Silver Hits Record Prices in China as Bitcoin Stalls on Christmas

Silver markets sent a clear signal on Christmas Day. While Bitcoin traded quietly in thin holiday liquidity, silver prices in China surged to record local levels, driven by tight physical supply and strong industrial demand.

The divergence highlights a growing macro theme. During periods of scarcity and geopolitical stress, capital is flowing toward hard assets rather than digital alternatives.

China’s Physical Silver Tightness Drives the Move

The latest silver move originated in China, where local prices reached record levels on December 25. Evidently, China is facing a shortage of physical silver.

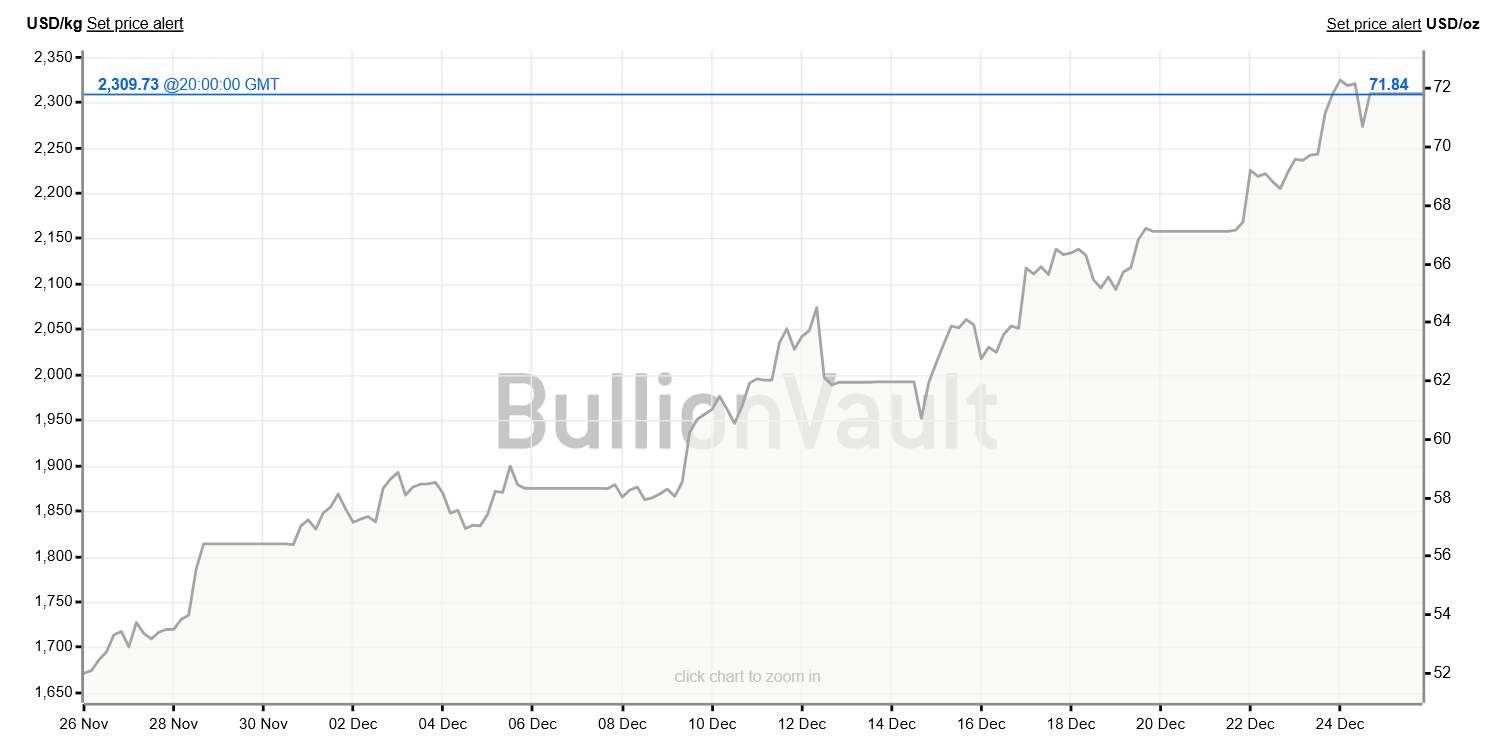

Globally, spot silver hovered near recent all-time highs around $72 per ounce, extending a rally that has pushed prices up more than 120% in 2025.

Gold also posted strong gains this year, rising roughly 60%, while Bitcoin ended December lower after peaking above $120,000 in October.

