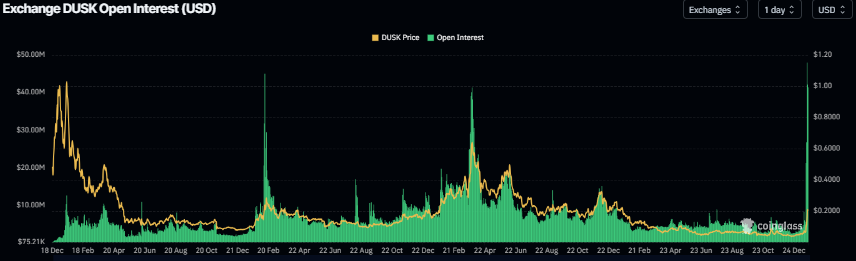

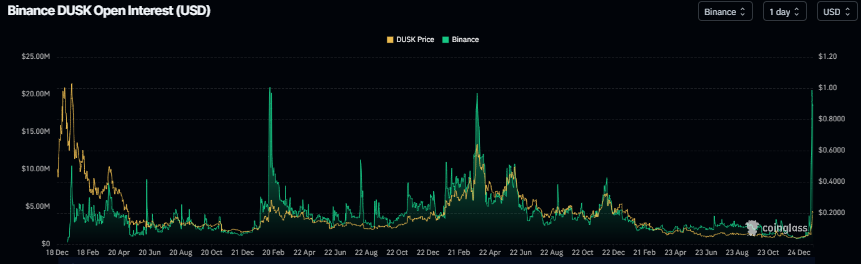

DUSK’s derivatives and on-chain data show bullish bias

CoinGlass’ data shows that futures OI at exchanges reached a new all-time high of $47.94 million on Monday and steadied around $41.38 million on Tuesday. Moreover, during the same period, the OI on the Binance exchange has reached $20.54 million, levels not seen since February 2023. An increasing OI represents new or additional money entering the market and new buying, which could fuel the current DUSK price rally.

In addition to rising OI, Santiment data indicates that the DUSK ecosystem’s trading volume (the aggregate trading volume generated by all exchange applications on the chain) reached a new all-time high of $298.43 million on Monday and steadied around $264.16 million on Tuesday. This volume rise indicates a surge in traders’ interest and liquidity in DUSK, boosting its bullish outlook.

[08-1768883028950-1768883028951.10.41, 20 Jan, 2026].png)

DUSK partners with Chainlink to bring regulated institutional assets onchain

DUSK announced on Monday that it has joined hands with Chainlink to integrate key standards across DuskEVM. This enables cross-chain interoperability for tokenized real-world assets and supports real-time, high-integrity data for compliant financial applications, backed by NPEX, a fully regulated Dutch stock exchange.

These partnerships and developments highlight DUSK’s growing focus on real-world asset tokenization, strengthening its infrastructure and boosting its long-term utility, which is bullish for DUSK’s native token prices.

DUSK Price Forecast: DUSK bulls are aiming for the $0.33 mark

On the weekly chart, DUSK’s price has nearly tripled since the end of December, printing four green weekly candlesticks through last week. As of this week, DUSK continues its rally, gaining nearly 30%, breaking above the weekly resistance level at $0.17.

If DUSK continues its upward trend and closes above its weekly resistance at $0.17, it could extend the rally toward the December high of $0.33.

The Relative Strength Index (RSI) on the weekly chart stood at 79, above the overbought threshold, indicating strong bullish momentum. The Moving Average Convergence Divergence (MACD) also showed a bullish crossover, with rising green histogram bars, further supporting the bullish outlook.

On the daily chart, DUSK price broke above its ten-month-long horizontal parallel channel on Saturday and rose by more than 79% through Monday. As of writing on Tuesday, DUSK is trading at $0.21.

If DUSK continues its upward move, it could extend the rally toward Monday’s high of $0.33.

The RSI on the daily chart reads 91, indicating extremely overbought conditions and signaling an elevated risk of a short-term pullback or consolidation. The MACD showed a bullish crossover, which remains intact, supporting a positive view.

However, if DUSK faces a correction, it could extend the decline toward the 50% price level at $0.18.