Sygnum Reveals 87% of Surveyed Asian HNWIs Hold Crypto Amid Rapid Market Maturation

According to a recent report, 87% of surveyed high-net-worth individuals (HNWIs) in Asia hold digital assets, and 60% plan to increase allocations.

This reveals a maturing digital asset space across the region. Wealthy investors in key markets are increasingly viewing crypto as an essential component of their portfolios.

Digital Asset Adoption Accelerates Among Asian Wealthy Investors

The findings come from Sygnum’s APAC HNWI Report 2025. The survey of over 270 wealthy and professional investors across 10 Asia-Pacific markets indicates a significant shift: digital assets are becoming a structural component of long-term wealth strategies in the region.

The report revealed 87% already own digital assets as part of their investment portfolios. Furthermore, 49% of the respondents allocate more than 10% of their portfolios to crypto, placing median HNWI exposure in the 10–20% range. 60% intend to increase their allocations.

“HNWIs in Singapore and the wider APAC region are embracing digital assets as a genuine wealth creation and preservation opportunity. Their disciplined, intergenerational approach to investing, combined with a higher risk appetite, is driving substantial allocations to digital assets—particularly within Singapore’s well-regulated MAS framework that provides the institutional-grade safeguards these investors expect.” Lucas Schweiger, report author and Sygnum Crypto Asset Ecosystem Research Lead, said.

Wealth Preservation Overtakes Speculation

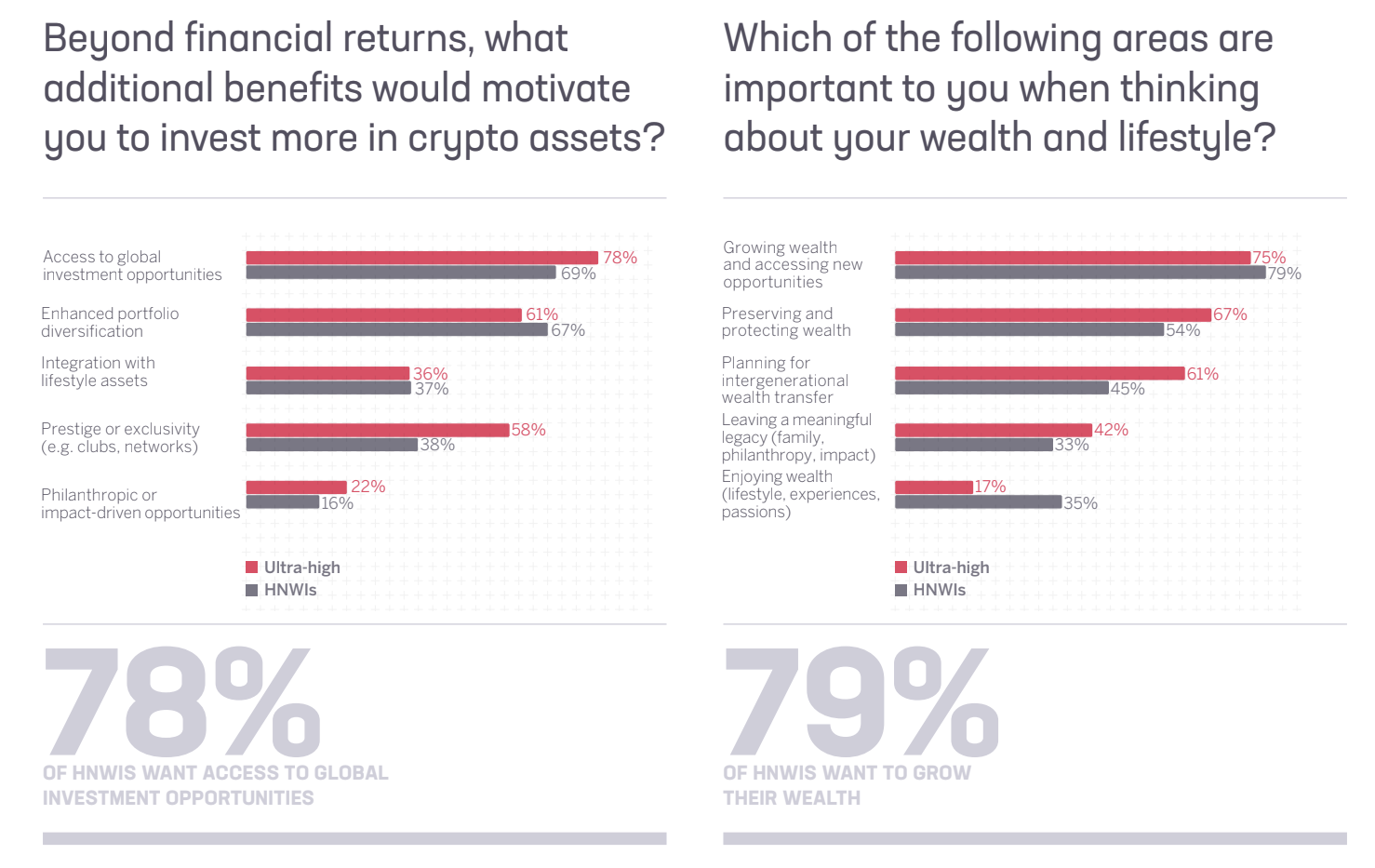

A key narrative throughout the report is the maturing behaviour of Asian private investors. 90% of respondents now view digital assets as important for long-term wealth preservation and generational planning. Diversification has become the top motivation for allocation decisions, surpassing short-term trading and megatrend exposure.

Wealthy Asian Investors’ Outlook On Crypto. Source: Sygnum

Wealthy Asian Investors’ Outlook On Crypto. Source: Sygnum

The appetite for more sophisticated products is also rising. HNWIs are showing an increasing interest in actively managed strategies, outsourced investment mandates, and yield-enhanced products that fit neatly into their existing wealth structures.

