Strategy and other Bitcoin treasury firms under pressure as market momentum slows

- Bitcoin’s sharp rallies and deep pullbacks left 2025 performance flat to slightly negative, straining corporate BTC treasury models.

- Strategy stock declined by more than 60% from its year-highs, sharply compressing NAV premiums.

- Treasury companies that raised capital via PIPEs have experienced significant stock drawdowns, with share prices often gravitating toward their issuance levels.

Strategy (MSTR) and other corporate Bitcoin (BTC) treasuries remain under pressure as 2025’s volatile BTC performance – marked by sharp rallies and deep corrections – left annual returns flat to slightly negative. MSTR stock prices are down more than 60% from their year-highs, while peers that raised capital through Private Investment in Public Equity (PIPE) have also seen their stock prices erode toward their issuance levels.

Strategy: The largest BTC corporate holder

Michael Saylor’s Strategy, formerly known as MicroStrategy, is an American business intelligence (BI) and mobile software company that has treated BTC as its primary treasury reserve asset since August 2020.

As shown in the graph below, the firm has so far accumulated 671,268 BTC in its treasury reserves, valued at $60.04 billion, at an average price of $74,972 per BTC. This makes it the world's largest corporate BTC treasury company, holding 3.19% of the total BTC supply of 21 million.

The company raises capital through convertible notes, preferred stock, and at-the-market equity offerings to purchase Bitcoin, even during price dips.

In addition to these capital-raising methods, the firm announced on November 30 the creation of a dedicated US Dollar reserve, funded entirely through at-the-market (ATM) issuance of new MSTR common stock.

The reserve is explicitly intended to cover:

- Cash dividends for Strategy’s preferred stock classes (around $700 million per year).

- Interest on its outstanding convertible bonds.

- Short-term liquidity needs in the event capital markets tighten.

This reserve is managed separately from the firm’s Bitcoin one, making Strategy a dual-reserve entity for the first time. As of December 22, Strategy has increased its USD reserve by $748 million to $2.19 billion, which is sufficient to cover approximately $700 million in annual preferred stock dividends for over three years.

Stock performance and challenges in 2025

Strategy's stock price on the weekly chart has declined sharply from a yearly high of $457.22 recorded on July 14 to a low of $155.61 on December 1, down over 63%. MSTR is currently trading near $160, nearing its yearly lows and below its 200-week Exponential Moving Average (EMA) at $184.09.

There are some reasons for this correction in the MSTR price.

Bitcoin's sharp rally to a record high of $126,199 on October 6, followed by a slide below the yearly open at $93,576 and now heading toward the yearly low at $74,508, has left 2025 performance flat to slightly negative, nearing year-end. Due to MSTR's leverage exposure as a debt-financed Bitcoin bet, its stock price swings more than BTC's, leading to significant losses for investors despite unchanged holdings.

In addition, Strategy funds its Bitcoin accumulation primarily through convertible debt, preferred stock, and at-the-market equity offerings rather than by selling BTC. As a result, much of its older debt is cheap. However, new borrowing and preferred shares carry much higher costs, driving up annual interest and dividend payments.

In addition, frequent share issuances dilute existing investors, so each share represents a smaller slice of the company and its Bitcoin holdings. Thus, in a strong yet volatile 2025, marked by pronounced quarterly swings in the Bitcoin market, this has become a problem for Strategy. The company can no longer raise cheap capital easily, while higher financing costs and dilution pressure cash flows and weigh on the stock price, even if Bitcoin does not fall sharply.

Potential index-exclusion risks, such as those from Morgan Stanley Capital International (MSCI), may remove companies whose balance sheets are dominated by Bitcoin (over 50% of assets) from key stock indices, thereby treating them more like investment vehicles than operating companies.

If Strategy is excluded, passive funds and ETFs that track these indices would be forced to sell MSTR shares, triggering billions in outflow. In addition, investors are likely to reallocate capital from high-volatility assets, such as leveraged Bitcoin proxies like MSTR, toward more stable assets. This development would reduce liquidity and institutional demand, potentially creating a downward spiral in MSTR stock prices.

Strategy shows weak NAV premium

The NAV premium metric measures how much the market values the company relative to the net value of its Bitcoin holdings and other assets, excluding liabilities. The current NAV premium reads -18.12% (0.82x), implying the market values MSTR at 82% of the value of its Bitcoin holdings per share (excluding other business value).

