Internet Computer Price Forecast: ICP extends rally as bulls target levels above $5

- Internet Computer price extends gains on Friday after surging more than 40% so far this week.

- On-chain and derivatives data suggest bullish sentiment with rising open interest, trading volume and long bets.

- The technical outlook suggests further gains, targeting levels above $5.

Internet Computer (ICP) trades above $4.30 on Friday, up more than 40% so far this week. The bullish price action is further supported by strengthening on-chain and derivatives data. On the technical side, it suggests rally continuation with bulls targeting levels above $5.

ICP’s trading volume hit a nearly two-month high

Santiment data indicates that the ICP ecosystem’s trading volume (the aggregate trading volume generated by all exchange applications on the chain) reached $583.84 million on Wednesday and steadied at around $475.64 million on Friday, the highest level since the end of November. This volume rise indicates a surge in traders’ interest and liquidity in ICP, boosting its bullish outlook.

[10-1768542074074-1768542074075.45.40, 16 Jan, 2026].png)

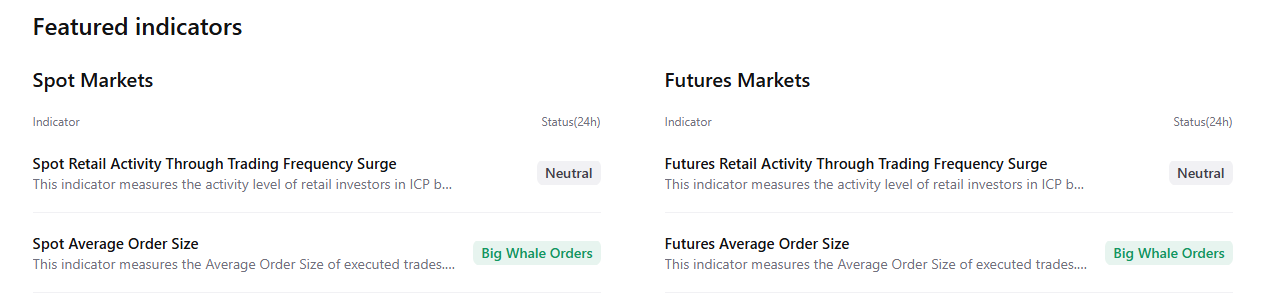

The CryptoQuant chart below also supports a positive outlook, as ICP’s spot and futures markets show large whale orders, signaling a potential continuation of the rally.

Derivatives data supports bullish bias

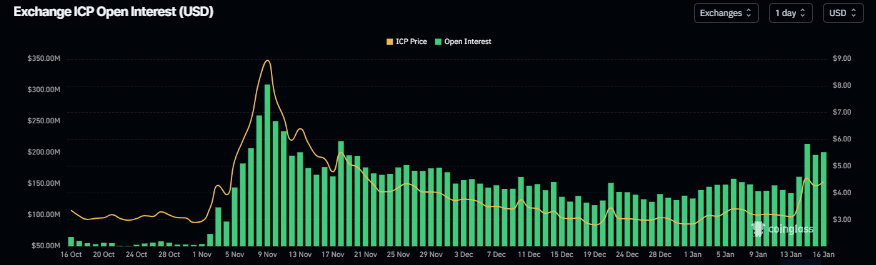

CoinGlass’ data shows that Internet Computer futures OI across exchanges surged to $213.71 million on Thursday, the highest level since November 19. An increasing OI represents new or additional money entering the market and new buying, which could fuel the current ICP price rally.

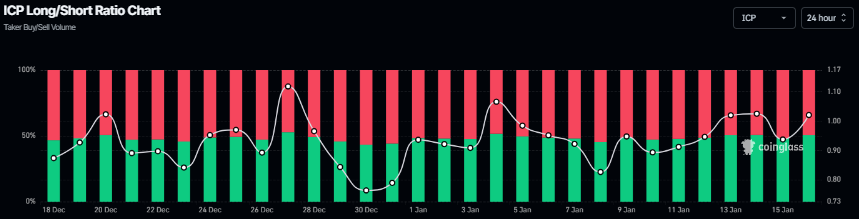

Additionally, ICP’s long-to-short ratio is 1.02 on Friday. This ratio, above one, reflects bullish sentiment in the markets, as more traders are betting on the asset price to rise.

Internet Computer Price Forecast: ICP bulls aiming for levels above $5

Internet Computer price rose more than 16% on Tuesday and closed above the 50-day Exponential Moving Average (EMA) at $3.54. ICP extended its gains the next day by 25%, nearing the 200-day EMA at $4.40 and hovered around this level through Thursday. As of writing on Friday, ICP is trading at $4.39.

If ICP closes above the 200-day EMA at $4.40, it could extend the rally toward the psychological $5 level. A close above this could extend the gains toward the next resistance at $5.42.

The Relative Strength Index (RSI) reads 69, pointing upward toward the overbought level of 70, indicating strong bullish momentum. In addition, the Moving Average Convergence Divergence (MACD) indicator shows a bullish crossover and rising green histogram bars above the neutral level, further supporting the bullish outlook.

However, if ICP corrects, it could extend the decline toward the 50-day EMA at $3.54.