Cryptocurrencies Price Prediction: Pi Network, Bitcoin & Dogecoin – European Wrap 15 December

Pi Network Price Forecast: PI rebounds after eight-day decline, bearish outlook remains intact

Pi Network (PI) edges higher by almost 2% at press time on Monday, after a steady decline for eight straight days. Still, the Pi Foundation’s 1.1 million token offloading amid large deposits of over 2.4 million PI into accounts linked to Banxa, a payment gateway, could exert some selling pressure. The technical outlook for PI is bearish, with focus on the $0.1919 support level.

PiScan data shows that the Pi Foundation wallet #4 has offloaded 1.13 million PI tokens in the last 24 hours, indicating low confidence among the core team wallets.

Bitcoin Price Forecast: BTC struggles to regain $90K as bearish pressure persists

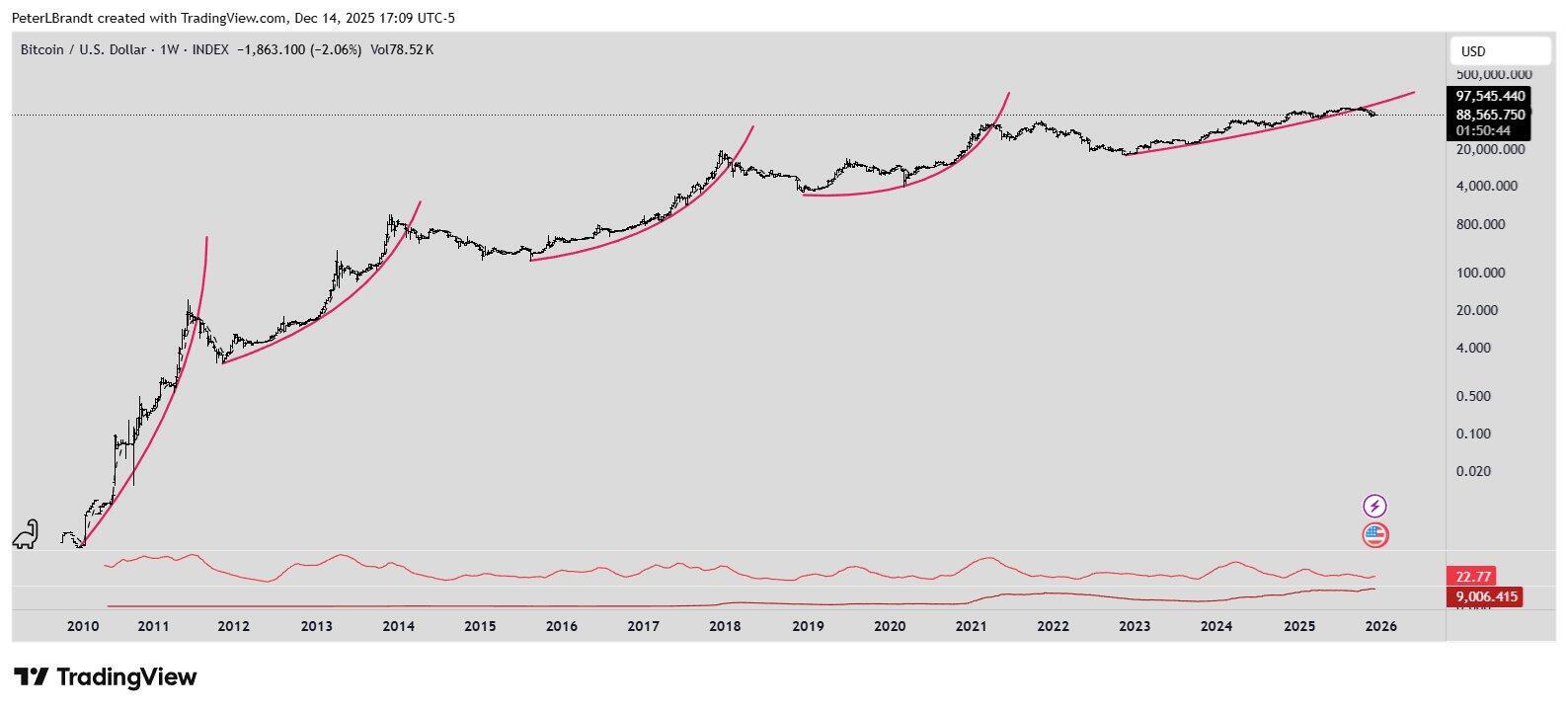

Bitcoin (BTC) steadies above $89,000 at the time of writing on Monday, after failing to break above a descending trendline last week. Meanwhile, modest inflows into US-listed spot Bitcoin Exchange Traded Funds (ETFs) suggest improving institutional interest. However, traders should remain cautious, as bearish technical outlook and warnings from veteran trader Peter Brandt keep downside risks firmly in focus.