This suggests that investors are currently unwilling to pay a premium for Strategy’s leveraged Bitcoin exposure, as concerns over dilution, rising debt costs, and Bitcoin’s sideways performance weigh on sentiment – making it harder for MSTR to raise low-cost capital for further BTC accumulation without pressuring shareholders.

However, during strong bull markets, this premium often ranged from 1.5x to 2.5x, allowing Strategy to raise capital cheaply and increase Bitcoin per share through accretive financing.

Copycats and the broader Treasury landscape

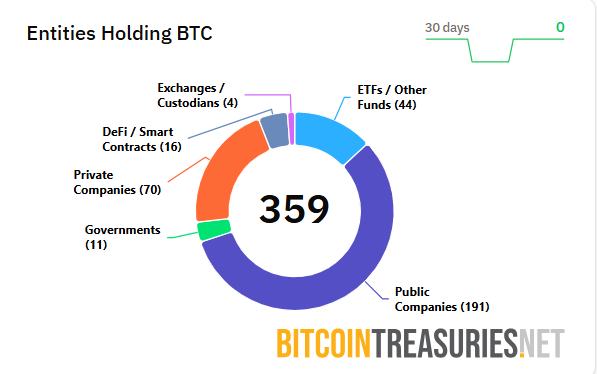

Copycats of Strategy continues to grow, with over 191 public companies holding BTC in their treasury reserves, according to Bitcoin Treasuries data.

Many of these public companies follow Strategy's debt- and equity-funded buys, but mining firms like Marathon Digital (MARA) blend production with holding. Other companies, such as Metaplanet, have global appeal as inflation hedges.

As it happens with Strategy, the stock prices of these companies have fallen 50–80% from their 2025 highs, and NAV premiums are shrinking as Bitcoin underperforms expectations. See the example in the chart below.

A CryptoQuant report highlighted that Bitcoin treasury companies that raised capital via PIPEs have experienced significant stock drawdowns, with share prices often gravitating toward their PIPE issuance levels.

The analyst concluded that a sustained Bitcoin rally is the only likely catalyst to prevent further declines in these stocks. Without it, many are poised to continue trending toward or below their PIPE prices.

What’s next for Strategy and other Bitcoin treasury companies?

Indeed, in 2025, Bitcoin’s volatile price action and broader consolidation led Strategy's and most of its peers' stock prices to crash sharply, as explained above.

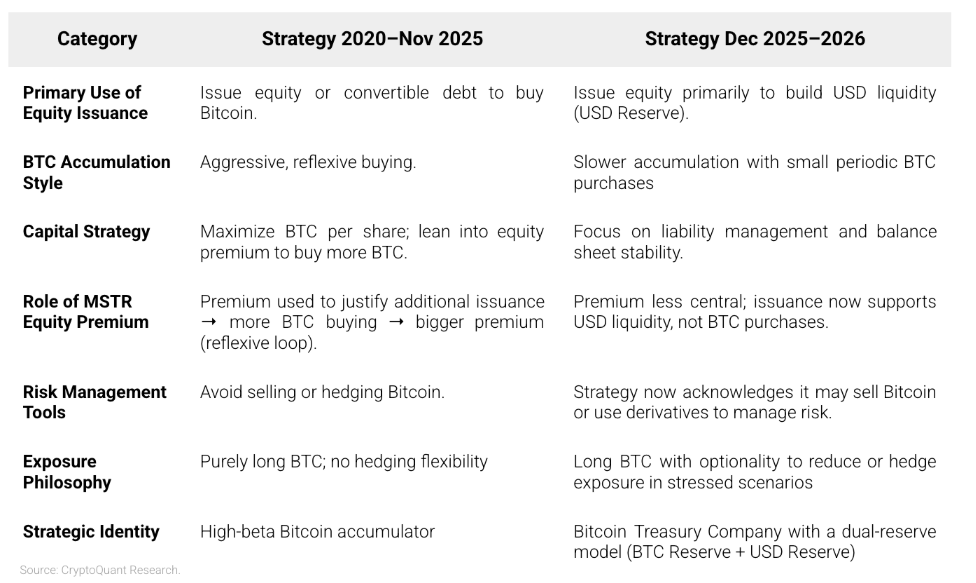

CryptoQuant's report mentioned that Strategy has made a tactical shift in its Bitcoin accumulation model, as Bitcoin may experience a weak 2026 after entering a bear market last month.

The analysis explained that the company no longer treats its Bitcoin exposure as untouchable across all market conditions. It is still the center of their long-term thesis. Said this, management now acknowledges that maintaining the BTC stack requires the flexibility to defend it with cash buffers, hedging and selective monetization in distressed scenarios.