Notably, investors increasingly expect traditional wealth managers to keep pace. Recently, BeInCrypto reported that a significant share of investors in the US have already shifted funds away from advisors who do not provide crypto exposure.

“Singapore’s MAS framework and Hong Kong’s advancing digital asset regulations have established the infrastructure needed for traditional wealth managers to offer crypto services—the question is no longer whether private banks can serve this demand, but when they will move to meet it,” Gerald Goh, Sygnum Co-Founder and APAC CEO, stated.

Diversification in ETF Demand Goes Beyond Bitcoin and Ethereum

Demand for varied exchange-traded funds is particularly pronounced. The report finds 80% of respondents want ETFs that go beyond Bitcoin and Ethereum. Solana stands out, with 52% interested in exposure to this asset.

It is followed by multi-asset crypto indexes at 48% and XRP at 41%. Notably, 70% revealed they would allocate, or increase allocations, if staking yield were incorporated into ETF structures.

However, Sygnum observed that a significant share of investors are approaching the market cautiously after recent market volatility.

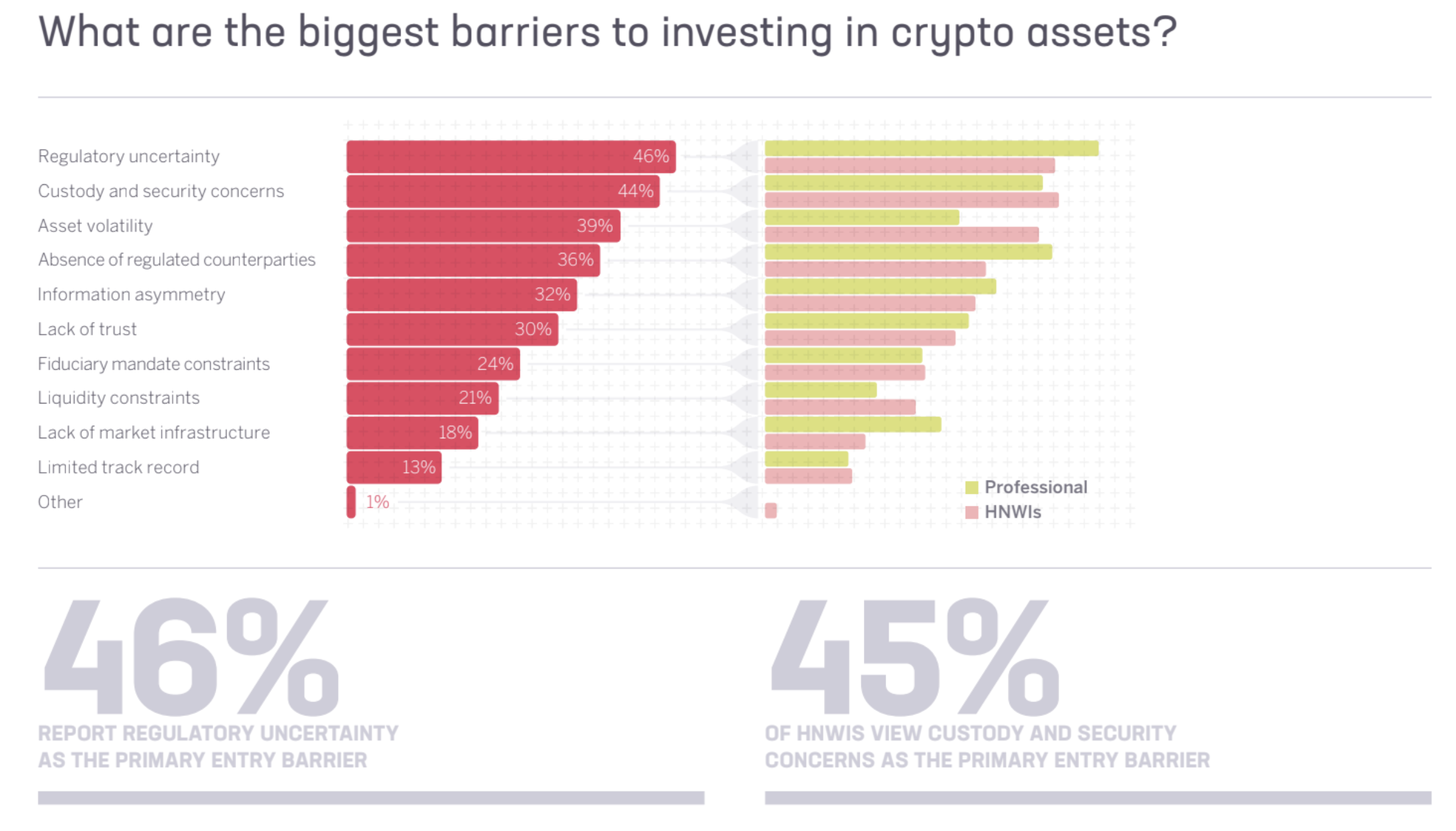

Investors Outline Roadblocks. Source: Sygnum

Investors Outline Roadblocks. Source: Sygnum

Factors such as unclear regulation, ongoing concerns around custody and security, and varying licensing requirements across jurisdictions continue to limit wider involvement.

Even so, long-term confidence remains firm. 57% of HNWIs and 61% of UHNWIs expressed a bullish or strongly bullish long-term view of the crypto market. Their confidence is bolstered by the deepening integration between crypto and traditional finance.

Goh emphasized that APAC is quickly emerging as one of the world’s fastest-growing and most influential digital asset hubs, and expects this momentum to accelerate further as the region heads into 2026.