Top Crypto Gainers: Zcash, MYX Finance, MemeCore extend gains as market recovers

- Zcash edges above $450 after an 11% rise on Thursday, with bulls aiming for the $500 mark.

- MYX Finance rose 6% on Thursday, aiming to break above the 50-day EMA.

- MemeCore ticks higher by 5%, marking its fifth consecutive day of uptrend.

Zcash (ZEC), MYX Finance (MYX), and MemeCore (M) lead the cryptocurrency market recovery with double-digit gains over the last 24 hours. The technical outlook for Zcash and MemeCore suggests upside potential, while the MYX Finance token remains trapped between converging moving averages.

Zcash rally aims for the $500 mark

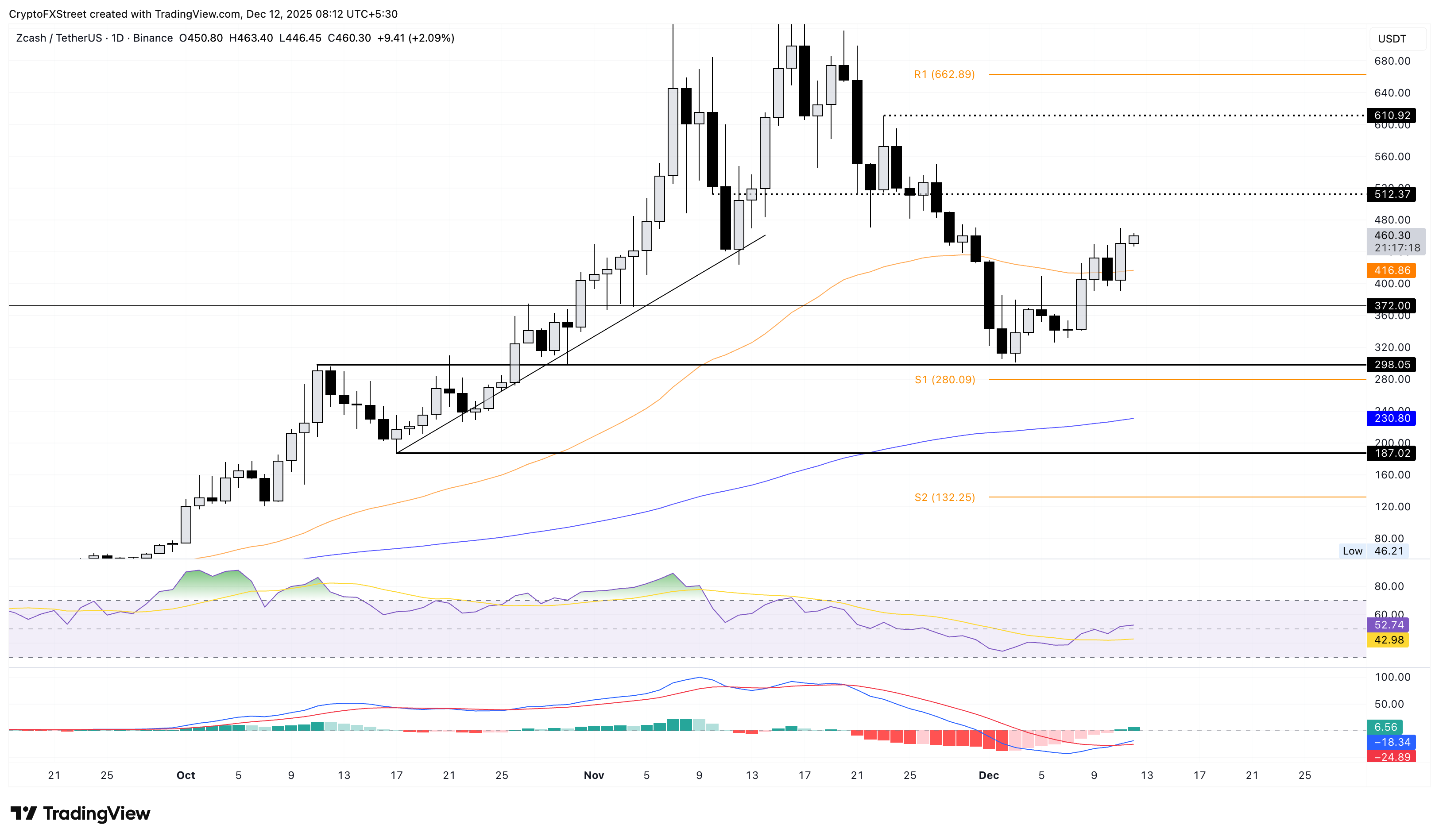

Zcash edges higher by 2% at press time on Friday, building on the 11% gains from the previous day. The privacy coin has cleared the 50-day Exponential Moving Average (EMA) and is targeting the November 10 low at $512.

The Relative Strength Index (RSI) on the daily chart is at 52, above the midline, indicating a rise in buying pressure. RSI flashes upside potential, with room to the upside before reaching the overbought boundary at 70.

Meanwhile, the Moving Average Convergence Divergence (MACD) triggered a buy signal with a crossover on Thursday. If the MACD and signal line continue to rise, it would confirm a bullish momentum boost.

Looking down, the 50-day EMA at $416 could serve as the immediate support.

MYX Finance recovery aims to exceed the 50-day EMA

MYX Finance trades between the converging 50-day and 200-day EMAs, reflecting a consolidation range. At the time of writing, MYX struggles to break above the 50-day EMA at $3.17 on Friday, after a 6% rise the previous day.

If MYX exceeds $3.17, it could extend the rally to the R1 Pivot Point at $3.73.

The RSI at 53 hovers above the halfway line, indicating a buying pressure dominance. Still, the MACD and signal line risk a bearish crossover as they inch closer.

If MYX slips below the 200-day EMA at $2.69, it could test the S1 Pivot Point at $1.90.

MemeCore’s rally could extend toward $2

MemeCore records a 5% rise at press time on Friday, extending the rally for the fifth consecutive day and bringing this week's gains to over 30% so far. The recovery run could confirm a bullish double-bottom breakout if it sustains a daily close above $1.52.

On the upside, the 50-day EMA at $1.76 and the November 27 high at $1.99 could serve as key resistances.

The RSI at 47 shows an upward trend approaching the midline, indicating a shift away from bearish pressure. Meanwhile, the MACD and signal line hold a buy signal triggered after Tuesday’s bullish crossover.

If MemeCore reverses below $1.52, it would nullify the double bottom pattern and potentially extend the decline to the November 27 low at $1.19.