The report concluded that MSTR appears to recognize a non-trivial probability of a deep or extended Bitcoin drawdown. Strategy’s shift from aggressive Bitcoin accumulation to a more conservative liquidity-focused treasury approach coincides with Bitcoin’s largest drawdown of 2025.

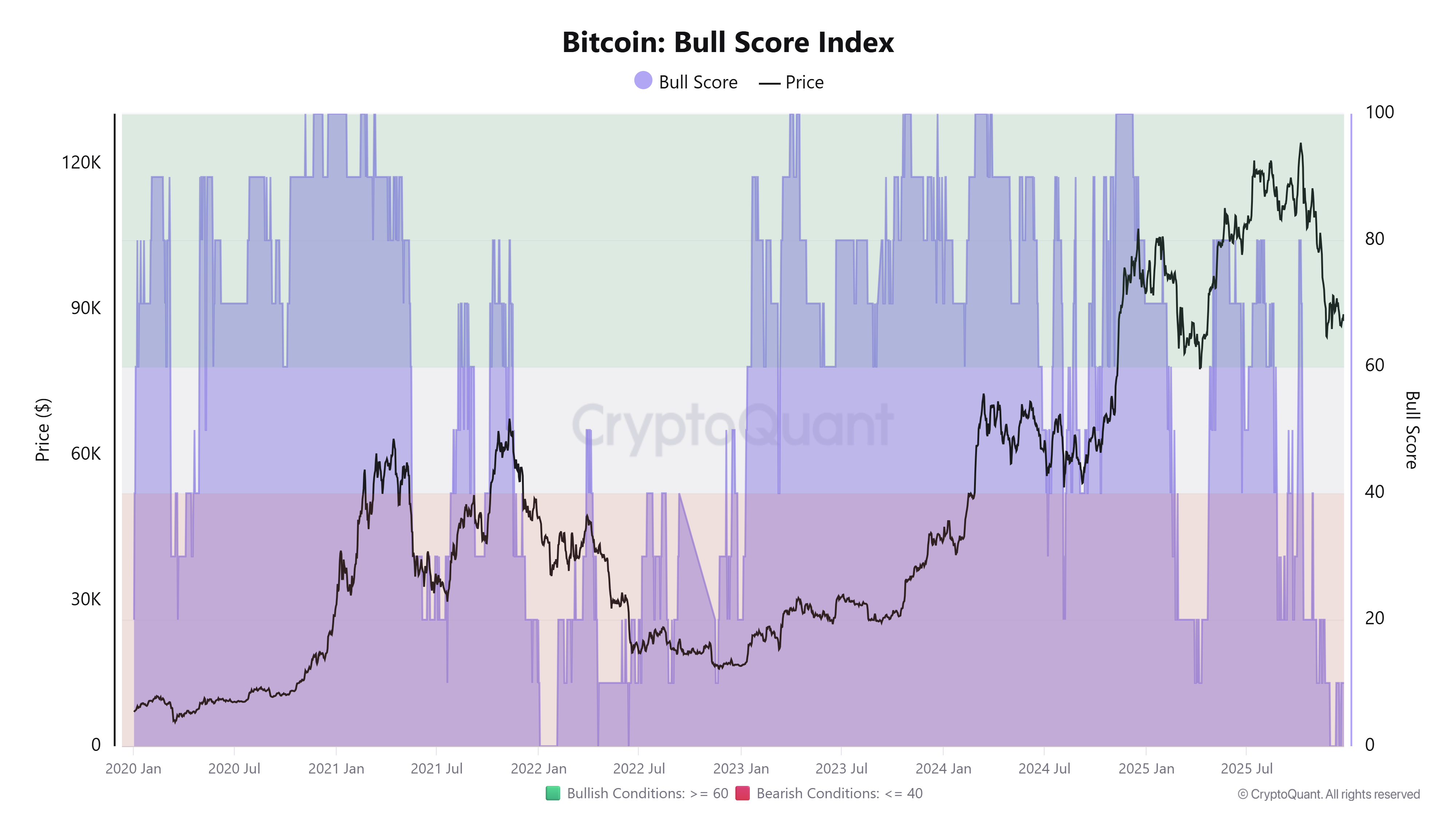

“A decline severe enough that nearly every major on-chain and technical indicator now signals the market has entered a bearish phase, as seen in CryptoQuant’s Bull Score Index dropping to zero (most bearish) for the first time since January 2022, when the previous bear market was starting,” says CryptoQuant analyst.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.