Peter Brandt, a veteran commodity trader, posted on his X account on Monday that BTC could fall toward $25,240. Brandt explained that Bitcoin bull cycles have experienced exponential decay, indicating that the explosive move in BTC is slowing over time and signaling the asset’s maturity. Historically, all previous bull cycles have gone through a parabolic move, as shown in the chart below.

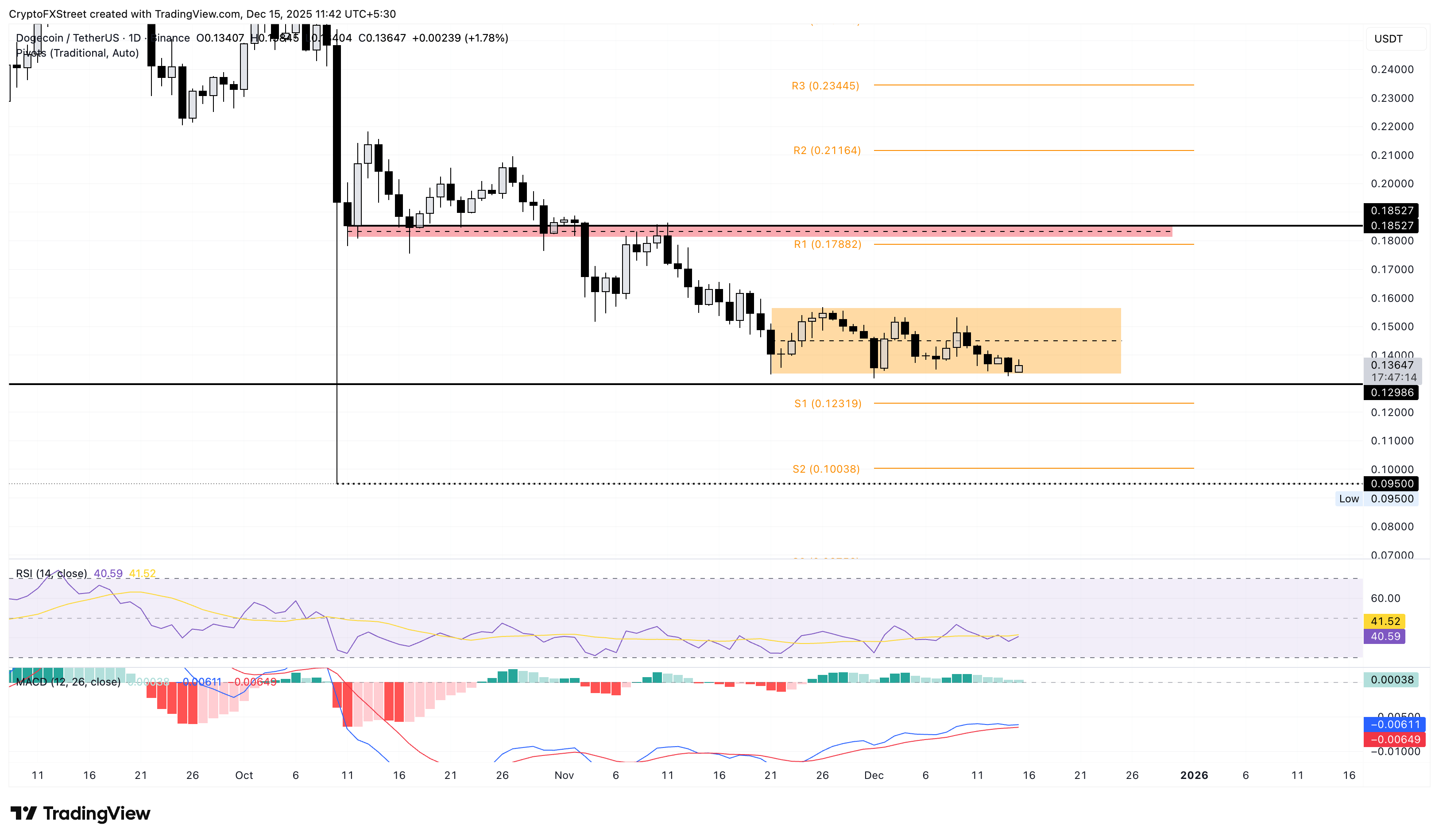

Dogecoin Price Forecast: DOGE at key support flashes mixed technical signals

Dogecoin (DOGE) edges higher by nearly 2% at press time on Monday, recovering from a 3.57% loss on the previous day. The meme coin risks falling out of a consolidation range amid weak institutional demand and declining bullish momentum. However, the derivatives market sees a surge in bullish bets as traders anticipate a potential rebound, increasing the capital exposure in DOGE futures.

CoinGlass data shows that the Dogecoin futures Open Interest (OI) has increased by 4.88% in the last 24 hours, to $1.49 billion. This indicates an increase in the notional value of active derivatives contracts, possibly due to increased capital or leverage exposure.