SEC Drops Long-Running Investigation Into Aave Protocol

The US Securities and Exchange Commission has closed its investigation into the Aave Protocol without recommending enforcement action, according to a notice dated December 16.

The decision ends a multi-year probe into one of the largest decentralized finance (DeFi) lending platforms and removes a major regulatory overhang for the sector.

Investigation Closed Without Enforcement

In its notice, the SEC said it had concluded its investigation into the Aave Protocol and does not intend to recommend enforcement action at this time.

However, the agency emphasized that the closure does not constitute an exoneration and does not prevent future action should circumstances change. The notice follows standard SEC practice under Securities Act Release No. 5310.

The investigation began around 2021–2022, during a period when the SEC intensified scrutiny of crypto lending, staking, and governance tokens.

Aave, a non-custodial DeFi protocol, allows users to lend and borrow digital assets through automated smart contracts. The protocol operates without intermediaries and is governed by holders of the AAVE token.

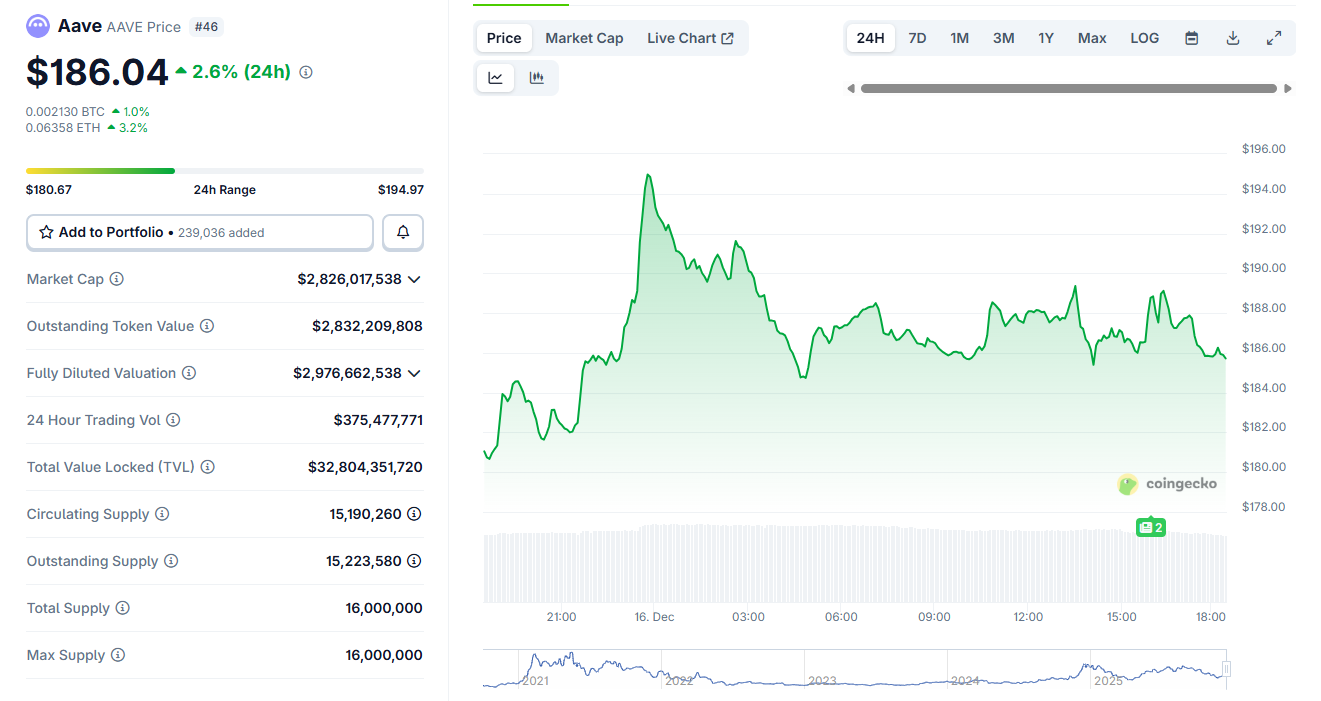

AAVE Briefly Climbs After SEC’s Announcement. Source: CoinGecko

AAVE Briefly Climbs After SEC’s Announcement. Source: CoinGecko

Aave Revenue and Governance Under the Spotlight

The SEC decision comes as Aave faces separate internal scrutiny over revenue and governance.

Earlier this week, DAO members raised concerns that a front-end infrastructure change may have redirected swap fee revenue away from the Aave DAO treasury. The issue followed a shift from ParaSwap to CoW Swap on Aave’s official interface.

Governance delegates said the change could reduce DAO revenue by up to $10 million annually, depending on trading volumes.

Aave Labs responded that the front-end is a separate product and that prior revenue sharing was voluntary.

For now, Aave emerges from regulatory scrutiny without penalties, which has been a common pattern as the SEC backtracks from crypto enforcement under Paul Atkins.

Still, the protocol faces ongoing questions around governance, decentralization, and value capture as DeFi matures.