Chinese spot and futures markets have traded at persistent premiums to London and COMEX benchmarks.

In some cases, contracts briefly moved into backwardation, a sign of immediate supply stress. China accounts for more than half of global industrial silver demand, making local shortages a global issue.

The pressure comes from several sources. Solar manufacturing remains the largest driver, while electric vehicle production continues to rise.

Each EV uses significantly more silver than a traditional car, particularly in power electronics and charging infrastructure.

At the same time, grid expansion and electronics manufacturing have kept demand elevated.

Silver Price Chart in December 2025. Source: BullionVault

Silver Price Chart in December 2025. Source: BullionVault

Bitcoin’s Christmas Stagnation Tells a Different Story

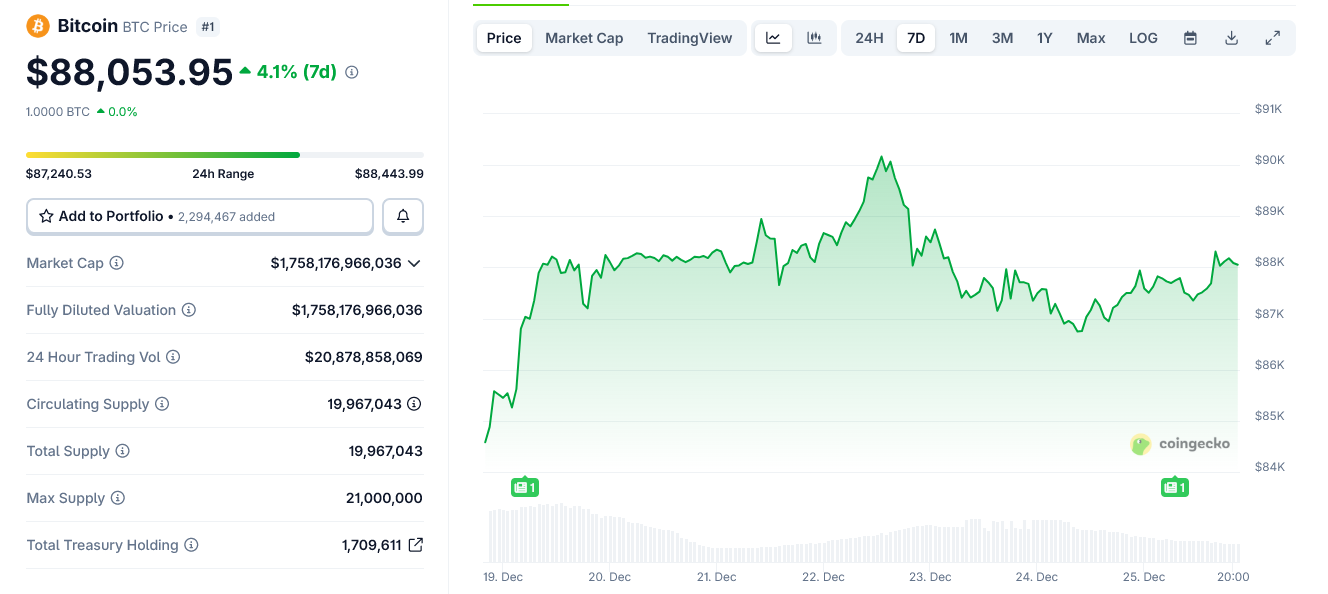

Bitcoin, by contrast, showed little reaction on Christmas Day. Prices moved sideways amid low volume, reflecting reduced institutional participation rather than a shift in fundamentals.

However, the lack of defensive inflows stands out.

In late 2025, Bitcoin has traded more like a high-beta liquidity asset than a crisis hedge. When physical scarcity and supply-chain stress dominate the narrative, investors have favored metals over digital assets.

Bitcoin Price Chart Throughout Christmas Week 2025. Source: CoinGecko

Bitcoin Price Chart Throughout Christmas Week 2025. Source: CoinGecko

Geopolitical risks reinforce that trend. Rising defense spending linked to conflicts in Ukraine and the Middle East has increased demand for silver in military electronics and munitions.

Unlike investment silver, much of this metal is permanently consumed.

The divergence between silver and Bitcoin reflects a broader macro point. Digital scarcity alone has not been enough to attract capital during supply-driven shocks.

Physical scarcity, especially when tied to energy, defense, and industrial policy, continues to matter.

As markets head into 2026, that distinction may shape asset performance more than narratives around risk appetite alone.